Blog

ESG Disclosures Set the Tone for Leading Corporate Investors

Investors and shareholders increasingly care about environmental, social, and governance issues at the corporate level. Yet some boards of public companies are still not fully addressing this concern, or even fully understanding what the concern is.

This is not surprising. While the term "ESG" is getting used a lot these days, not everyone agrees on what it involves.

The Nasdaq defines ESG as a "broad set of environmental, social and corporate governance considerations that may impact a company's ability to execute its business strategy and create value over the long term."

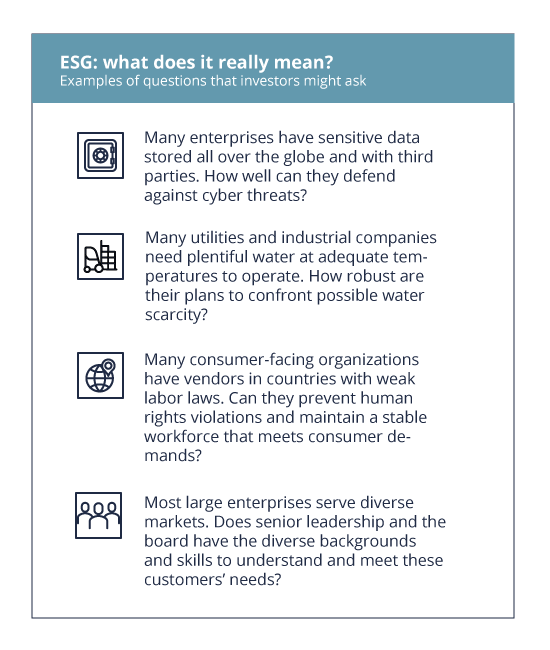

PwC, in its report on ESG in the boardroom gives some helpful examples of issues that fall under ESG:

ESG is a concept that has already gone mainstream in the investment community. According to research highlighted in this article at Harvard Business Review (HBR), the world's top investors all have ESG on their minds.

And who could forget the CEO of BlackRock's 2018 annual letter, which called for corporations to maximize societal value in addition to shareholder value?

Certainly not the CEOs of almost 200 major companies, including Amazon, Apple, Exxon, United Airlines, and Walmart, which recently signed a statement issued by the Business Roundtable pledging to update its view of the role of the corporation to include the concerns of stakeholders other than just shareholders.

This commitment includes support for the environment, investing in employees and fostering diversity. According to The New York Times, the statement is also "an explicit rebuke to the notion that the role of the corporation is to maximize profits at all costs …"

Aside from public declarations from the largest institutional investors about the importance of ESG, there's plenty of research that shows investment companies worldwide are looking at ESG issues when making their investment decisions.

FTSE Russell 2019 data show 58% of companies are now either implementing or evaluating ESG considerations in their investment strategies. This is up from 53% in 2018.

As the HBR article I mentioned earlier points out, we're at a tipping point driven by investment firms that feel a responsibility for ESG. They're looking at the long-term view of their investments, and this is fueled by promising financial returns from companies that do well with ESG issues.

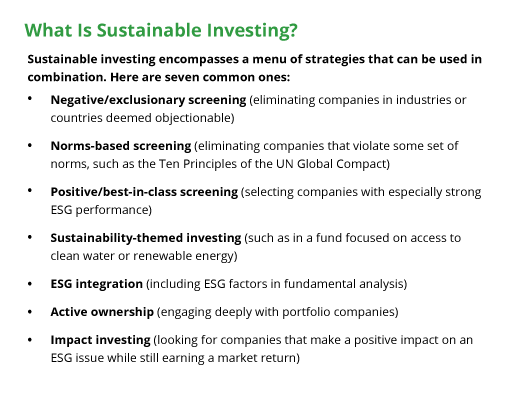

"Sustainable investing" is the next generation of investing, and it's here today. The HBR article gives several examples of what sustainable investing looks like in action:

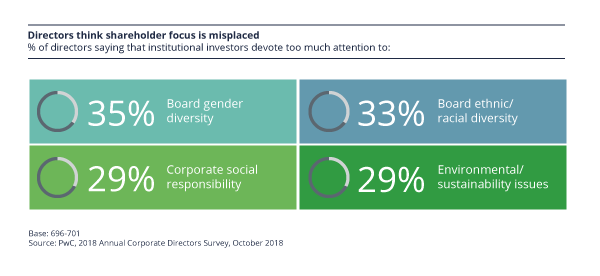

Notwithstanding all the press around investor interest in ESG, some corporate boards are not fully aligned with the focus on ESG. According to PwC data, a meaningful percentage of boards still think investor interest in ESG topics are misplaced:

While there are surely a myriad of reasons the directors in this survey feel as they do, one common concern is the bedrock belief that the role of the board is to maximize returns for shareholders.

In such a framework, some argue ESG-focused efforts might detract from the board's main purpose.

Other companies may already be taking on ESG in a serious way, but not getting credit from investors for their efforts.

A lack of consistent, industry-wide standards for measuring and reporting on ESG is a challenge. A number of third parties are working to fix that

Notably, the Nasdaq released an ESG reporting guide in 2019 based on widely adopted third-party reporting methodologies. The guide is meant to help both public and private companies navigate the latest ESG metrics, data collection, and disclosures.

The bottom line is this: ESG is not a passing fad. Boards in 2020 will need to identify or refine ESG goals and how they are going to measure and communicate them in a meaningful way to investors.

Author

Table of Contents