Blog

32 Securities Class Action Cases Filed in Q1 2014 (Research Report)

When it comes to personal D&O liability risk, the high-severity risk you want to monitor continues to be securities class action suits. The latest D&O Databox Flash Report (a Woodruff Sawyer publication) reveals that 32 securities class action cases were filed against U.S.-listed public companies in Q1 2014 – that’s a 13-percent increase year-over-year from Q1 2013.

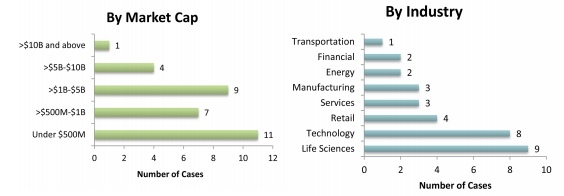

Here’s the breakdown by market cap and industry for Q1 securities class action suits:

The most frequent cases occurred in the under $500 million market cap, with 80 percent falling under the $5 billion marker.

Industries seeing the most cases were life sciences and tech, with allegations in the life sciences sector including off-label marketing, solvency, deceptive promo tactics to boost stock prices and more.

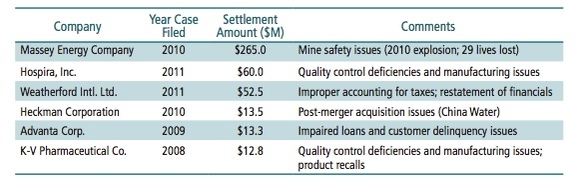

Sixteen cases saw settlements totaling approximately $462 million in Q1, with Massey Energy settling for the largest amount—$265 million for suits relating to disclosure and mine safety issues.

Weatherford Intl. Ltd. settled for about $53 million for improper accounting for taxes and the restatement of its financials. Boards always have to pay close attention to their companies’ financial statements. Now is certainly not the time to ease off on the scrutiny, given that the U.S. Securities and Exchange Commission’s Financial Reporting and Audit Task Force is currently strengthening efforts to identify reporting violations and audit failures.

As reported in a post at The Wall Street Journal, the chair of the task force, David Woodcock, said the following areas will be of particular focus for the SEC:

- Accounting revisions.

- Book earnings vs. taxable income.

- Off-balance-sheet transactions.

- Non-GAAP measures.

- Material weakness and internal controls.

Co-director of the SEC’s Enforcement Division, Andrew Ceresney, said in a speech to the American Law Institute in September 2013 that even though there had been an overall reduction in restatements over the past few years, there was an increase in the number of restatements for companies with market caps more than $75 million.

He expressed doubts that a drop in reported fraud is a reduction in instances of fraud. He also said incentives still exist to manipulate financial statements, and that the methods to do so are still available.

Consequently, we expect the SEC’s fraud task force to continue to make this matter a focus for the remainder of the year.

With this Q1 research, we can say that the bad news is that there’s still plenty of litigation, but the good news is that it’s the predictable kind.

For more tips and data about Q1 securities class actions and how to prepare for the SEC’s fraud task force, check out the full report here.

The views expressed in this blog are solely those of the author. This blog should not be taken as insurance or legal advice for your particular situation. Questions? Comments? Concerns? Email: phuskins@woodruffsawyer.com.

Author

Table of Contents