Blog

Side A Insurance Overview for Directors & Officers

Anyone who has been involved in renewing their D&O insurance knows that the cost of coverage is climbing. As such, we are seeing many opt for creative solutions to save money, even going so far as having a wealthy individual indemnify directors personally.

I have written elsewhere about how the frequency and severity of securities class action litigation, as well as the numerosity of open securities class action cases, has caused D&O insurance rates to increase dramatically.

The classic form of D&O insurance is largely designed to respond to D&O litigation defense costs and indemnifiable settlements of securities class action lawsuits. So when these costs go up, of course, the cost of D&O insurance goes up.

Historically, the cost of Side A insurance has been less expensive than the cost of the classic form of D&O insurance. That is still true, but to the dismay of purchasers of D&O insurance, the cost of Side A insurance has also gone up.

Side A Coverage Basics

The classic form of a D&O insurance policy is a combination of corporate balance sheet protection and protection for directors and officers. The policy has three components: Side A, Side B, and Side C, which make up the ABC policy.

The Side A part of the policy is designed to protect directors and officers when they are sued in their capacity as directors or officers and the corporation cannot indemnify them. Bankruptcy is one scenario. Derivative suits are another.

Side A insurance has no self-insured retention (like a deductible). Side B, which reimburses a corporation for its indemnification obligations to its directors and officers, typically has a self-insured retention (SIR). Side C of a D&O insurance program, which responds on behalf of a corporation when it is named in D&O-type suit, is also subject to an SIR. For public companies, Side C is limited to securities claims and breach of fiduciary duty suit claims.

Many corporations purchase Side A insurance on a standalone basis. As there is essentially just "one pot of insurance money" in an ABC policy, if that money is used to protect the corporate balance sheet, there may not be anything left for the individuals.

Standalone Side A is reserved exclusively for the individual directors and officers. For that reason, most public companies have their brokers create a D&O insurance program for them that includes both the classic form of D&O insurance as well as additional standalone Side A insurance.

One feature of a standalone Side A insurance program is that it can be a "difference in condition," or DIC policy. DIC policies typically offer broader coverage than a classic ABC policy by having fewer exclusions. In addition, a DIC policy can "drop down" in certain circumstances that are important to consider when determining how much standalone Side A insurance to purchase (discussed below).

Historically, it has been especially easy for highly solvent companies to justify the purchase of standalone Side A because it was relatively inexpensive. In 2020, $10 million of ABC insurance still costs more than $10 million of Side A insurance, but the cost of Side A insurance has been increasing.

Given that Side A responds when directors and officers are sued and their bankrupt company cannot protect them, no one would be surprised if Side A insurance were to become more expensive at renewal for a financially troubled company.

Unfortunately, even highly solvent companies are seeing big increases in the cost of Side A insurance. Why? Escalating costs of derivative suit settlements.

Derivative Suits Are Getting More Expensive to Settle

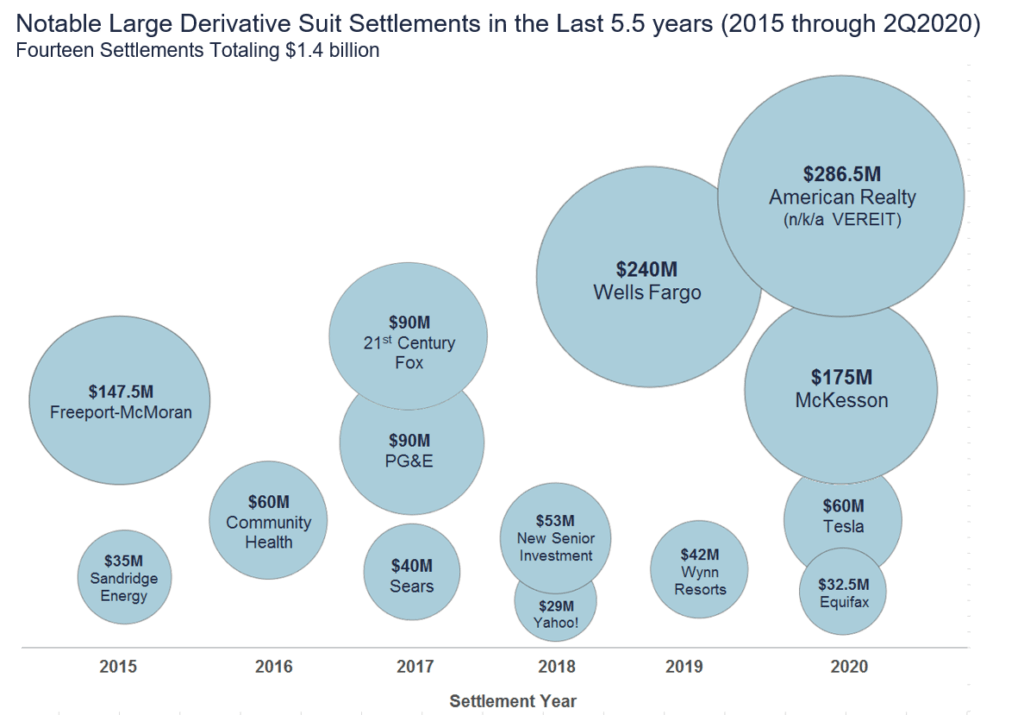

Woodruff Sawyer's D&O Databox is a proprietary set of D&O-related litigation data. We've been tracking derivative suits for some time. The Wells Fargo $240 million settlement in 2019 was certainly notable. However, it is only August of 2020 and we have already had some notably large settlements:

Insurance underwriters, of course, do not just consider the past; they are intensely focused on what future litigation looks like as well. The inventory of open derivative suits with potentially large settlements is sobering.

At Woodruff Sawyer, we are tracking more than 20 separate companies with difficult derivative litigation pending. Many of these cases have been covered extensively in the press, e.g., Boeing (737 Max 8 Jets), Google (#MeToo), and Marriott (data breach). Some companies like Facebook and Oracle have multiple derivative suits pending against them.

Derivative Suits and Indemnification

As a reminder, shareholders bring derivative suits on behalf of the corporation against directors or officers for breach of fiduciary duty claims. It is common to see derivative suits brought against directors and officers as a byproduct of a securities class action suit, but, of course, derivative suits can be brought without any stock drop or related securities class action case.

Derivative suits are especially threatening for directors and officers. While the individual's defense costs in a derivative suit are indemnifiable by the corporation in most states, the settlements under most state corporate law codes (including those of Delaware and California) usually only can be paid by the individual or insurance.

If your company is incorporated in a state where derivative suit settlements are indemnifiable, purchasing standalone Side A coverage is less important, assuming you are highly solvent and thus unlikely to face any claims in bankruptcy. It's important to discuss with your corporate counsel whether your state of incorporation is one where derivative suit settlements are indemnifiable.

For all others, it has become a best practice to purchase standalone Side A insurance in addition to classic D&O insurance.

How Much Side A to Buy?

Once a corporation has decided that standalone Side A is a good idea, the next question is usually: How much in limits? This is a complex question. But here are a few things to consider.

Assess the "A" in a Combination ABC Policy

I mentioned that when you buy a combination ABC policy as part of your D&O insurance program, it includes Side A. The Side A portion of an ABC policy can respond in all Side A scenarios.

If a claim looks to be catastrophic from a Side A perspective, for example because there will be an enormous derivative suit settlement, the directors and officers can preserve the insurance for this purpose by instructing the ABC carriers to refrain from paying indemnifiable claims.The embedded Side A insurance in an ABC policy makes buying a moderate amount of standalone Side A insurance more comfortable than it otherwise would be.

Determine Coverage for Derivative Lawsuits

The vast majority of derivative suits are small. However, as discussed, it is notable that we have seen larger derivative settlements in the past few years than years prior. These larger settlements and their circumstances should be a factor when you think about how much Side A to buy.

Match Your Self-Insured Retentions

Assuming your standalone Side A is a DIC policy, it is useful to match the size of your standalone Side A program to the size of your D&O program's self-insured retention. This is because, should your company decide not to pay the ABC program's SIR, the DIC policy will drop down and pay it.

It might feel strange to buy a $20 million standalone Side A policy for a $20 million SIR, but the alternative is the risk that a director or officer gets into a dispute with the company and the company refuses to fund the self-insured retention.

If a claim is subject to an SIR (e.g., defense costs or the settlement of an indemnifiable claim like a securities class action suit), the ABC carriers will not pay even one dollar before the SIR has been paid. No individual wants to be on the hook for this amount, particularly if the self-insured happens to be in the millions or tens of millions.

An individual director or officer with a D&O insurance program that includes Side A DIC insurance will not have to try to self-fund the SIR. Instead, the DIC carrier will drop down and pay the SIR so that the rest of the ABC program can respond as intended.

Of course, as one would expect, the DIC carrier will then turn around and sue the company on behalf of the individual for the SIR amount that was wrongfully withheld.

Remember that a good personal indemnification agreement makes it less likely that a company will leave a director or officer high and dry.

Match Your Largest Underlying Layer of Insurance

Large insurance programs are built in layers with different insurance carriers. It's a bad day if one of the carriers goes bankrupt while you have a claim. It's a much worse day if a carrier goes bankrupt while you have a claim that is not indemnifiable by the corporation.

Of course, the best-case scenario is not to partner with an insurer who may become insolvent. Good brokers are careful to recommend stable, highly solvent carriers to their clients. If a carrier goes bankrupt while you have a non-indemnifiable claim, however, the limits you purchase for your standalone Side A can protect you.

Ideally, you'll purchase a limit of standalone Side A insurance that is at least as large as the largest underlying layer of insurance that you have on the D&O insurance program. This is important because a well-designed standalone Side A policy with a DIC feature will drop down and step into the shoes of a carrier that becomes insolvent if that insolvency happens while you, the insured, have a Side A exposure.

For example, if you're a company that buys insurance in layers of $5 million, then the minimum Side A insurance purchase in order to take full advantage of the drop-down feature is $5 million. If your largest layer of insurance is $10 million, then you'll want to match the standalone Side A to the $10 million layer.

In each case, try to make sure that if you have to replace an insolvent insurer, you have enough in that drop-down limit to avoid any gaps in coverage.

From time to time, we see the standalone Side A policy with a carrier that is also part of the underlying ABC insurance program; this is not helpful if that's the carrier that goes bankrupt, but many corporations use this type of structure in order to gain better pricing in the overall program. This is a perfectly fine strategy so long as the directors and officers understand the tradeoffs involved.

(Quick side note: If an underlying insurer becomes insolvent while you have an indemnifiable claim, which is to say a Side B-type claim, the standalone Side A policy will not drop down to respond. This is because Side A only responds to non-indemnifiable claims.)

Review Balance Sheet Protection

If you are relying on the Side A portion of the ABC policy, consider how much balance sheet protection the company needs. Reducing balance sheet protection but buying more in a standalone Side A is one way that companies may save on their D&O insurance premiums. Though, in the current pricing environment for Side A insurance, these savings will be more muted than in the past.

For balance sheet protection, think about how much cash your company has and how much of it is surplus beyond working capital and other "normal" business needs. Then think about how likely a bankruptcy might be if faced with unexpected costs (like litigation). Companies with less free cash may be interested in purchasing more standalone Side A.

Usually, companies that have a billion dollars or more in free cash on their balance sheet tend to drop Sides B and C coverage from the D&O program altogether. Given the current cost of D&O insurance, all companies may consider that an option while pumping up the standalone Side A program.

Finally, before purchasing any standalone Side A insurance, it is useful to work with outside counsel to understand what scenarios in today's climate might trigger the need for this extra coverage for directors and officers.

Whiteboard Breakdown:

Sides A, B & C of a Director & Officer Liability Insurance Policy

Author

Table of Contents