Blog

Representations and Warranties Culture Clash in International Deals

This article was originally published in Law360, a LexisNexis Company.

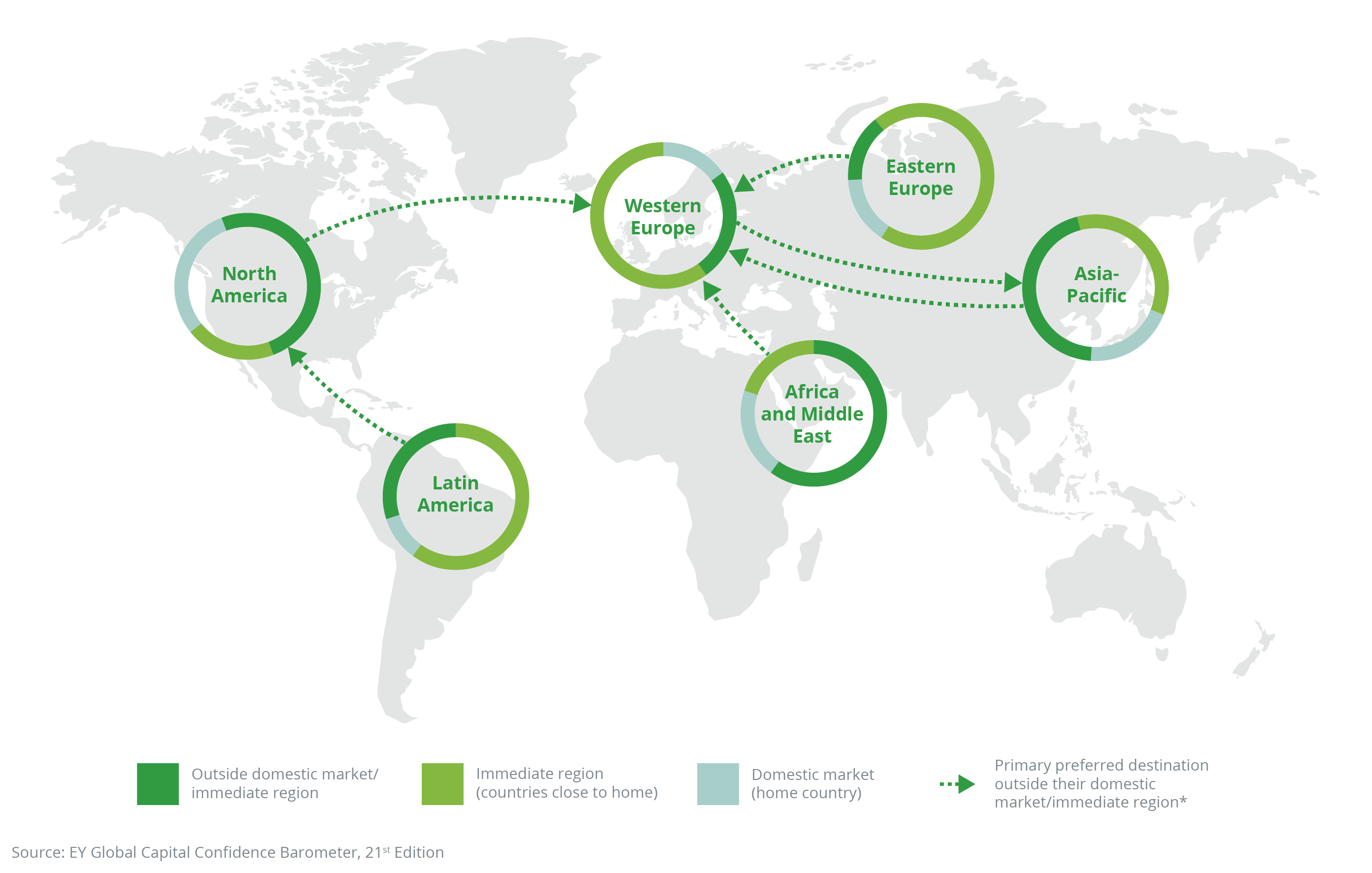

Before the recent coronavirus outbreak threw a monkey wrench into the midst of the bullish M&A market, the outlook for 2020 was optimistic. According to the October 2019 EY Global Capital Confidence Barometer, 52% of EY survey respondents were planning to actively pursue M&A in the next 12 months. Western Europe continued to be the primary focus of US investment due to relatively lower valuations and an abundance of high-quality assets. However, the new M&A trend is the strengthening deal activity between Europe and Asia. Asian companies are looking to acquire European intellectual property, while European companies are tapping into the favorable growth and demographics in Asia.

From the insurance perspective, the robust cross-border M&A market presents many challenges and opportunities for innovation. Specifically, many of our US clients want to know how they can use the M&A representations and warranties insurance ("RWI") to their advantage when they are acquiring foreign targets and many of our international clients are asking the same question as they are looking for acquisitions in the United States.

The differences in policy language and coverage could be stark, as can the expectations for diligence conducted and disclosed as part of the acquisition process.

First, let's take a quick side-step to understand where some of these companies are coming from. In the United States, for example, RWI has gone from relative obscurity to stardom in the last four years. Private equity firms latched on to the product early on and made it a market standard in private M&A to such an extent that strategic buyers are now experiencing difficulties avoiding it.

In Europe, on the other hand, the European version of RWI, the warranty and indemnity ("W&I") insurance, has existed for many years, but is now experiencing an uptick, particularly in the United Kingdom. Aside from the United Kingdom it is used widely in transactions in Germany, the Netherlands, the Nordic countries and Central and Eastern European countries, and has been gaining popularity in France, Italy, Spain and Portugal.

The Australian market, not only being one of the more mature and competitive markets for this kind of insurance, has gotten to the point where the use of W&I insurance as security for breaches of warranties and indemnities exceeds the use of any other form of security. This trend is expected to continue in 2020. According to DLA Piper, there has been an increase in Australia in the number of insurers who are willing to accept more US-style coverage positions. More on these below.

In Asia, which is in the midst of a seller-friendly market, auction processes for attractive targets are common and majority of the bidders come to the table with W&I insurance already included in their submissions.

With all of these market norms developing and evolving simultaneously, but also colliding and shifting on cross-border deals, it is no wondering that keep on top of the differences in practice and emerging trends is becoming increasingly difficult.

US and European companies, for example, have differing expectations as to coverage and diligence based on the method and style of coverage they see being used in their local markets.

It is worth taking a more detailed look at a few of these differences, some of which were discussed at a February 25, 2020 transactional liability roundtable presented by Mayer Brown.

Disclosure, Diligence Process and Policy Presentation

| US Style RWI Policy | European Style W&I Policy |

|---|---|

| Data room and due diligence reports from third-party advisers are provided to insurer for review. Due diligence reports and data room are NOT deemed disclosed. This means that while the information is provided for review in the data room, the reviewer is not deemed to have read it, so the risk that indemnity claims will be defeated by unread or unclear documents in the data room is much lower. | Data room and due diligence reports from third-party advisers are provided to insurer for review. Due diligence reports and data room ARE deemed disclosed. However, according to Baker & McKenzie, for additional premium, the requirement that the entire data room is deemed disclosed for purposes of indemnity claims, can be removed. Insurers typically agree to remove this requirement only if the seller agrees to give a full disclosure schedule, which the seller often resists. |

| Insurer holds a 2-hour diligence call with buy-side internal diligence team and third-party advisers and sends written follow-up questions. Oral responses are sufficient on the diligence call and written or oral responses to the follow-up questions are expected. | Written responses to insurer questions are expected. |

| Insurer holds a short bring-down call with buy-side management and attorneys prior to deal closing. | Sellers are expected to provide full bring-down disclosure if warranties are repeated at closing. |

| Insurers charge a separate $20,000 - $50,000 underwriting fee to cover the costs of legal counsel advising them on the diligence. This fee is in addition to the premium. | The underwriting fee is usually included in the premium in Germany but is charged separately, in addition to the premium, in the United Kingdom. |

| The policy refers to the representations and warranties in the purchase agreement and includes general and deal specific exclusions. Some of the wording of the representations and warranties in the agreement is altered and alterations are specified in the policy. | A warranty spreadsheet listing out the covered warranties along with deal specific exclusions are attached to the policy to specify the coverage position for each listed warranty. The coverage works off the amended wording of the warranties that is outlined in the spreadsheet. |

Materiality and Knowledge Scrapes

A full materiality scrape is the concept of disregarding or "reading out" from the purchase agreement materiality qualifiers in representations and warranties to determine: (1) the amount of losses resulting from a breach or (2) whether the breach has occurred. A partial or single materiality scrape is when the materiality qualifiers are disregarded or read out only for purposes of determining the amount of losses.

| US Style RWI Policy | European Style W&I Policy |

|---|---|

| Insurers are refusing to grant knowledge scrapes. | Knowledge scrapes are possible. |

| Full materiality scrapes are standard. However, they typically reflect the materiality qualifiers in the purchase agreement and can also vary depending on the nature of the transaction and the insurance terms being offered. For example, if the retention is to be split between the buyer and the seller, most insurers will require the purchase agreement to have a full materiality scrape before they agree to include a full materiality scrape in the policy. If the buyer is solely responsible for the retention, most insurers will agree to include the full materiality scrape in the policy even if the purchase agreement does not have one, but will only do so if they are certain that the seller provided wholesome disclosure in the disclosure schedules and did not hamper that disclosure with some arbitrary materiality threshold. | Materiality scrapes are generally not provided. |

Other Coverage Positions

| US Style RWI Policy | European Style W&I Policy |

|---|---|

| Tax gross-up to cover net taxable income to the buyer that may result from the proceeds of a representations and warranties policy is not market standard. | Tax gross-up is market standard. |

| Retention can be eroded by non-covered losses. | Retention can be eroded only by covered losses. |

| Insurers are willing to leave the policy language silent as to multiplied damages and diminution in value if the purchase agreement remains silent on those points. Insurers typically push back on removing their multiplied loss exclusion if the valuation multiple is too high. | Insurers do not take into account multipliers when determining the loss. |

Regulation and Availability

Let's say you know whether you want US style policy or a European style policy or even a European style policy with US style elements (aka the hybrid policy). The next question is more of a logistical one. Which insurance carriers should be approached and which of them will be able to write the type of policy needed in the location that is needed?

There is a great deal of variety in the answer. Some US domestic underwriters can only write policies for purely domestic transactions. Some can write policies for international transactions as long as the buyer is in the United States. The larger carriers have international operations but may have to pass the policy to their European colleagues to do most of the underwriting even if they can provide US-style coverage.

The answers to the following questions can dictate which carriers will be able to write the policy:

- What law is the purchase agreement subject to? If the purchase agree is subject to US law, there will be a wider pool of available carriers. If it's subject to European law, there are fewer available markets to choose from.

- Where are the buyer, seller and the target company domiciled?

- Does the seller have a parent entity in a different country?

- Is the sale a carve-out of a subsidiary or an asset sale?

- Where do most of the staff of the target company reside?

- Where is most of the target's revenue generated?

For illustrative purposes, at Woodruff Sawyer, we received requests to place the following types of policies just in the last few months:

- A US company, buying a Belgian company with a purchase agreement that was subject to French law;

- A US company buying a French company with a purchase agreement subject to US law;

- A Nordic company buying a US company with a purchase agreement subject to US law; and

- A German company buying a US company through a US subsidiary with a purchase agreement subject to German law.

In each of these cases, different groups of insurance underwriters were able to quote these various risks depending on their licenses and locations.

In Conclusion

There is tremendous variety in the style and expectations between US style and European style deals, both from a cultural perspective and from an insurance one.

Most of our US clients want the US style deals and coverage that they get domestically when they are buying foreign companies or assets. It is worth remembering though that, in some cases, although we are looking for "US style" coverage, the deal itself still needs to be underwritten via the European arm of a particular company.

This means that although you may get US style coverage terms such as silence for multiplied and consequential damages or the data room NOT deemed disclosed (assuming the seller is willing to provide a full disclosure document), you will still get some aspects of European style underwriting such as the purchase agreement spreadsheet. You will also likely have more caveats and reps and warranties language that is deemed deleted.

It's important to keep all of this in mind from the very earliest stages of a deal that will span two jurisdictions. We have had several clients who did not realize until they reached out to us that there was such a difference in availability and structure across borders.

Authors

Table of Contents