Blog

Reps and Warranties Insurance Market Update: Volatility and Trends

At Woodruff Sawyer, we believe it’s essential to keep our clients up to date on a relatively small and rapidly developing market for reps and warranties insurance. Thanks to feedback we’ve received on the volatility index, we’ve been able to do just that.

Let’s look at updated data and emerging trends in RWI.

New Deal Activity in January and February 2022

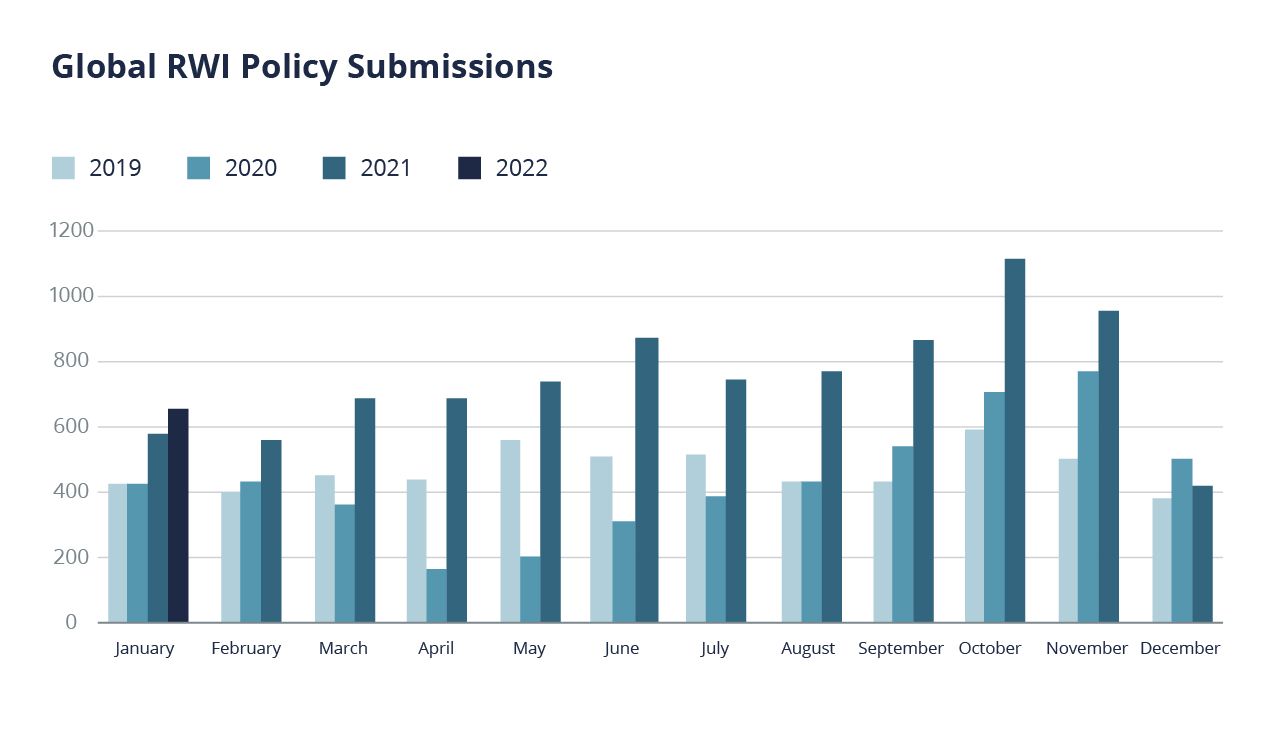

Euclid Transactional Insurance’s ever-helpful submission numbers strongly indicate how many deals seek RWI across the whole range of transactions. While this doesn’t tell us how many deals are happening, it gives us a good view of how robust RWI is as a tool for dealmakers and how much deal activity there is overall.

High Global RWI Policy Submissions Put Pressure on Advisors and Underwriters

As we can see, submissions in January are higher in 2022 than in previous years, but they’re far below the September-November 2021 numbers that puts significant pressure on M&A advisors and the underwriting community.

It’s worth noting that some of these new submissions may well be deals that could not find homes at the end of 2021. They’re now being re-marketed in the hopes of better terms.

This shows us those M&A practitioners who use RWI continue using the product in the face of temporary higher pricing and tighter terms. It also implies that the M&A market remains robust.

At Woodruff Sawyer, we saw a growth in new deal activity of nearly 50% year on year between January 2021 and January 2022, suggesting the need for RWI has not changed and that M&A remained strong. February was slightly lighter than January, which is consistent with the overall pattern of M&A activity we have seen in the last few years.

RWI Statistics Everyone Needs to Know

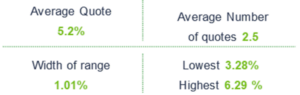

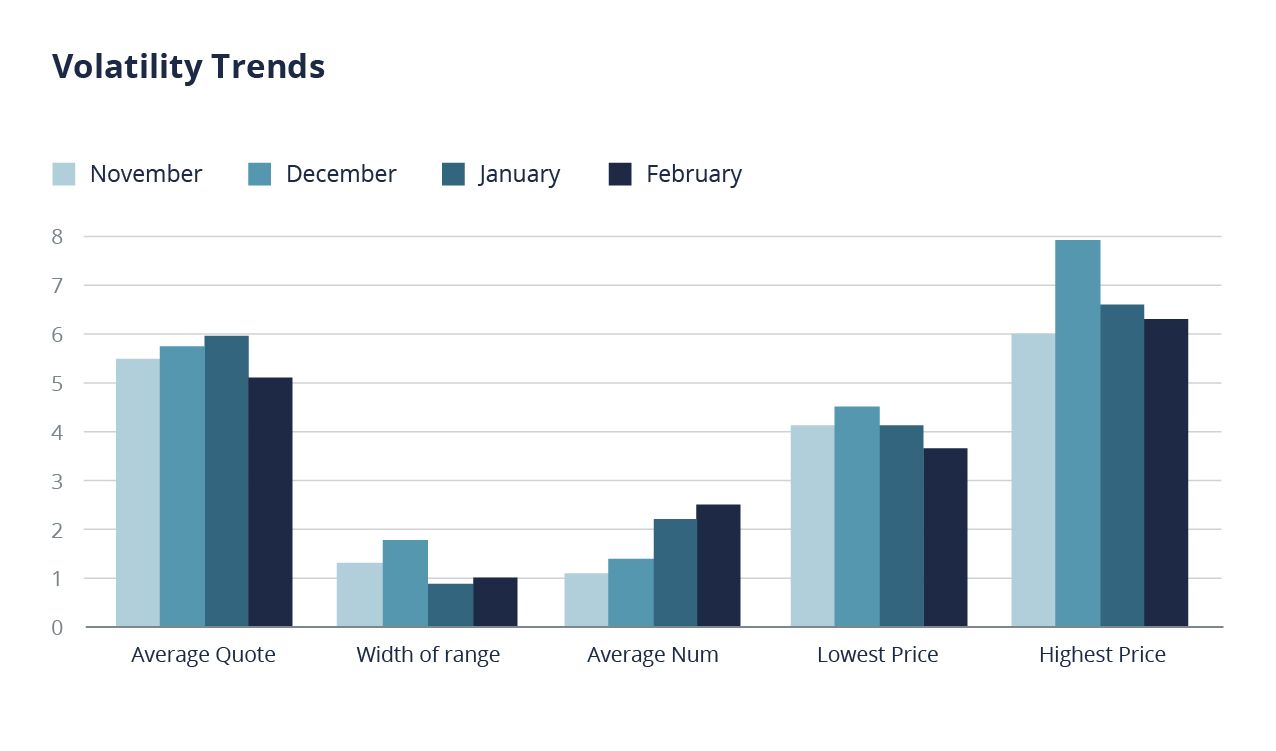

Overall, the news was good for our clients.

The lowest quote we saw was 3.28%, a return to the middle of last year in terms of pricing. It was an outlier from the majority of quotes we saw still in the 4.5–5.5% range but good to see, nonetheless.

The average quote was down from 5.9 to 5.1, which is a significant drop. As an example, on a $10 million policy, this generates a savings of $80,000 on average.

The average number of quotes rose from just over 2 to 2.5, showing the continued return of underwriting capacity. This could either be due to reduced deal flow or increases in human capital.

As we saw above, the lowest price came in at 3.28, which is a significant drop. Just as noteworthy is that their highest pricing has also dropped from 6.6% last month to 6.2% in February, again a substantial saving for deals priced this month as opposed to the previous month.

“Heightened Risk” Trends: What They Mean to You

Anyone experienced in placing a RWI policy should be familiar with the areas of heightened risk listed on every NBIL. Underwriters focus on deal-specific areas during their review of the diligence conducted by the buyer’s team of advisors. Should diligence be lacking in one of these areas, underwriters will likely seek to put an exclusion in the policy for that portion of the risk.

Our aim is to keep you up to date with trends we see in the market. Next let’s discuss the often-overlooked subject of underlying insurance and how it can impact your RWI policy.

A standard note you might see in the Areas of Heightened Risk section, commonly refers to cyber/data breaches or environmental matters. In that case, you would read something along the lines of “our coverage will sit excess and no broader than the underlying [cyber or environmental] insurance policy.”

This is not new to the RWI marketplace; in fact, it’s not even a trend. However, currently trending is the level of scrutiny underwriters are applying to determine the adequacy of the underlying insurance. This could prove problematic if the target company does not have a sufficient underlying limit.

The issue of underlying insurance is particularly relevant in spinouts. In this situation the insurance often sits at the topco level and cannot be transferred. Also, more common in smaller deals there has sometimes been no historical policy in place at all. Depending on the risk, underwriters may seek to apply a separate retention equal to what the insurance limit in place should have been. In that instance, a broker who can speak to the adequacy/typical limits for the enterprise is extremely valuable in keeping that retention realistic. Brokers who are not part of a full-service brokerage may not have the expertise or credibility to provide comfort to the RWI Underwriter, leaving the buyer at the whim of the underwriter in providing that retention.

Alternatively, we have seen instances of underwriters attempting to use this as grounds for a broad exclusion, denying coverage for that risk, which is obviously unacceptable.

In short, we urge our clients to get an early understanding of the Target’s insurance program in order to avoid any last-minute surprises. It’s worth noting that some brokers will charge an extra fee for an insurance due diligence report, Woodruff Sawyer does not and will not because we feel this is a vital part of placement.

Word on The (Insurance Market) Street

Several RWI carriers, brokers, attorneys, and advisors gathered for an RWI-focused conference at the end of February. They shared some of the more interesting developments and trends in the market. They agreed that while the claims rates continue like previous years, areas of note in the last few months included an increased focus on the sufficiency and condition of assets and customer contracts. And indeed, we see more questions from carriers on whether buyers are actually getting on calls with key customers and suppliers to make sure those relationships continue post-closing.

An interesting view from several conference panelists and participants was there hadn’t really been any COVID-19 related claims, which reflects WS observations. If these kinds of claims materialize, they will likely come later in the year or in 2023.

There is a lot more focus on the precise language of the definition of Fraud in the purchase agreement, at least from counsel representing the carriers. Carriers want to make sure they are reserving their rights as they relate to their ability to subrogate against the seller for fraud.

And finally, new tax insurance options are being developed in the market. Tax insurance in general is growing to cover not only tax issues spilling out of M&A activity, but areas not related to M&A such as intercompany sales, tax controversy, tax audits and foreign tax credits.

Final Thoughts on RWI

To conclude, much has changed since the beginning of the month. The war in Ukraine has put interest rate rises on the back burner. It also threatens to exacerbate the supply chain issues pushing up inflation, and so it seems that cycle will continue at least in the short term.

As it is impossible to know how long this conflict will go on, it is also impossible to predict the impact it may have on deal-making in the near to middle-term future.

Targets might change in line with those stocks that have become more valuable in a time of war, but we all hope that the conflict ends long before it has long terms effects.

Authors

Table of Contents