Blog

Tips for Effective Board Self-Evaluations

It's December, and it's that time of the year again… and I'm not talking about candy canes and mistletoe. I'm referring to something that is maybe equally magical when done well—board self-evaluations.

The NYSE requires them. So do multiple other international governing bodies. Per a recent Spencer Stuart report, all but nine companies or 98% of S&P 500 company boards reported engaging in annual board self-evaluations.

Beyond the fact that board evaluations are basically mandatory, there's little direction on how to conduct them.

So the next question is, are you doing them effectively? Are you uncovering meaningful insights and proactive next steps on how to improve? Or are you just checking the boxes?

According to research conducted by the Rock Center for Corporate Governance at Stanford University along with The Miles Group back in 2016, there is some evidence that improvement is needed: only 78% of respondents said they were satisfied or very satisfied with how their board evaluations were being conducted.

The Rock Centered followed up in 2017 with a paper assessing "Board Evaluations and Boardroom Dynamics." According to this paper, "The more difficult but also more value-producing part of the board evaluation process is to review the contribution of individual directors and the interpersonal and group dynamics among board members."

Unfortunately, per the data, this is an often short-changed or skipped step of the process. According to the 2016 research, only about half (55%) that conducted board evaluations evaluated individual directors. Just 36% believed they did a good job of accurately assessing the performance of directors. Only about half (52%) believed they dealt well with underperforming directors.

This time of the year is an opportunity to reflect on performance and also how to evaluate performance. Here are some tips from experts on how to conduct great board self-evaluations.

Tips on Effective Board Self-Evaluations

As I have discussed in an earlier article on this topic, there are many different ways to conduct a board evaluation. For example, some boards prefer a written format, while others prefer more of an oral interview style. It may take a few times of trying different methods before you find one that works for your board. It's also not a bad idea to change your method from time to time if only to mix things up.

You might start with understanding how organizations like the Council of Institutional Investors see board evaluations. For example, they are explicit in their view that the lead independent director should lead the board evaluation process (a little surprising since many would think that this is a job for the chair of the nomination and governance committee).

A paper they authored discusses at length good examples of board self-evaluation disclosures.

You might also look to experts who are well versed in board self-evaluations, like the authors of the book, "Reviewing Your Board—A Guide to Board and Director Evaluation" by James Beck, Geoffrey Kiel, Gavin Nicholson, and Jennifer Tunny.

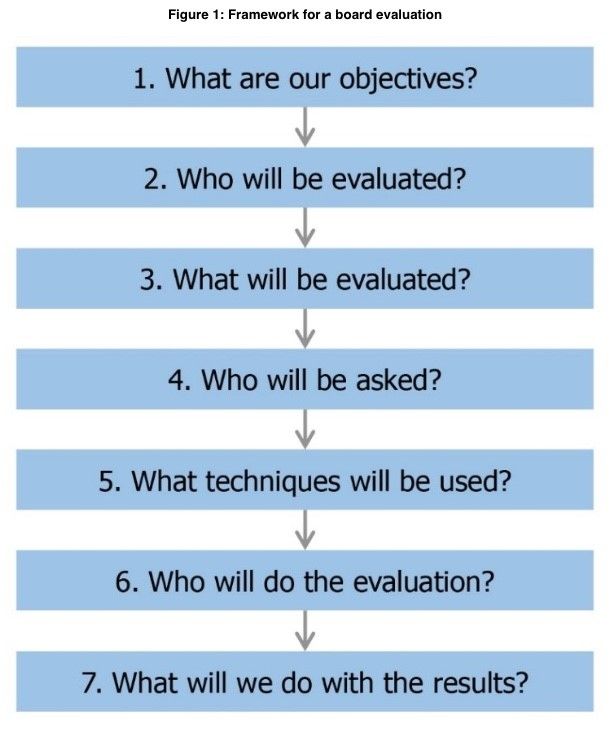

In an article at Harvard Law School Forum on Corporate Governance and Financial Regulation, two authors of the book on board evaluations, Professor Geoffrey Kiel and James Beck, both affiliated with Effective Governance Pty Ltd., described the seven-step framework for board self-evaluations.

Another part of board self-evaluations is to consider board committee self-evaluations. The following video from America's Boardrooms with TK Kerstetter and Mike Berthelot, a board member at Fresh Del Monte Produce, talks about the fact that committee self-evaluations are just as important as conventional board evaluations.

Speaking of America's Boardroom, it has another, more detailed resource on the topic of board evaluations. This six-part series runs the gamut from the basic building blocks of board evaluations all the way to guidelines for taking action based on the results of board evaluations.

In the end, we conduct board self-evaluations in an effort to optimize outcomes for shareholders. A high-functioning board is certainly more likely to grow and protect the value of a firm on behalf of shareholders than a disengaged board.

As you reflect on the past year and your board's performance, it's worthwhile to also reflect on how you will conduct a meaningful board self-evaluation, and what you will do with the information the evaluation yields.

Author

Table of Contents