Blog

Event-Driven Litigation Update: COVID-19 and D&O Lawsuits

Event-driven litigation in the world of D&O liability is a grave concern for boards of directors and D&O insurance carriers alike. One reason is that it is much more difficult to predict compared to litigation arising from missed earnings or a financial restatement, i.e., “classic” D&O litigation.

Event-driven litigation can arise due to a corporate catastrophe or scandal (e.g., #MeToo), or it can be the case that national or worldwide events play a role. An example of the latter is D&O litigation related to the COVID-19 pandemic.

At the start of the pandemic, every business was focused on health and human safety. Employers reacted swiftly by instituting rules to protect employees and customers.

After considering the health and welfare of their employees, company boards had to swiftly move to caring for their businesses. This involved contingency plans for keeping their businesses up and running, as well as addressing concerns about D&O-related litigation.

Predictions that the plaintiffs’ bar would file D&O litigation related to COVID-19 proved to be true. In 2020, plaintiffs rapidly filed lawsuits related to the pandemic. About 10% of the securities class action lawsuits filed in 2020, in fact, were connected to the pandemic in some way.

Not to be left out, the Securities and Exchange Commission also brought six enforcement actions related to COVID-19 disclosure issues.

I wrote in depth about 2020 pandemic-related D&O litigation here: COVID-19 Litigation: Where We’ve Been and Where We’re Headed.

The Pandemic Rolls On...and So Does Pandemic-Related D&O Litigation

COVID-Related Securities Class Action Cases

It’s now the fourth quarter of 2021. While infections, hospitalizations, and even death continue to result from COVD-19, businesses have found ways to move forward—and so has the plaintiff’s bar, according to data from Woodruff Sawyer’s proprietary database, the D&O DataBox.

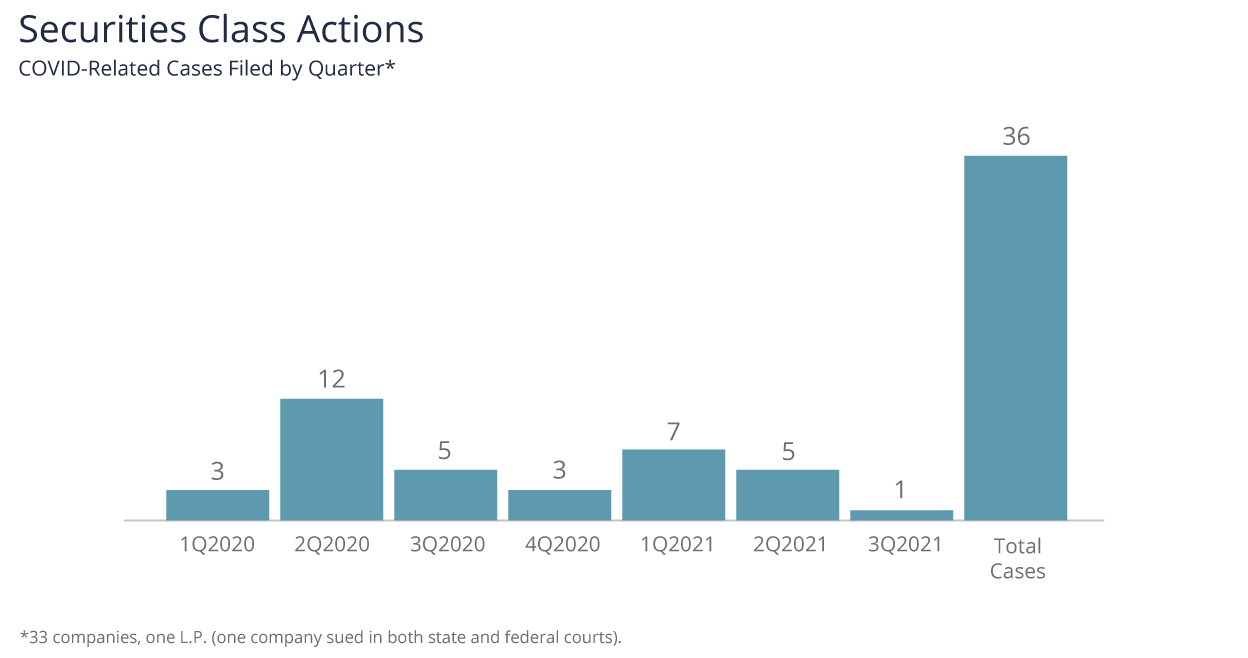

Through the first three quarters of 2021, we’ve seen 13 securities class actions related to COVID-19: Seven in Q1, five in Q2, and one in Q3. This is a significant downturn compared to the 20 we saw through Q3 of 2020.

The total number of cases filed related to COVID from 2020 through the first three quarters of 2021 is 36.

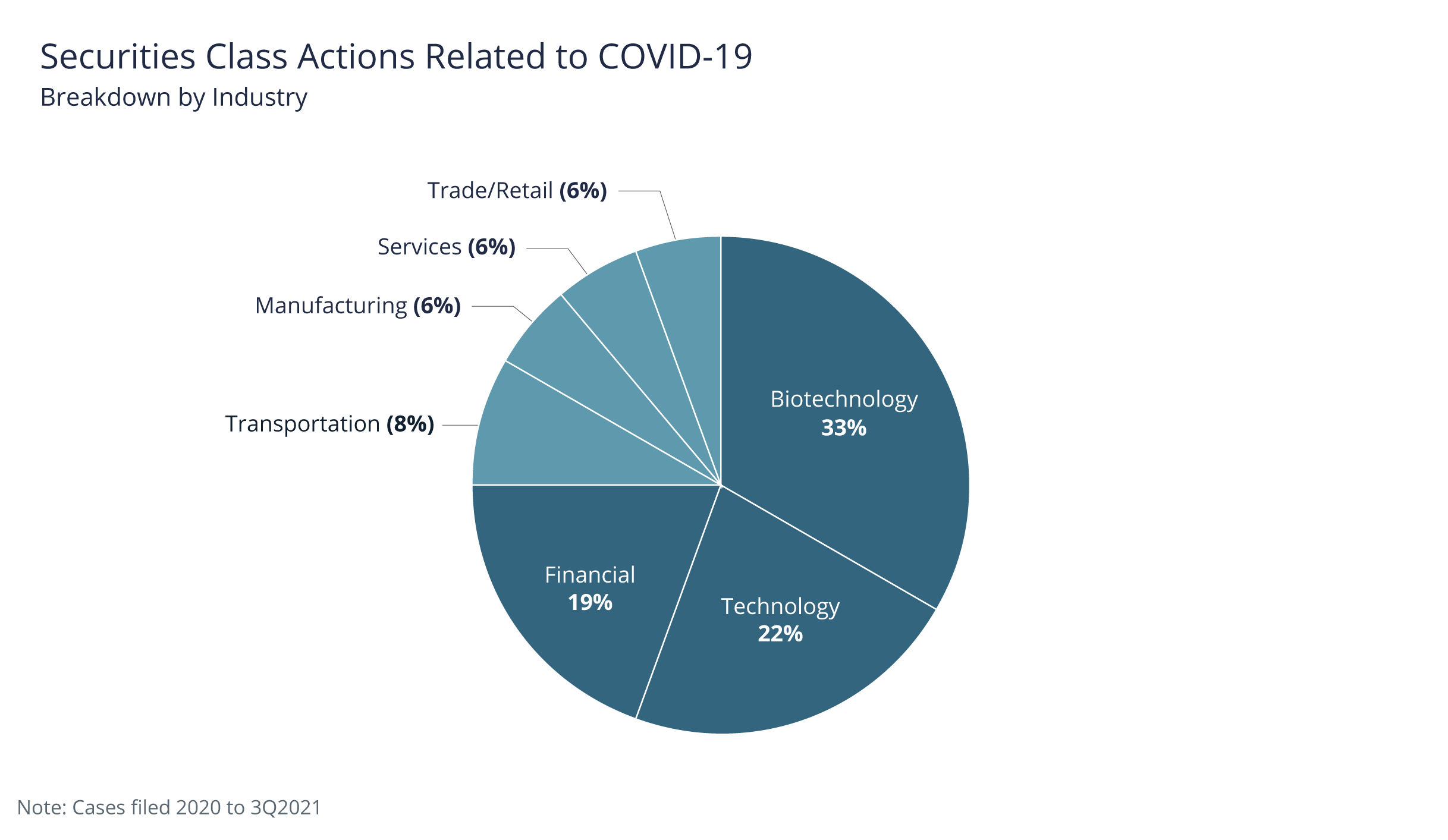

In looking at all securities class actions from 2020 through the first half of 2021, here is the breakdown of COVID-related cases by industry:

However, the pace of securities class action litigation is slow. As a result, the outcome of many of these lawsuits is still unknown. Out of all cases from 2020 through the third quarter of 2021, there are currently 30 open cases; four have been dismissed, and two were withdrawn.

When cataloging the pandemic-related D&O cases brought by private litigants in my January 2020 article, I had noted the following categories:

- Impacted directly by a virus outbreak, e.g., Norwegian Cruise Line

- Impact of the virus on the world’s economies, which directly affected the company’s immediate or projected finances, e.g., Colony Capital Inc.

- Business disruption that exposed vulnerabilities in operations, e.g., Zoom

- Direct involvement of virus-related matters such as the development of treatments for the virus and manufacturing virus-related products, e.g., Inovio Pharmaceuticals, Inc.

Notable cases in the first category (impacted directly by the virus outbreak) were brought against cruise lines, but those cases seem to have had limited traction.

For example, in April 2021, a judge dismissed one of the first COVID-19-related class actions—the one against Norwegian Cruise Line. Plaintiffs voluntarily withdrew a similar case against Royal Caribbean in February 2021. The securities class action suits against Carnival Cruise Lines was dismissed in May 2021, though there are reports that plaintiffs are still attempting to keep this suit alive.

In addition, the case I had featured as the classic case in the second category, the impact of the virus on the world economy, was the case against Colony Capital, Inc. That case has since been dismissed.

COVID-Related Derivative Suits

Securities litigation is often accompanied by derivative suits. Indeed, event-driven litigation in some instances might only consist of derivative suits. This happens if an unfortunate announcement is not accompanied by a precipitous stock drop. For example, many options back-dating announcements did not lead to stock drops and did not result in securities class action suits; by contrast, most of these announcements did result in derivative suits.

Derivative litigation is particularly personal for directors and officers because the allegations have to do with failing to fulfill fiduciary duties, and settlements typically cannot be paid through corporate indemnification.

This puts pressure on the Side A portion of the D&O insurance policies, the part of the insurance policy that is designed to respond when corporate indemnification is not available.

Through the third quarter of 2021, 16 (45%) of the 35 companies that have been hit with class action suits have also been sued derivatively.

COVID-Related Government Investigations

Event-driving private litigation is not always the end of the story. Sometimes government investigations or enforcement actions against corporations and individuals ensue following the types of revelations that lead to event-driven litigation.

In the case of COVID-19, through the end of the third quarter of 2021, eight of the 35 companies sued for class actions (23%) are being investigated. Here are some notable cases:

Decision Diagnostics Corp.

In 2020, the Securities and Exchange Commission charged this biotech company and its CEO for making false and misleading claims the company had developed a rapid, finger-prick COVID-19 diagnostic test. The Department of Justice indicted Decision Diagnostics’ CEO, Keith Berman, and the trial is currently set for 2022. In March 2021, investors filed a derivative lawsuit against the company.

Eastman Kodak

The SEC and several congressional committees started investigating Eastman Kodak in 2020 for possible insider trading linked to the announcement of a $765 million government loan for COVID-19 drug development. As a result, the loan did not go through as planned. In 2021, reports emerged that the New York attorney general was preparing an insider trading case against Eastman Kodak. The company has also been hit with three derivative lawsuits.

Emergent Biosolutions

A manufacturing plant that produces COVID-19 vaccines for Johnson & Johnson is under investigation for concerns about contamination that botched hundreds of millions of doses of the drug. In 2021, a democrat-led congressional investigation ensued to look at whether the company “won the federal contract to make the shots based on its cozy relationship with a top former Trump administration official,” reports say. Also in 2021, a derivative suit was filed against the company.

To date, the SEC has charged seven companies and six individuals with penalties linked to COVID-19 matters. Data shows that six entities make up $1 million in penalties. The SEC also penalized five individuals for a total of $300,000 in fines.

Protecting Against Event-Driven Litigation

One hopes that the more frivolous COVID-19-related suits get dismissed swiftly and in a way that discourages such litigation in the future.

Helpful to this cause will be the efforts diligent boards take when it comes to corporate governance and corporate risk oversight. This includes ensuring that risks to the business are appropriately disclosed in a company’s public filings.

Appropriate documentation of board discussions is always a plus as is following the guidance provided by Delaware courts when it comes to risk oversight—a topic discussed in detail by the Delaware court when substantially denying defendant’s motions to dismiss in the Boeing derivative suit.

Finally, while D&O insurance policies are not designed to respond to things like actual losses to the business from the pandemic (e.g., lost business when cruise ships were shut down), they do typically respond to the subsequent D&O litigation.

This is particularly helpful when it comes to paying for what can be substantial defense costs for both the corporation and individuals in the case of private litigation, as well as substantial defense costs for individuals in the case of governmental investigations. D&O insurance can also be used instead of the corporate balance sheet to pay settlements in securities class action suits. In the case of derivative suit settlements, Side A D&O insurance is all that stands between individuals and making personal out-of-pocket payments.

Author

Table of Contents