Blog

Protected Ventures: New Reps And Warranties Product Designed for VCs

In today's blog, we will be introducing you to our new Reps & Warranties product, Protected Ventures. This coverage will be a game changer for companies involved in multiple M&A deals. -- Emily

As a venture capital (VC) firm, you’re constantly fostering disruptive innovation, so naturally, you're involved in multiple Mergers and Acquisitions (M&A) deals each year. But are you protected from breach of contract in these deals?

While the use of traditional Representations and Warranties (R&W) coverage to protect M&A participants has exploded in recent years, few VCs have embraced it because traditional R&W products are either too expensive or they are perceived as a hassle that will get in the way of the deal. But by skipping coverage, you are vulnerable to risky lawsuits, particularly from Intellectual Property (IP) disputes.

We focus only on what you need.

With more VC clients than any other US broker, Woodruff Sawyer is a longtime advocate for VC firms. This has uniquely positioned us to develop a new product with our partner RLI, tailored especially for VCs. Called Protected Ventures, it focuses due diligence activity only on the IP, which saves you money and streamlines the process of securing coverage.

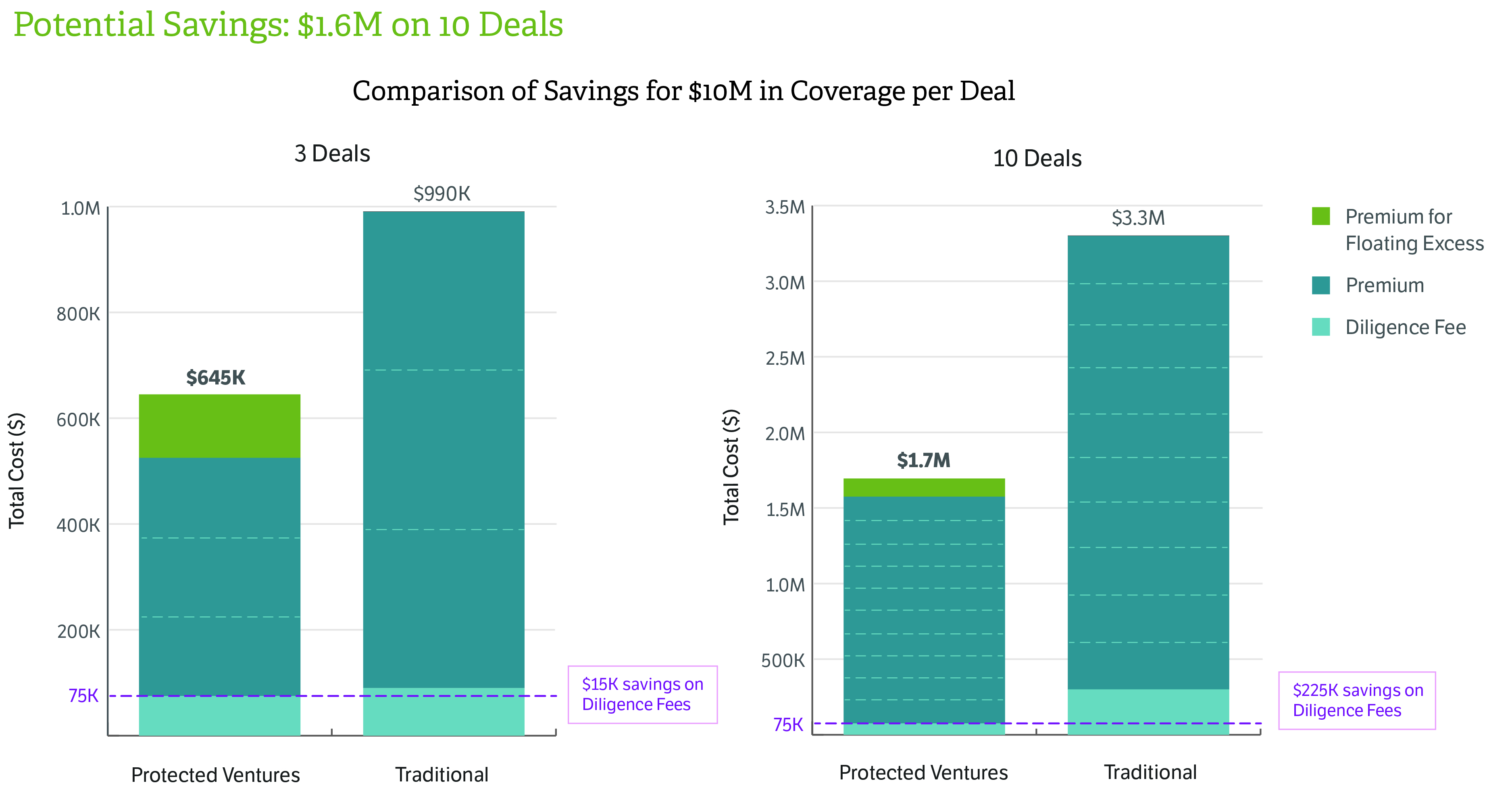

With traditional coverage, VCs pay hefty upfront due diligence fees of about $30,000 for each individual M&A deal. With Protected Ventures, you only pay one upfront due diligence fee per year, because due diligence is only needed on the IP itself.

Here’s how it works.

You pay one upfront due diligence fee of $75,000, covering your VC firm, so that it is taken care of before the deal occurs. You pay no further diligence fees on up to 10 deals that year. With Protected Ventures, we have introduced the concept of the “floating excess,” which means for every deal, you can buy an additional layer of coverage that floats over all deals and can be applied as needed.

You can see the advantage of our product by examining a three-deal scenario:

Protected Ventures provides you with real value for your dollar, and is another example of how we are addressing a rapidly evolving market in need of a specialized, niche product.

To learn more about leveraging this coverage for your M&A deal, please contact Emily Maier at emaier@woodruffsawyer.com.

Table of Contents