Blog

Coronavirus and D&O Litigation: An Update on Securities Class Action Suits

This blog post can also be found on our Coronavirus Resource Center.

I recently published the director's guide to coronavirus, and included a prediction that we would not see a lot of D&O litigation related to this health crisis. The market has continued to be extremely volatile, so this prediction will be tested. Unfortunately, two coronavirus-related cases have already emerged—but with an interesting feature that might tell us more about what future cases could look like.

Plaintiffs typically will not file a Section 10(b) securities class action lawsuit merely because a company's stock price has fallen, particularly when everyone's stock price is down. A good case for plaintiffs also requires some sort of disclosure that they can point to as having been false, so that when the truth was revealed, the stock price fell in response.

Ideally, plaintiffs will also be able to point to someone who sold securities of the company in the open market before the stock price fell because this helps the plaintiffs establish a motive for the alleged intentional wrongdoing.

To date we haven't yet seen a flood of cases. We have, however, seen two coronavirus-related securities class action cases filed against public companies with very direct connections to the coronavirus situation. (My thanks as always to the indefatigable Kevin LaCroix, author of the D&O Diary, for pointing these out.) Notably, both cases have very short class periods.

Typical Class Periods

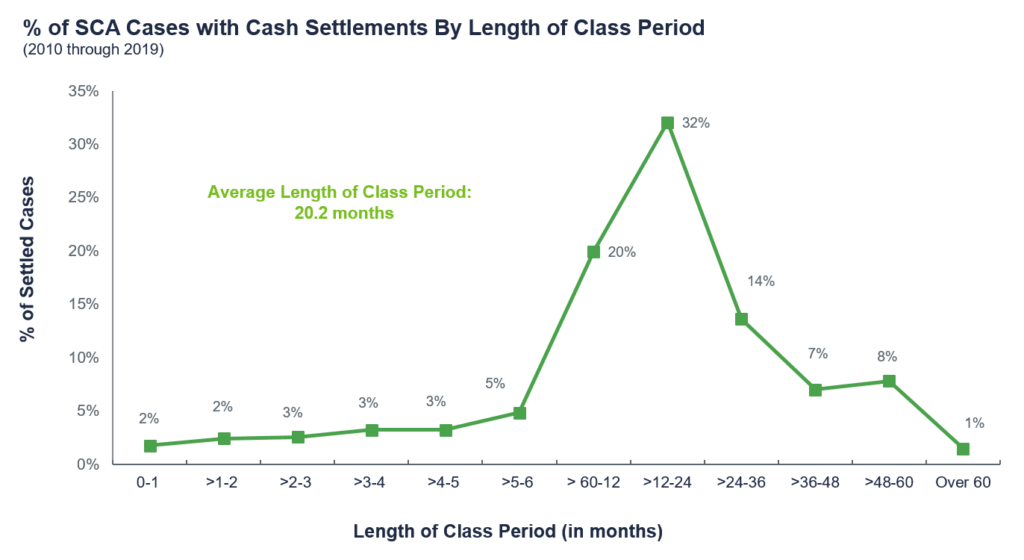

Among the many case details that Woodruff Sawyer tracks in the D&O Databox, our proprietary database of D&O-related litigation, is class periods. Looking at the past decade, the average length of a class period for securities class action lawsuits that resulted in cash settlements was 20.2 months.

By contrast the class periods for the two coronavirus-related suits are very short. Remember that to be part of a class, a shareholder must be a purchaser subsequent to the alleged material misrepresentation. In general, a shorter class period means less in damages because there will be fewer people in the class.

Coronavirus Class Periods

The two coronavirus-related securities class action suits filed to date were both filed on March 12, 2020.

The first is the securities class action suit filed against Inovio Pharmaceuticals. The alleged class period is only from February 14 to March 9, 2020, a mere 24 days.

The main allegation is that the CEO of the company announced that the company had developed a vaccine for COVID-19 on Fox Business, a statement that was re-affirmed in a meeting with President Trump. Subsequently, Citron Research, known in the financial community as a short seller, called Inovio's claims into question and the stock price fell on this news.

The second coronavirus-related securities class action suit filed was filed against Norwegian Cruise Lines. The class period runs from February 20 to March 12, 2020, a paltry 21 days.

February 20 was the date the company released financial results. In doing so, the company made certain disclosures about the known impact of coronavirus and the steps it was taking to avoid transmission of the infection. Plaintiffs point to a Miami New Times article that purported to demonstrate that the company's 8-K comments were false and misleading. The stock price fell on this news.

We expect plaintiffs to write aggressive complaints, and the complaints filed in these cases are no exception. It's also the case that only the plaintiff's side of things has been aired to date.

Securities class action suits take time to resolve, so it will be a while until we know the ultimate outcome of these two cases. According to the D&O Databox, if a case is to be resolved by a motion to dismiss, on average, it takes 1.9 years to get to a final dismissal. The average time from the first filing to the end of a case that is resolved by the payment of a cash settlement to plaintiffs is 3.1 years.

Industry Matters

We are in the early days of this situation, so seeing two coronavirus-related securities class action suits so soon is not good news. In addition to having extremely short class periods, it is notable that both suits are against companies with very tight connections to the coronavirus: a pharmaceutical company working on a coronavirus vaccine and an entity in the travel industry.

There is no doubt that companies like these are at a heightened risk of being sued compared to other companies.

What about companies whose bottom lines are impacted by coronavirus, albeit not as directly as those mentioned in the lawsuits (which is to say almost the entire world economy)? As economic activity grinds to a halt and the markets seize up, we will no doubt see some companies fall on hard times. Some of those companies may be sued.

Updating Your Disclosures

Having said that, careful disclosures should help many companies avoid being sued. Not everyone company that suffers a stock drop will find itself the subject of a securities class action suit. Plaintiffs will not be interested in suing everyone, and even the companies they sue may not end up paying the plaintiffs any settlements.

In the past decade, about half of all cases were either won by defendants on a motion to dismiss or withdrawn by the plaintiffs—meaning the plaintiffs did not obtain a lucrative settlement. Plaintiffs are not economically incentivized to go after "loser cases."

The best way to be a "loser case"—a good thing—is to be deliberate about updating and refreshing your public disclosures. In a recent video seminar held hosted by Cornerstone Research, Stanford Professor Joe Grundfest noted the following areas as good places to start:

- Risk factors that are no longer contingencies because they have materialized

- Material COVID-19 exposures that are not yet adequately disclosed in SEC filings

- Supply chain issues or customer issues that are not readily inferred from available public information

- Conditions in loan agreements, contracts or other financing arrangements that are implicated by COVID-19 risk but that are not otherwise apparent from disclosures

Several major law firms have also released good white papers that outline steps to take when considering updating disclosures. For example, the law firm Davis Polk makes a number of suggestions to consider when it comes to disclosure updates, including:

- Revolver drawdowns (if big enough)

- Pre-release and guidance changes

- Ratings downgrades

- Reductions in force that are large

- Termination of material agreements

- Material impairment charges

The stakes are high right now. So be sure to consult with outside counsel when considering updating your disclosures, including what the timing should be.

In addition to helping you with legal compliance, good outside counsel can also be helpful when it comes to the business issue of understanding what is becoming "standard" in your industry. You don't want to be the one company that failed to provide shareholders with the type of updates all of your peers decided to make.

Updating your disclosures may cause a further decrease in stock price in the immediate term, and the idea here is that doing the work now will make it harder in the future for plaintiffs to craft a winning securities class action complaint against the company.

As I've written elsewhere, it's also a good idea to close the insider trading window.

Other Steps to Take

While no one wants to be sued, it should also be said that the risk of being sued is exactly why individuals serving as directors and officers should have personal indemnification agreements and companies purchase D&O insurance.

It is true that the novel coronavirus has caused an unprecedented world health crisis, but it has not changed the normal steps directors and officers should take to protect themselves and the companies they serve from securities class action suits and other D&O litigation.

A Final Note on Securities Class Action Suits and Coronavirus

Author

Table of Contents