Blog

Extra Protection for Independent Directors: Wealth Security Policy

A question that often comes up for independent directors at public companies, private companies and even nonprofits is: What happens if the company has nothing left to protect me? Maybe the corporation didn’t buy enough insurance, or maybe it purchased a poorly written insurance policy. In these cases, is there anything an independent director can do to protect him or herself? The answer is yes. Independent directors can buy a wealth security policy, also known as an independent director liability policy.

Useful Times to have a Wealth Security Policy

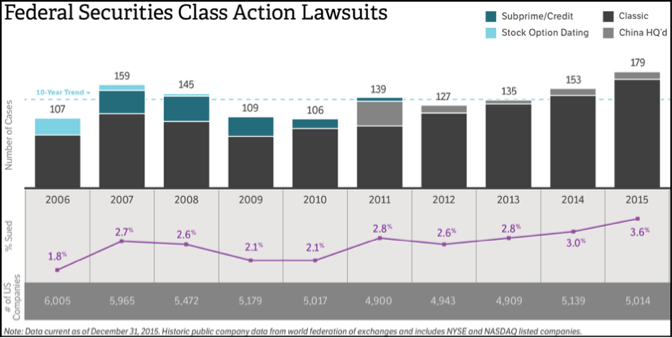

There are many instances where having this safety net is desirable. One example is corporate bankruptcy, a situation in which a corporation can no longer indemnify its directors. Another situation in which an independent director might feel vulnerable is the settlement of a breach of fiduciary duty suit that was brought derivatively. These types of suits are jarring because the only option for payment outside of a director’s personal wealth is insurance; a company cannot settle these suits for a director. Remember, however, that a good corporate D&O liability insurance program contemplates these exposures and should include enough in limits to keep a director from paying out of pocket. Another situation that some independent directors consider in terms of catastrophic personal exposure is securities class action suits. Securities Class Action Suits are, in fact, one of the most seriously significant exposures an independent director faces when measured by historical settlement amounts. And the number of class actions brought against corporations each year shows no signs of abating.  When independent directors are named as defendants in these cases, their personal assets are potentially at risk. Wealth security policies became popular after the personal settlements made in the WorldCom/Enron catastrophe (where directors agreed to pay millions out of their own pockets). In those cases, the directors’ paying out of pocket was a requirement of the settlements. It’s important to note that this outcome—personal payments by public company independent directors—is extremely rare. When we see it happening, it’s generally a situation involving unusually bad facts, an inadequate D&O insurance policy or corporate bankruptcy. Nevertheless, some independent directors have elected to purchase wealth security policies just in case they find themselves being asked to pay out of pocket to settle a lawsuit. Another reason an independent director might purchase a Wealth Security policy is to ensure that he or she has a limit of insurance that is not shared with anyone else.

When independent directors are named as defendants in these cases, their personal assets are potentially at risk. Wealth security policies became popular after the personal settlements made in the WorldCom/Enron catastrophe (where directors agreed to pay millions out of their own pockets). In those cases, the directors’ paying out of pocket was a requirement of the settlements. It’s important to note that this outcome—personal payments by public company independent directors—is extremely rare. When we see it happening, it’s generally a situation involving unusually bad facts, an inadequate D&O insurance policy or corporate bankruptcy. Nevertheless, some independent directors have elected to purchase wealth security policies just in case they find themselves being asked to pay out of pocket to settle a lawsuit. Another reason an independent director might purchase a Wealth Security policy is to ensure that he or she has a limit of insurance that is not shared with anyone else.

Wealth Security Policy Details

Wealth security policies are designed to be a final layer of protection between being personally sued as an independent director and the personal assets of that independent director. Wealth security policies are designed to cover the following situations if other sources of corporate indemnification or insurance are unavailable:

- Wrongful acts as directors

- Wrongful acts as an ERISA fiduciary

- Employment practice-type wrongful acts

The good news is that these policies tend to be relatively inexpensive – typically around $5,000 per $1 million in limits for an independent director who sits on one mid-cap public company board. It makes sense that these policies have a fairly reasonable price given that they are Side A policies that only respond when indemnification is not available. In addition, they’re designed to respond only after the underlying corporate insurance has been exhausted. If you are buying a Wealth Security policy, you will want to do it with your own money; don’t have your corporation buy it for you. Purchasing the policy directly should make it personal insurance, and thus not the type of “corporate insurance” that directors agreed not to use in the WorldCom and Enron settlements. (I note here that to my knowledge, no wealth security policy has been tested in a WorldCom/Enron–type situation. This is not surprising given how rare such situations are.) One feature of a wealth security policy for independent directors is that you can schedule multiple boards on one policy. The limitation on this feature is that each company you schedule must buy their own D&O insurance. You will have to provide the insurance carrier with information about each company’s D&O insurance program. A program summary will suffice.

Misconceptions

It’s worth mentioning that some directors believe that their personal umbrella policy will respond if they are sued in their capacity as a director of a for-profit company and no other source of indemnification or insurance is available. It’s true that you may be able to schedule your nonprofit boards on your personal insurance, particularly if you are working with a good personal lines broker. But it is unlikely that your personal liability umbrella policy will respond if you are sued as a director of a for-profit organization, be it a public or private company. What does your personal umbrella policy actually cover? Have a detailed conversation with your personal lines broker to find out.

Does Every Independent Director Need a Wealth Security Policy?

For many independent directors, working with an excellent broker or having a coverage attorney who specializes in D&O insurance will be enough to get comfortable with the protection being provided by the corporation he or she serves. This is especially true if the director also has a robust personal indemnification agreement and serves on the board of a highly capitalized company. In the end, whether you need a wealth security policy depends on factors like your appetite for risk, the potential for your company to become bankrupt, and the quality of your company’s D&O insurance program.

Woodruff Whiteboard Breakdown: Independent Directors Liability vs. Wealth Security Policies

Author

Table of Contents