Blog

Should We Form a Captive for D&O Insurance?

The cost of D&O insurance continues to rise, causing public companies to look for cost-effective alternatives. Completely self-insuring is typically off the table because of the need for someone to pay for the potential non-indemnifiable claims that Side A D&O insurance covers. In an extreme case, at least two companies have dropped insurance altogether in favor of having a wealthy individual provide indemnification instead of an insurance carrier.

Since most boards do not have a billionaire willing to provide indemnification to directors and officers, a lot of board and management teams are asking: Should we form a captive for D&O insurance? Companies are asking this question because they perceive that captives may be a cost-effective strategy compared to paying current D&O insurance rates.

The answer, unfortunately, is that forming a captive for D&O insurance is unlikely to be a cost-effective strategy. But there is some hope that using a captive to underwrite parts of a D&O insurance program might be a viable strategy for a company that already has a large, mature captive in place.

What Is a Captive?

A captive is a licensed insurance company that provides insurance for designated risks to its corporate parent company. Captives can offer many benefits, including:

- Increased control over all facets of insurance

- Insulation from insurance market volatility

- Access to reinsurance markets

- Flexibility to self-fund insurance costs and potentially reduce spending

- Tax savings

Mainstream insurance carriers can also front captives. "Fronting" means that an insurance carrier issues an insurance policy on behalf of the captive, but the captive and not the insurance carrier retains the risk. However, the insurance carrier would still be required to payout the policy if the captive failed.

Companies sometimes use a fronted captive for one of two main reasons:

- Regulatory requirements (e.g., workers' compensation)

- When a company knows that its customers would prefer to see proof of insurance from a commercial insurance carrier.

Companies that want to form a captive need strong financials and an appetite for risk.

How Much D&O Risk Can Your Organization Reasonably Bear?

Most corporate insurance buyers considering a captive for D&O insurance are reacting to recent rate increases by commercial D&O insurers. As premiums continue to grow for D&O coverage, it is natural to consider eliminating part of your costly D&O insurance program and financing layers of D&O risk on your company's balance sheet or in a captive insurance subsidiary.

The first step in evaluating the viability of using a captive to cover D&O risk is to determine whether taking on additional D&O risk is sensible given your company's financial strength, capital objectives and tolerance for variability in insurance costs. Shareholder claims against corporate Directors and Officers are difficult to predict and are often expensive. The average shareholder class action settlement in 2019 was $37 million.

As painful as recent D&O rate increases have been, exposing a company to a large potential loss may not be worth marginally reduced premiums. For the reasons detailed in this article, a captive does not eliminate the D&O risk; it simply creates an alternative mechanism to finance the risk. If retaining additional D&O risk is a non-starter for your organization, evaluating the feasibility of a D&O-focused captive is unlikely to be a good use of time and resources.

Does a Captive Make Sense for D&O Insurance?

Captives are typically used to underwrite high-frequency, low-severity, predictable claims that pay out over many years. Good examples of these types of risk are workers' compensation, general/products liability, medical malpractice, and errors and omissions. These types of risks are well understood by actuaries and captive insurance regulators because of the abundance of available claims data, both for specific companies as well as data held generally by the insurance industry. This plethora of data allows actuaries to model future losses and determine the amount of money that will be needed to cover those losses with a high degree of predictability.

D&O insurance claims, by contrast, are low-frequency, high-severity events. While there are some good data available on shareholder litigation settlements, this data pale in comparison to the enormous amounts of data available when it comes to workers' compensation claims, for example.

In addition, captives must hold adequate capital to backstop the limits of insurance they provide to their parent companies. Capital requirements are directly related to the riskiness of the coverage provided—that is, the potential for unpredictable outsized losses beyond actuarial expectations. Given the lack of predictability and potential for huge losses inherent to D&O, the amount of capital required for a D&O-focused captive would likely be onerous for even well-capitalized companies. This makes traditional insurance more appealing, even in the current market. It is also why we almost never see a company stand up its first captive for D&O insurance claims.

If a company already has a robust captive in place, however, it might be worth considering adding specific layers of D&O risk to the captive.

Will a Captive for D&O Insurance Save You Money?

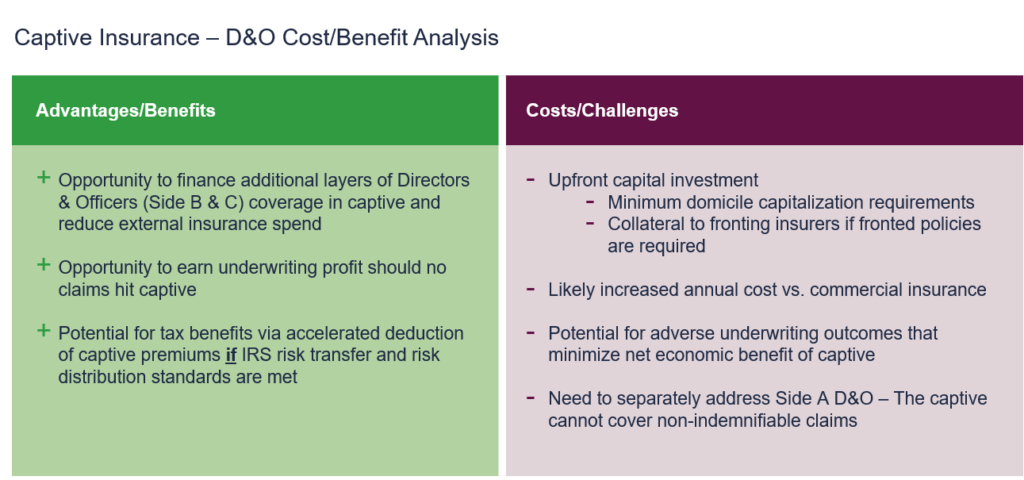

It is critical that companies considering setting up a captive begin the process with a clear understanding of costs, both financial and human. Those considering captives will want to review some of the costs, including:

- Upfront investment in captive formation and capitalization

- Additional frictional costs related to insurance program (captive management, fronting fees, actuarial, audit, premium taxes)

- Increased exposure to catastrophic claims costs

- Increased insurance operational complexity

- Requirement of captive owner time and resources (governance, board meetings, analysis)

That said, captives offer the potential to capture tax savings via the accelerated deduction of loss reserves. When a captive underwrites its parent's risk, it charges the parent a premium to cover reserves for future losses, a risk margin and captive operating expenses. The parent effectively pre-funds future losses by paying the captive premium, which is expensed at the inception of the program and immediately reduces the parent company's tax liability.

The captive structure's tax treatment is accelerated compared a traditional insurance program with large deductibles or self-insured retentions. With traditional insurance, the losses within the large deductible or self-insured retention can only be deducted when they are actually paid. This difference in the timing of the tax deduction, and the associated income statement impact, can be significant for expensive risks such as D&O.

Unfortunately, there is a challenge for D&O insurance-focused captives in achieving the tax benefits. A captive that receives a majority of its premium from D&O insurance would not likely meet the IRS's standards for insurance company tax treatment. The IRS requires tax-advantaged insurance companies to prove broad distribution of risk across many subsidiaries, units of exposure (such as thousands of employees, vehicles or locations) or unrelated, third-parties (such as customers purchasing extended service contracts).

A captive formed principally to cover the parent company's D&O risk would not meet this standard. So, running a D&O-focused captive will add frictional cost without an economic value from an accelerated deduction of losses.

Which Aspects of D&O Risk are Suitable for Captives?

A captive formed for D&O insurance has still another problem: not all aspects of D&O risk are suitable to be covered by a captive. Specifically, the premium associated with Side A D&O insurance would remain outside of the captive since most risk professionals advise against putting Side A in the captive.

Remember that Side A responds in the case of claims in which a company cannot or will not indemnify a director or officer, such as in the case of a derivative action settlement or corporate bankruptcy. If the captive is a wholly owned subsidiary of the parent company, as is the case for large corporate captives, it would likely suffer from the same inability to indemnify the directors & officers as the captive's parent.

Rather than take that risk, given the potential risk to directors and officers for bankruptcy-inducing personal loss, most companies decide to purchase Side A insurance from a commercial insurance carrier.

Given that companies will typically prefer to continue to purchase Side A insurance from traditional commercial carriers, when discussing a captive we are really talking about the balance sheet protection of D&O insurance. As a reminder, the balance sheet portion of the D&O insurance policy is the Side B of the D&O insurance policy (reimbursement for the corporation's indemnification obligations to its directors and officers) and Side C (coverage for the corporate entity for securities claims filed against a public company).

For companies with significant Side B and C D&O premiums, using a captive to underwrite Sides B and C while covering Side A with commercial insurance is a potential solution. However, in the current market, the cost of buying external insurance for Side A-only coverage may prove to be a deal killer.

Historically, Side A-only coverage had been relatively inexpensive for well-capitalized companies since the risk of bankruptcy was small and derivative suits settlements for large dollar amounts were rare. More recently, however, the cost of Side-A only coverage even for cash-rich companies has gone up dramatically due to some very large dollar cash settlement of derivative suits (e.g. Wells Fargo and others) as well as some pending cases that carriers believe will yield additional large derivative suits settlements in the next few years.

The resulting increase in the cost of Side A-only insurance means that insurance carriers are providing much smaller discounts for stripping out B & C coverage from traditional ABC insurance programs. In other words, even if a company were to finance its B & C premiums via a captive (which again requires operating cost and significant capital), the company would still likely have to pay significant premiums to traditional commercial insurance carriers to purchase Side A coverage.

A Captive for D&O Insurance—Worth It?

Given the cost and administrative burden of setting up a captive, and the subsequent cost of regulatory compliance--not to mention the need to add additional capital to the captive over time—is attempting to use a captive to replace at least some portion of traditional D&O insurance worthwhile?

Perhaps. If you are setting up a captive, the right first step is to conduct a feasibility study to better understand the math of your specific situation. In most cases, however, the answer of the feasibility study will be that it is not worth moving forward with setting up a captive to replace commercial D&O insurance.

On the other hand, using an existing captive to underwrite a portion of D&O insurance coverage suitable for a captive, namely Side B and Side C coverage, may be economically viable for large companies that already have a lot of experience with their own existing captive insurance company.

Download Your Copy of This Post

Woodruff Whiteboard Breakdowns: D&O Captives

Authors

Table of Contents