Blog

The Impact of Underlying Insurance Policy Types on Reps and Warranties Insurance and M&A

We examine two underlying insurances, claims-made and occurrence-based, and their impact on the RWI companies should purchase for their merger or acquisition.

Most forms of insurance fall into one of two categories: claims-made or occurrence-based. This distinction is crucial when you are acquiring a new company and deciding how best to merge the target’s existing insurance coverage with your own. We’ll examine the two underlying insurance categories in this blog and their impact on the reps and warranties insurance that companies should purchase for their merger or acquisition.

What Is an Occurrence-Based Policy?

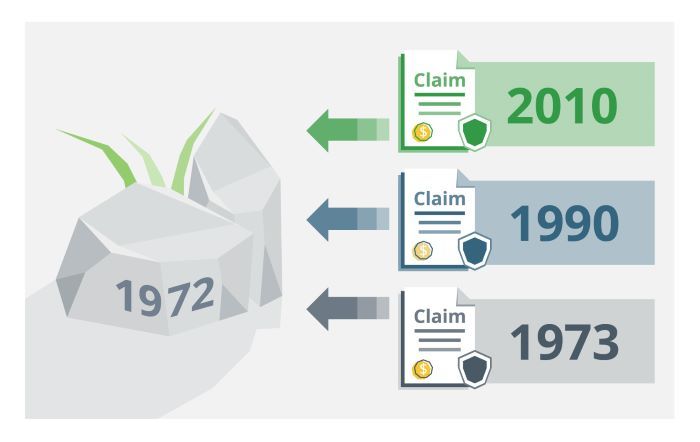

Occurrence-based policies cover claims for events that occur during the life of an insurance policy. They can cover events that cause injury or damage years after they occur, but the policy must have been active when the actual incident happened. Examples of occurrence-based policies are general liability, commercial auto, and umbrella liability insurance. Perhaps the simplest way to think of it is like a rock that sits in place forever. It doesn’t matter when the claim gets filed; incidents that occur are covered if they fall within the time period delineated in the policy.

The rock for 1972 shows the time period covered as 1972-2012. Claims that come in in 1973, 1990, 2010 are covered since the incidents occurred within the time period specified in the rock/policy.

What Is a Claims-Made Policy?

On the other hand, a claims-made policy requires that not only the time of the incident be covered but also that the policy is still active when the claim gets reported. Typical examples are errors and omission (E&O), directors and officers (D&O), employment practices liability (EPL), and certain parts of cyber coverage.

You can think of claims-made policies like an elastic band that stretches to cover a specific period.

In this example, a company purchases a claims-made policy every year between 2020 and 2025. Any claim that both occurs and is filed within that period is covered. In addition the coverage can stretch in both directions if required.

Claims-made insurance can extend back in time with the purchase of “retro cover.” This comes into play when a company just started out and didn’t need certain coverage for a while. When they got to the point of purchasing insurance, they may want to cover any actions or incidents that took place before first buying coverage.

Also called “retro dates,” “backdated coverage,” “prior acts,” or even “nose coverage" (if it covers a previously lapsed policy period).

In addition to stretching backward, claims-made policies can stretch forward in a limited capacity. Here’s another example. Let’s say you have run your company for years, but now it’s time to close it or sell it. You are no longer perpetrating any acts or potentially creating any incidents; however, you may still get claims several years after the transaction. For this situation, we use a mechanism called extended reporting, run-off, or tail coverage.

So, you can see that although you only bought coverage for a few years, you can stretch it in either direction like a rubber band.

Choosing the Right Coverage

Each transaction is different, and you will run into different issues depending on the structure of the policy. Here are some examples of various transaction scenarios and the impact on insurance policies:

- Share sales. In share sales, whereby the buyer purchases all the shares in the company acquiring the company as a whole rather than just the assets, the ownership or value of both current claims-made and -occurrences policies are usually granted to the acquirer. The buyer and seller will need to decide if they are buying an extended reporting period for the claims-made policies. They will also need to look at whether the target’s risks should be rolled into an existing program that the buyer already has or kept separate. Experienced insurance due diligence practitioners can analyze the target’s and buyer’s policies and make recommendations and projections about which is the most cost-effective.

- Asset sales. Asset sales can be more nuanced. If it is purely assets that are being purchased the buyer could just add those assets to their current insurance policies. The issue gets murkier when employees or even directors are coming with the acquisition. Then this needs to work more like a share sale. Add to that the potential in some transactions for specific assets to come with the potential for cyber risk attached to them, and you have a situation that needs to be considered carefully.

- Carve-outs. Carve-outs can be the most variable option. Usually what is being carved out can be a whole business or a single product line that was previously covered under a parent company policy. This change makes it challenging as you need to parse out the different business units or product lines.

- Spinouts. Spinouts come with their own challenges, many of which are similar to carve-outs. However, spinouts often start from scratch for most lines of coverage, which can make it less complex.

What About Reps and Warranties Insurance?

How does all this information apply to Representations and Warranties Insurance (RWI)? RWI most often sits above the existing/extended reporting period of the target’s insurance policies. The underwriter will need to understand the path the buyer is going to take in all the various scenarios above.

In addition, RWI does not serve as an umbrella policy or the bad insurance practices of a target company. We often see small and even mid-size companies that have not bought some coverages, like cyber or D&O. While it is understandable, this oversight can lead to an exclusion or a separate retention on the RWI policy.

At Woodruff Sawyer, we prioritize due diligence and provide it for free with every placement. Not only does this scrutiny lead to the greatest coverage opportunities, but it also allows our diligence experts the opportunity to offer the greatest coverage and cost-saving suggestions for the buyer, leading to the best potential deal outcomes.

Author

Table of Contents