Blog

Will New HSR Rules Lead to Costlier RWI Interim Breach Coverage?

On October 10, the Federal Trade Commission (FTC), aiming to fill information gaps and ensure effective antitrust review, voted to adopt new rules for the Hart-Scott-Rodino (HSR) Act premerger notification form and reporting process. Not surprisingly, these rules will require merger parties to disclose more information with their premerger notification form than they needed to before. More disclosure is likely to result in merger parties taking more time to make their HSR filings.

How Are the New Rules Relevant to RWI?

In the context of representations & warranties insurance (RWI), this change means that the interim period between a deal’s sign and close will likely also grow longer, requiring deal parties to negotiate for a longer interim breach coverage period in their RWI policies.

The new HSR rules are not expected to become effective until mid-January 2025, so there is time to prepare. First, let’s look at what interim breach coverage is.

A Quick Summary of Interim Breach Coverage

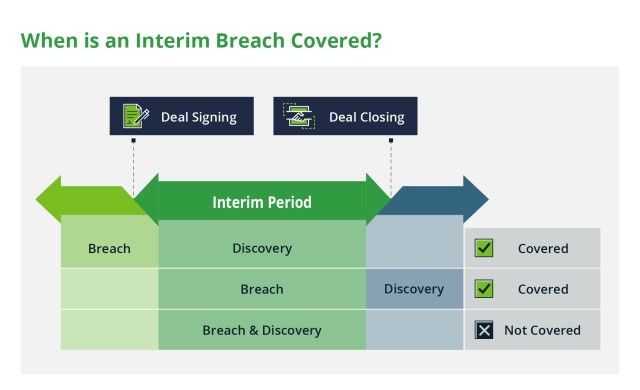

In short, the coverage between the signing and closing of a deal is called interim breach coverage. Although some carriers have offered full interim breach coverage in the last year or so, the additional premium associated with such coverage typically drives RWI buyers to accept the more standard partial interim breach coverage, which encompasses the following:

- If a breach occurs before signing and is discovered during the interim period (i.e., the period between signing and closing), the breach will be covered.

- If a breach occurs during the interim period and is discovered after closing, it will be covered.

- If a breach both occurs and is discovered during the interim period, it will NOT be covered.

Why Is Interim Breach Coverage Important?

The interim period between signing and closing can expose buyers to risks not anticipated at the time of signing. Interim breaches could come in various forms. For example, the target company's financial condition could deteriorate beyond the agreed-upon valuation and the valuation preservation mechanisms negotiated at the time of signing of the purchase or merger agreement.

Over a lengthy interim period, customer or supplier relationships could sour, or previously unavailable information about them could surface. Similarly, previously unknown and unanticipated legal or regulatory problems could arise. Without interim breach coverage, any new issues discovered during the interim period would need to be addressed through re-negotiations or left to the buyer to pay for and manage after closing.

However, even with the standard interim breach coverage, many of those problems could be solved through RWI. Once an issue is discovered, the buyer could reach out to their RWI broker to discuss its implications on the purchase price and the business. The broker can then help the buyer file a claim with the insurance carrier and negotiate with the carrier to ensure that the policy responds correctly.

Length and Costs of Interim Breach Coverage

The length of the interim period the carriers are willing to include as part of the base insurance premium is currently somewhere between 120 and 180 days. For longer periods, carriers typically charge additional premium, usually on a per-month basis. Depending on the transaction and the carrier, the additional premium is typically in the thousands of dollars.

We have seen interim periods ranging from two weeks to over a year. The shorter periods tend to come with smaller, non-cross-border, and simpler deals where HSR and other regulatory filings are not required. The longer periods are associated with larger, more complex deals. The new HSR rules are likely to extend the waiting period between sign and close for those larger deals.

A recent legal newsflash talks about how while today most parties “make their HSR filings five to 15 days after signing a transaction,” the filing required by the new HSR rules “will likely take much longer to prepare,” transforming “the pre-filing period from a week or two to several weeks or more, depending on the deal profile.”

Those additional weeks will, of course, extend the interim breach period for deals with RWI coverage. It is worth keeping in mind that for longer interim periods, in addition to extra premium, carriers often request a refresh of the due diligence or, at the very least, a more robust bring-down call ahead of closing.

Also, some carriers do have an absolute cut-off for the length of the interim period, so if parties anticipate an especially long stretch between signing and closing, it is a good idea to negotiate that with the carrier prior to engaging the carrier. An experienced insurance broker with strong carrier relationships can often achieve better results (longer period, lower additional premium) and facilitate the exchange and update of information so that it is satisfactory to the carrier while not being burdensome to the deal parties.

Are Carriers Likely to Shift Practice or Pricing?

Will carriers start charging more premium for longer interim periods? Unlikely. Considering the current extremely competitive RWI market, carriers are not likely to shorten their current standard interim coverage periods or suddenly start charging exorbitant premium for longer terms.

A six-month wait between sign and close should not create any additional hassles or cost more than the base premium. If the FTC becomes more aggressive in its antitrust reviews and deals start falling apart at a higher rate, then the carriers may need to increase their additional premium for interim periods going past the six-month mark.

Although that scenario is unlikely to happen in the near term, interim breach coverage could be one of the elements that could shift once the RWI market starts hardening in 2025.

Author

Table of Contents