Blog

M&A Reps and Warranties Claims: Takeaways from the 2019 AIG Claims Report

Recently, AIG came out with its fourth annual claims report covering M&A representations and warranties insurance ("RWI") claim data. The use of RWI in the United States has grown exponentially over the last few years. Although market participants from private equity firms to strategic acquirers are becoming increasingly comfortable with using the product, many questions remain around the claims process, the likelihood of payment, and the ability of the ever-widening circle of insurers to cover the claims.

AIG's report comes at a critical time in the market and provides an overview of valuable claims data from over 580 claims. These claims came out of RWI policies that covered approximately 2,900 deals written by AIG between 2011 and 2017 in the US and internationally. A few key takeaways are as follows:

Claims Severity and Frequency

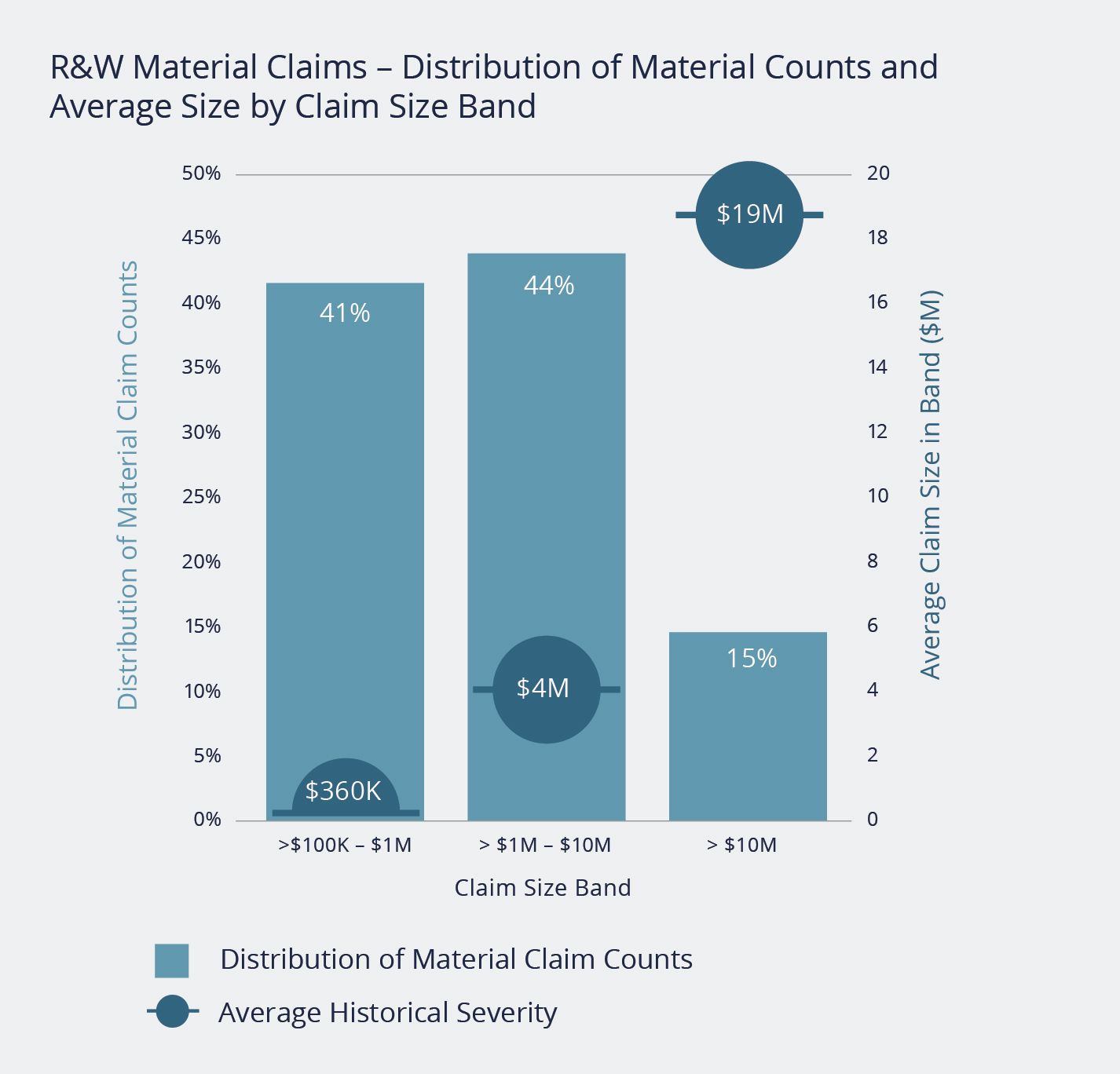

- The proportion of claims over $10 million increased significantly, as compared to last year, from 8% to 15%.

- The frequency of claims remains highest for the largest, most complex deals.

- Claims notifications for M&A deals between $500 million and $1 billion increased from 21% to 26% from the previous years.

- The overall frequency for all deals on a global basis stands at 20%, a constant over the last few years.

Source: "Taxing times for M&A Insurance," AIG, 2019.

Source: "Taxing times for M&A Insurance," AIG, 2019.

Claim Notifications

- Claims notifications are increasing in frequency, especially in the Americas, driven by increasing sophistication of the insureds.

- 74% of claims globally are notified within the first 18 months from policy inception, 29% within the first six months, but a significant number of claims (14% in the Americas) continue to come in after the first two years.

- In North America, nearly 50% of claim notifications are received after 12 months, which may cause the insurers to rethink their current practice of dropping the retention after 12 months.

Breach Types

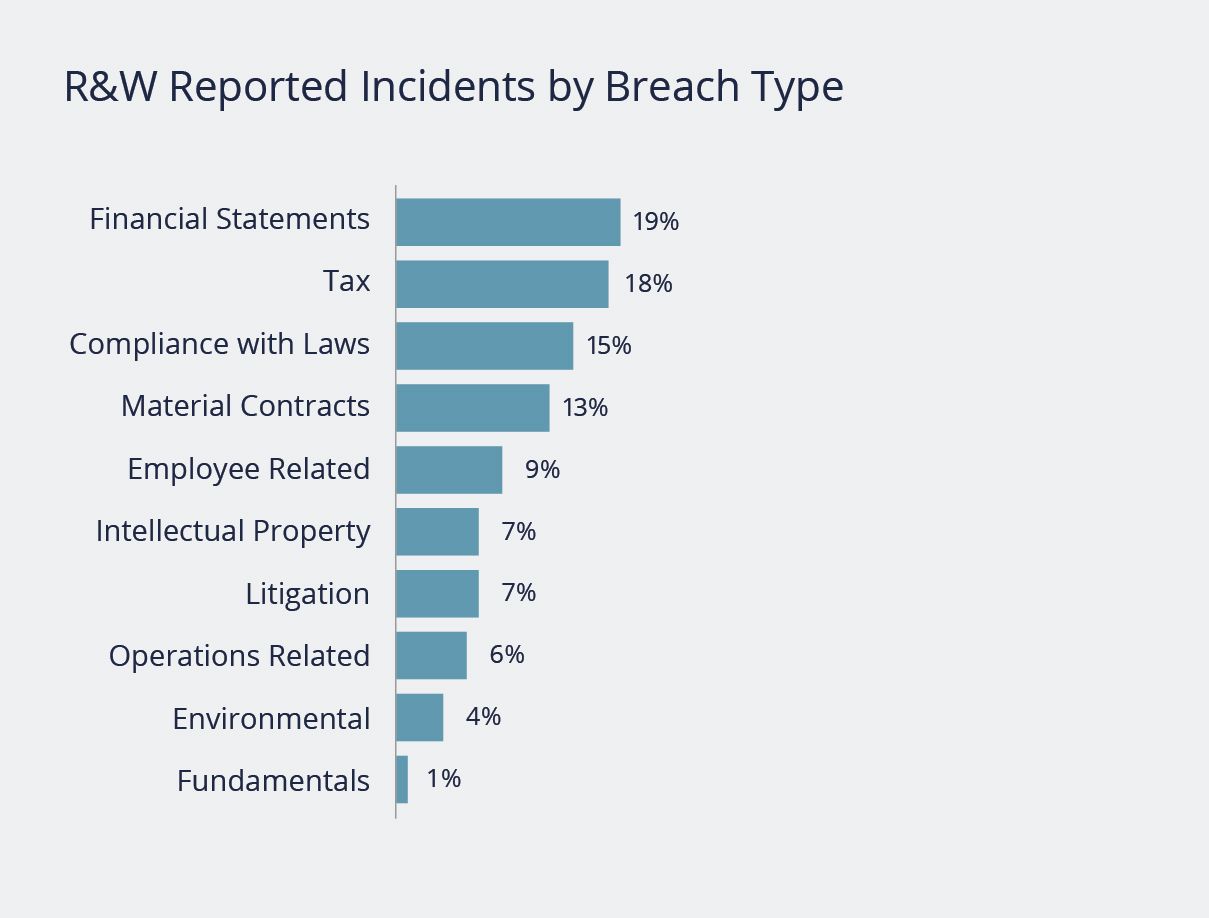

- The main drivers of claims notifications globally continue to be:

- Financial statements (19%);

- Tax (18%);

- Compliance with laws (15%); and

- Material contracts (13%).

- Undisclosed liabilities, for which coverage has become more common in the UK, make up almost a third of all financial statement breaches.

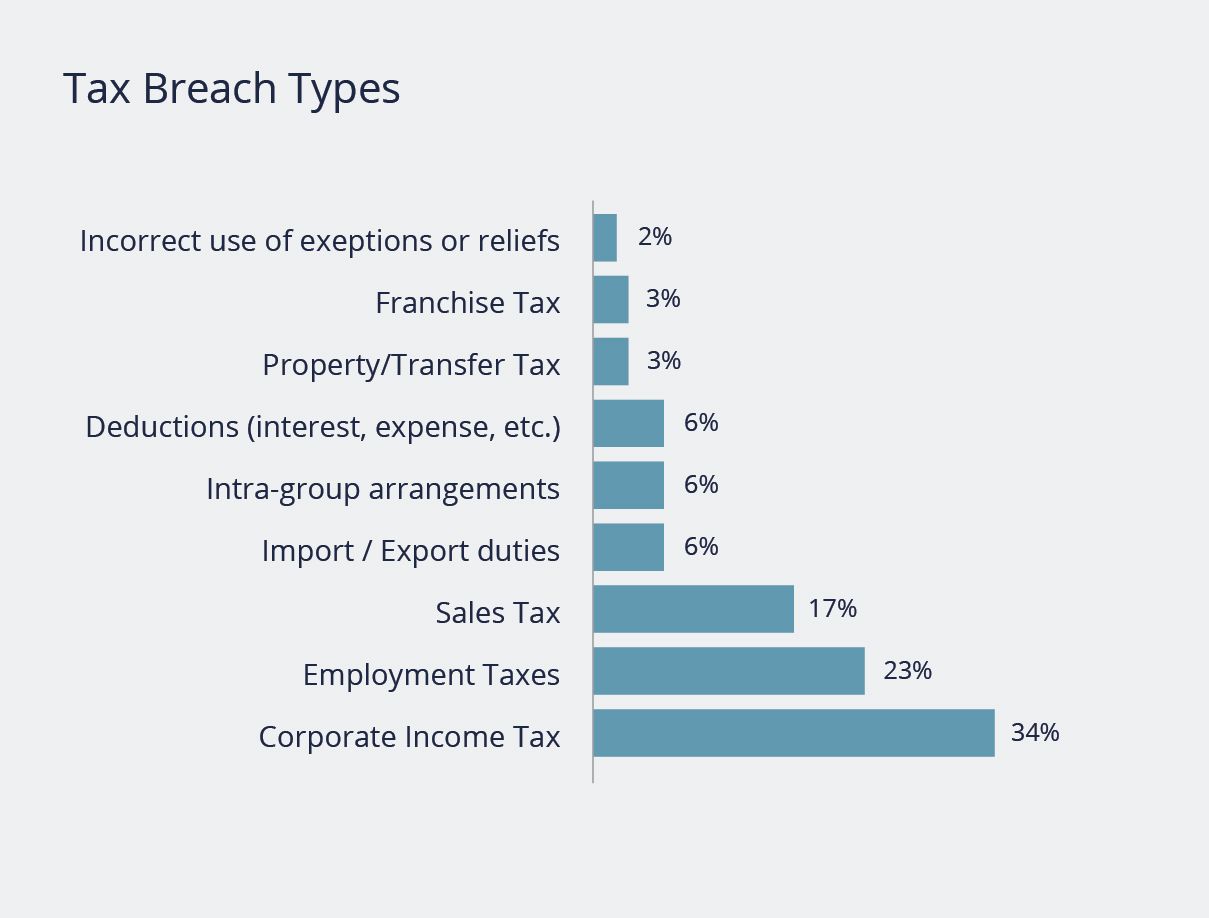

- The bulk of tax claims across all regions come from:

- Corporate income taxes, which will dominate tax breach notifications for years to come;

- Employment taxes; and

- Sales taxes.

- Franchise taxes account for over 5% of tax notifications in the United States.

- Breaches of fundamental representations, although a low risk, are not at zero. They make up 1% of all claims.

- Breach types most prevalent in specific industry sectors include:

- Compliance with laws, which is seen in 30% of transactions in health and pharmaceutical industries and in 15% of transactions in the financial services industry;

- Intellectual property is responsible for 16% of claims in technology deals; and

- Material contracts make up 17% of claims in the financial services industry and 16% of claims in manufacturing transactions.

Source: "Taxing times for M&A Insurance," AIG, 2019.

Source: "Taxing times for M&A Insurance," AIG, 2019.

Woodruff Sawyer Projections

Competition among insurers entering the M&A RWI market is causing a decline in premium rates and the broadening of policy terms and conditions. However, the popularity of the product is also increasing the frequency of large claims, which creates a profitability challenge for the insurers.

We believe that over the next few years:

- The use of RWI will continue to grow and eventually become standard practice in the M&A market.

- Some of the current insurers will be forced to exit the RWI market.

- More experienced carriers will continue to underwrite RWI policies and will make the placement process more streamlined and efficient.

- The insurance premiums will stabilize, likely at a higher than current level.

- The market will continue to evolve to include additional coverages.

M&A Representations and Warranties insurance is an elegant solution to many roadblocks in the M&A process. It is a complex product that works best when properly tailored to each transaction. If you have questions about M&A Reps and Warranties or Tax Liability insurance products, the Woodruff Sawyer M&A Insurance Team would be happy to answer them.

Author

Table of Contents