Claims Management

Claims Instructions and Resources

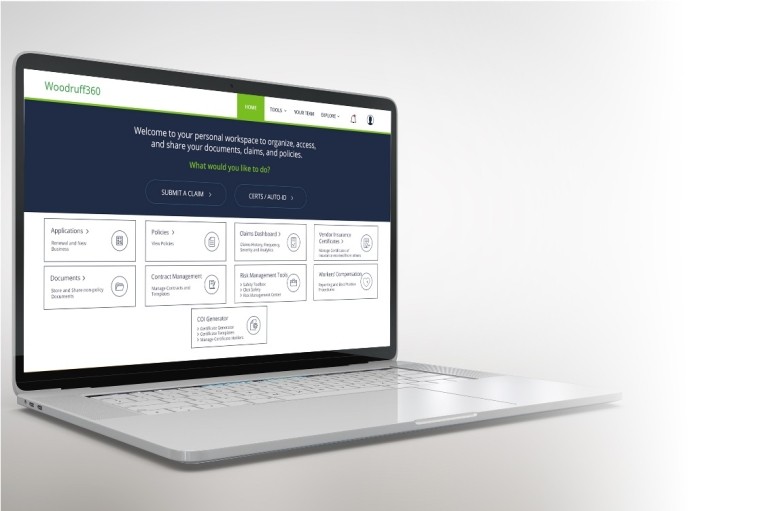

Submit Your Claim Online—It’s Fast, Easy, and Secure

Woodruff Sawyer’s Claims team fiercely advocates for you when you need it most: when a claim hits. As our client, you get full-service, end-to-end support from our dedicated claim specialists by line of coverage.

We’ll acknowledge receipt and report your claim to the insurance carrier within 24 hours.

*Forgot your login or password? Contact your Woodruff Sawyer account team.

**Exception: Workers’ compensation claims should not be reported via W360.

Employers must report workers’ comp claims directly to the insurance carrier.

Need more help?

Watch this video tutorial on submitting a claim.

Claims Handling Frequently Asked Questions

Claim reporting data varies based on the type of loss, but in general the following information is required:

- When the loss occurred - This may also include when you or someone at your company had knowledge of the loss.

- Where the loss happened - Be specific and if more than one location is impacted, provide addresses.

- What happened - Provide a comprehensive description of the loss and any damage or injuries.

- Who was involved - List all parties involved along with contact information, if applicable.

- Contact person - List the name(s) and contact information of who the insurance adjuster should contact for additional information and questions.

- Photos and documents - Be prepared to share photos and documents, including contracts and personnel files that may be relevant to the loss. Preserve evidence.

Maybe. It’s important to read and understand the defense provisions of the policy prior to engaging counsel. Oftentimes the insurance carrier will provide defense counsel at their cost from an approved panel. If the policy is a Duty to Defend policy and you retain counsel without carrier approval, any costs incurred may not be covered. For cyber claims, do not retain any vendors (e.g., breach counsel, forensics investigator) without advising Woodruff Sawyer and obtaining the insurer’s consent.

Contact your Woodruff Sawyer cyber account and claims team. They will help connect you with your primary cyber insurer’s hotline and assist with providing formal written notice to all relevant insurers.

We recommend that you notice a claim to comply with the conditions of the policy and preserve your right to pursue that claim. If it turns out the loss is below the deductible, the claim can be withdrawn and/or closed.

The duration of the claims process can vary greatly based on a number of factors including type of claim, severity of the claim and supporting documentation required.

Yes, you can email all of the claim information to claimfnol@woodruffsawyer.com. In the email, please also inform us that you’re not able to log into W360. We’ll work to resolve your login issue for the future.

Workers’ Compensation

The answer will vary state-by-state, but often it may be as simple as any one-time treatment of minor scratches, cuts, burns, splinters, or other minor industrial injury. Minor industrial injury shall not include serious exposures to a hazardous substance.

Examples of First Aid Treatment for Minor Injuries:

- Application of antiseptics during first visit to medical personnel

- Treatment of first-degree burns

- Application and use of bandages during first visit

- Removal of foreign bodies from wounds by simple instruments such as tweezers (exception: foreign bodies removed from eyes)

- Use of non-prescription medications

- Medical observation

- Hot or cold compresses Ointments to abrasions

For an injury to be work-related, it generally must arise out of the employment and occur in the course of employment. "Arising out of employment" means that the accident or injury had its origin in the employment and is traceable to causes connected with the employment. "In the course of employment" means the injury takes place where the employee may reasonably may be performing their duties, and where they are engaged in their duties or something incidental to them.

The following are some common red flags that may warrant additional questions on a claim.

- History of short-term employment

- Held a seasonal job and it was ending

- Took extensive time off before filing claim

- Was disciplined or terminated prior to filing claim

- Sought change of treating physician after being released to work

- Filed similar types of claims in the past

- The injury was unwitnessed

- Information from coworkers about the injury may be “bogus”

- The injury was reported after a weekend or vacation

It’s important to fully cooperate with the adjuster throughout the life of the claim. Here are some important considerations:

- Report claims immediately

- Provide information about the employee’s work shift and wages

- Identify witnesses and provide access to the claims adjuster

- Advise of any personnel issues and provide copies of the personnel file

- Provide available information about prior injuries or pre-existing medical conditions

- Provide video footage of the area where injury occurred, if available

- Provide information about an injured worker’s whereabouts, hobbies, recreational activities, social media accounts, prior and concurrent employment

- Identify red flags and potential fraud indicators

Yes, remote and telecommuting workers typically are covered under WC policies if an injury or illness occurs while an employee is completing a work task during work hours. In most cases, the remote worker has the burden of proof, meaning that they must be able to demonstrate that they were acting in the interest of their employer at the time they got sick or injured. However, the courts have found that, even though the employer does not have control over an employee's home environment, lack of evidence is not a reason to deny claims. Therefore, employers are responsible for providing the same safe work environment for both their on-site workers and remote workers.

Claims Guides and Best Practices

Insights

Commercial Claims Tips

Claims can be daunting and cause irreparable damage to an organization’s bottom line and reputation. Having a basic understanding of claims will help you through the process. These bite-size tips break down the fundamentals of commercial claims, helping you identify and handle claims to achieve a quick, and often full, recovery.

Claims Management

About Our Claims Services

Our dedicated Commercial Claims Audit and Consulting team stands ready to protect you before, during, and after a claim occurs.

- Property & Casualty: Auto, Liability, Property, Cargo/Stock Throughput, Worker’s Compensation, Pollution, Builders Risk, Construction Defect, Aviation & Marine

- Management Liability: Employment Practices Liability, Directors & Officers, Errors & Omissions, Cyber, Medical Malpractice, Professional Liability, Fiduciary Liability, Kidnap & Ransom, Reps & Warranties

Log into Woodruff 360 to Report a Claim

Woodruff360 is our proprietary insurance program management portal. Submit claims, view your policies, manage certificates of insurance and more, all online.