Guide

General Partnership Liability: Risk and Insurance Trends for 2025

Rising defense costs, a shifting regulatory environment, competitive insurance pricing, and increasing claims activity are shaping the current general partnership liability (GPL) marketplace. Other challenges stem from general partner infighting and personal disputes, which incur high defense costs and higher-than-average settlements, and SEC regulations that encroach on the exempt reporting adviser space for venture capital firms.

Woodruff Sawyer’s first GPL Looking Ahead Guide, written for the venture capital and private equity community, delves into these trends, as well as pricing dynamics and claims insights from our experts. We also include results from our recent survey of underwriter expectations for 2025.

This article shares highlights of the GPL Looking Ahead Guide. You can read the full Guide here. Plus, watch the GPL Looking Ahead webinar on deamand.

Four GPL Insurance Trends to Watch

- Outside Counsel Rate Increases Continue to Accelerate. When facing sensitive regulatory or securities litigation matters, asset managers want to retain the most effective outside counsel. While best-in-class lawyers in this space have always commanded high fees, billing rate increases have accelerated in recent years.

- A Regulatory Inflection Point. In 2025, SEC leadership will set the regulatory tone for investment advisers. In one possible future, the government will continue to aggressively police the asset management industry, including by targeting technical violations that do not involve clear or material investor harm. In another possible future, regulators will take a more circumspect approach to marginal cases, particularly in the context of private funds advising sophisticated institutional investors.

-

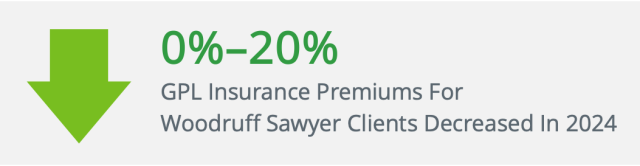

Competitive Pricing Environment Should Continue for Top-Tier Risks. The soft market trends of the past 12–24 months continue in Q3 and Q4 2024, as increased insurance carrier capacity drives competition. For clients without significant historical or ongoing claims and with conventional investment strategies, the pricing landscape should remain favorable in 2025, with pricing anywhere from flat to down 20% YoY.

- Focus on Regulatory Investigation Coverage. In today’s soft market, broad coverage for regulatory investigations may be available for venture capital and private equity firms—if they are working with a broker who knows the right questions to ask. Strong competition between carriers can give your broker significant leverage to negotiate pricing and retentions. Like most coverage issues, the devil is in the details.

Venture Capital and Private Equity Claims Trends

Private capital markets will continue to play an outsized role in the corporate ecosystem in 2025. This trend will continue to attract scrutiny from private plaintiffs and regulators, driving more of the kinds of claims activity that we have seen in recent years. Macroeconomic conditions and the broader political/regulatory environment are the unknown variables that may impact claims frequency and severity.

Here are three claims trends we’ve observed recently.

- Outside director liability (ODL) claims have been consistent and common over the years, which is unsurprising given the overall frequency of securities litigation. ODL coverage is the part of the GPL insurance policy that covers claims against the partners due to their roles as directors for portfolio companies.

- Employment practices liability (EPL) claims. Historically, we have seen many EPL claims alleging wrongful termination or discrimination, often preceded by a demand letter or agency filing.

- Government inquiry claims. Last year, about 10% of our GPL insurance claims involved some type of government inquiry. These claims fall under two main categories—potential issues at privately held portfolio companies and investigations focused on the investment advisory practices of our clients.

Underwriters’ Survey Results

Woodruff Sawyer surveyed insurance carriers about pricing expectations, retention structures, renewal strategies, and claim trends. Here are a few survey highlights.

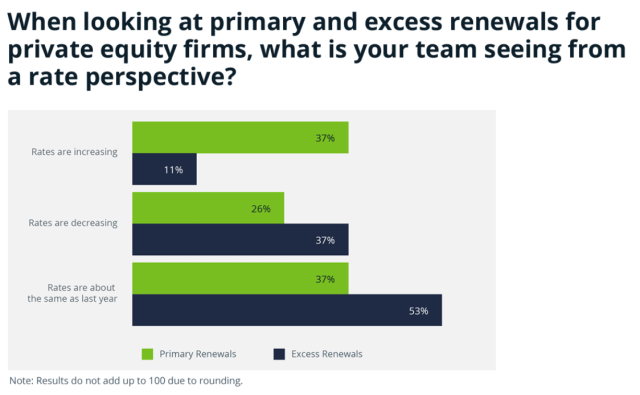

Pricing for Private Equity Firms. While most underwriters surveyed said they saw unchanged/decreasing rates year over year, more than one-third saw increasing rates for primary renewals. This trend is consistent with our perspective that rates will continue to increase for those funds that are seeing an uptick in claims activity.

Pricing for Venture Capital Firms. Most underwriters also said they saw unchanged rates, but none said they saw increasing rates for primary renewals. Flat or decreasing rates are consistent with what we have experienced for clients in 2024, but the picture could change next year with new claims activity.

Retentions for Private Equity Firms: Most respondents said retentions are the same as last year, and we expect this to continue into 2025.

Retentions for Venture Capital Firms. Almost 80% of respondents said retentions have stayed the same, which is largely consistent with what we have seen across our book of venture capital GPL business.

For more expert insights and the full results from our underwriters’ survey, read the complete General Partnership Liability Looking Ahead Guide and watch our on-demand webinar.

Author

Table of Contents