Blog

How IPO Companies Are Adopting Choice of Forum Bylaws to Avoid Section 11 Suits in State Court

It’s 2017 and we’re seeing a lively IPO environment. According to Renaissance Capital, the 2017 US IPO market came out “with a far stronger start than the 1Q16,” where “momentum continued through the quarter, ending with 25 IPOs raising nearly $10 billion.” This laid the groundwork, according to Renaissance, for “a year still on pace to see over 150 IPOs.”

If you’re planning an IPO, an important part of your risk management strategy should be planning for potential post-IPO litigation.

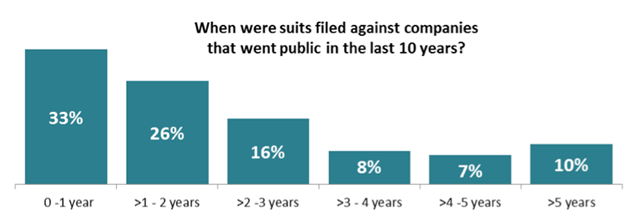

As we’ve continued to see, IPO companies are a target for securities class action lawsuits—especially within the first three years of going public.

Image source: D&O Databox Flash Report” for 2016

On top of this, we’ve seen a trend over the past seven years in which IPO companies are sued pursuant to Section 11 of the Securities Act of 1933 in state court—specifically in California.

Section 11 suits can be brought when a company’s stock price drops below its IPO offering price. In the last D&O Notebook article about this trend, I pointed out the attraction of these types of suits for the plaintiff’s bar:

Section 11 claims are challenging for defendants because companies are strictly liable for material misstatements and omissions in their S-1 registration statements. The directors and officers who sign the registration statement are also subject to liability. Unlike Section 10(b) claims of the ’34 Act, plaintiffs do not have to show intent in Section 11 claims, making them easier for plaintiffs to win.

These cases tend to survive in the California state court environment where there is a very low dismissal rate due to plaintiff-friendly pleading standards. This is one of the reasons that litigation in a California court is much more expensive than if the same suit were brought in federal court.

Solution: Choice of Forum Bylaws

This trend has not gone unnoticed, and some clever potential solutions have been proposed.

One of those solutions, dubbed the “Grundfest Solution” after Professor Joe Grundfest of Stanford Law School, involves inserting choice of forum provisions into a company’s bylaws that make federal courts the exclusive venue for litigation arising under the Securities Act of 1933.

When the Grundfest Solution was first put forth, objections included the concern that the Securities and Exchange Commission may not allow a company to declare its registration statement effective if that company had federal choice of forum provisions in its bylaws or its articles of incorporation.

From an earlier article I wrote (linked to above):

The first-blush reaction to this solution by most corporate and securities attorneys is that the type of limitation imposed by the Grundfest Solution might be prohibited by Section 14 of the ’33 Act.

The relevant language reads: “Any condition, stipulation, or provision binding any person acquiring any security to waive compliance with any provision of this title … shall be void.”

We’re now aware of at least three public companies that have adopted the Grundfest Solution. They have inserted in their bylaws or certificates of incorporation provisions that are explicitly designed to ensure that any Section 11 litigation will be brought in federal and not state court.

These companies include KKR & Co., Lpath, Inc. (now Apollo Endosurgery) and Snap Inc. The Snap IPO has demonstrated that the SEC does not object to this innovation.

Many more corporations are considering adopting these types of provisions, including some early stage companies that want to adopt these provisions today in anticipation of an IPO that may, in fact, be several years down the road.

Considerations for Adopting Choice of Forum Bylaws

In my experience, there are three questions that tend to come up when considering the adoption of federal choice of forum bylaws for Section 11 suits.

1. If we adopt federal choice of forum provisions, will that in and of itself cause us to be sued in advance of a stock drop?

I believe the answer is no.

This concern arises from the memory of what happened when companies like Chevron and Federal Express adopted state choice of forum provisions. They adopted these provisions when they were already a public company, and their shareholders sued them over it. In the end, the companies won, but of course, they had to spend time and money on the litigation to achieve this outcome.

It is unlikely that private company shareholders would sue the company’s directors and officers for adopting this type of provision.

Of course, any buyer of IPO company stock will have bought the shares already knowing that the provisions were part of the company’s charter documents. As a result, it’s unlikely that the mere fact of having choice of forum provisions before a company goes public would cause a company to be sued by shareholders who purchased shares in the IPO.

2. If plaintiffs bring a Section 11 suit against us, will having adopted federal choice of forum provisions make the litigation more difficult for us, including an increased cost of litigation?

Again, I think the answer is no.

Having federal choice of forum provisions gives you an opportunity to argue that a Section 11 brought in state court should be moved to federal court.

However, a company can always decline to assert its right to remove a case to another court. We see this happening in the M&A environment for companies that have intrastate choice of forum provisions naming Delaware, but are sometimes sued in California. Some companies insist on moving the litigation to Delaware; other companies do not.

Having the provisions gives you options, but having the option to move something to federal court doesn’t mean you have to do so. If a company declines to assert its federal choice of forum provisions, the company is in the same boat as if it had never adopted a federal choice of forum provision at all.

3. What do we give up if we don’t implement federal choice of forum provisions before the IPO?

The answer to this is optionality, not to mention the chance to potentially get ahead of the curve when it comes to expensive, tough litigation.

It will be harder to adopt a federal choice of forum provision post-IPO for all the reasons that Chevron and Fed Ex were sued when they tried to implement provisions post-IPO. It’s best to adopt a provision of this sort as a private company. Some private companies are considering doing this well before their IPO event, a move that I think makes a lot of sense.

Also, consider what happens if another company ends up being the test case for federal choice of forum provisions, and wins. Any IPO company that doesn’t have federal choice of forum provision in their charter documents will wish it had—but it will be too late.

In other words, if you don’t have these provisions and it turns out they work, a case that you might have handled for about $1 million will instead take at least $10 million.

On the other hand, if another company loses the test case (unlikely, in my view), when you are sued you can simply decline to attempt to enforce the provisions.

For all of these reasons, I am a proponent of company’s adopting the Grundfest Solution. If you want to be serious about avoiding state court litigation in connection with your IPO, it makes a lot of sense to talk to your outside counsel sooner than later about adopting federal choice of forum provisions in your corporate bylaws.

Author

Table of Contents