Blog

Multinational Companies: FCPA Enforcements in Full Swing

Multinational companies that are headquartered in the US take note: FCPA investigations are ongoing and settlements are larger than ever.

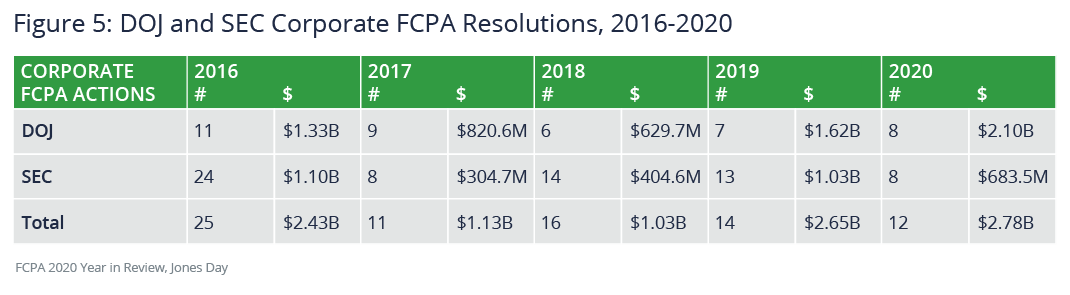

In 2020, the US Department of Justice and the US Securities and Exchange Commission collected record FCPA fines totaling $2.78 billion. This surpassed the previous record, which was set the year prior at $2.65 billion. This is according to the report FCPA 2020 Year in Review by Jones Day law firm, an excellent resource for anyone trying to get up to speed quickly on the current FCPA landscape.

Now is a good time to understand the lay of the land when it comes to FCPA and to ensure you’re prepared when doing business abroad.

A Refresher on FCPA

The Foreign Corrupt Practices Act of 1977 (FCPA) relates to anti-bribery laws in business and applies to both public and private companies. It is enforced by both the DOJ and SEC in the United States. Almost every country has its own version of anti-bribery regulations, making the issue important for all corporations doing business abroad.

FCPA’s anti-bribery rules prohibit individuals and companies from trying to wrongfully influence an official of a country by authorizing payment or anything of value-–directly or indirectly-–to obtain or retain business. FCPA’s bookkeeping laws forbid concealing the fact that bribes are being paid.

If you’re looking for more than just a brief overview of FCPA, check out an earlier article I wrote: FCPA: What’s the Big Deal?

Notable FCPA / Anticorruption Cases in 2020

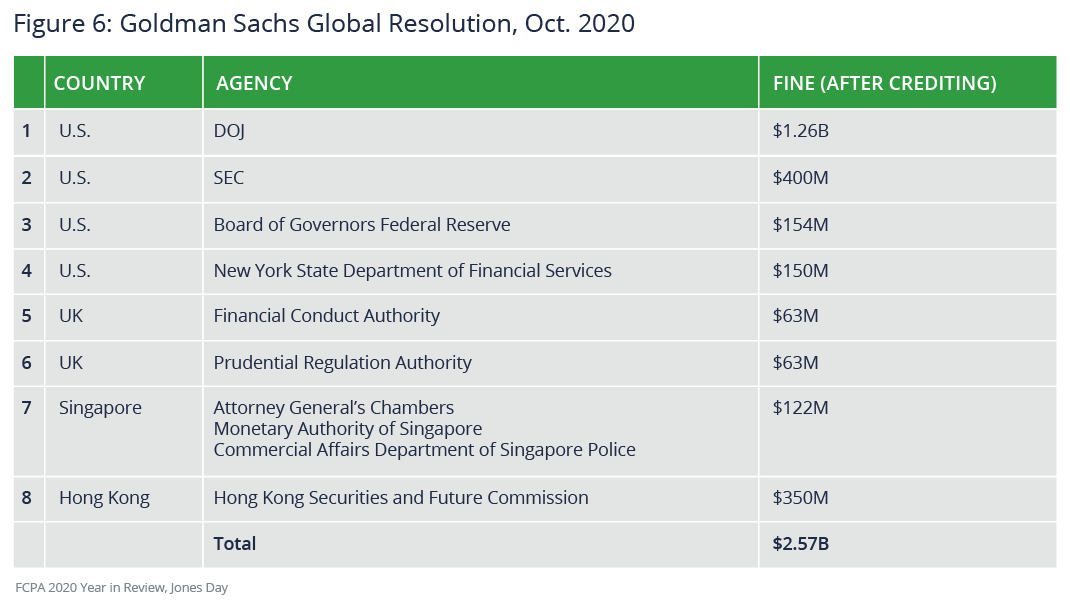

According to the Jones Day report, the year 2020 saw the largest settlements in history related to anticorruption, including Airbus at $3.68 billion–the largest ever recorded.

Airbus

In the largest multi-governmental anticorruption resolution in history, European aerospace corporation Airbus SE agreed to pay $3.68 billion for bribery allegations in more than 20 countries across the globe over the course of several years to gain business from private enterprises and state-owned organizations. This included a $294.5 million FCPA-related settlement.

The worldwide bribery scheme was “pervasive and pernicious,” according to the United States District Court judge supervising the settlement for the United States. It was also elaborate and had been taking place for more than a decade.

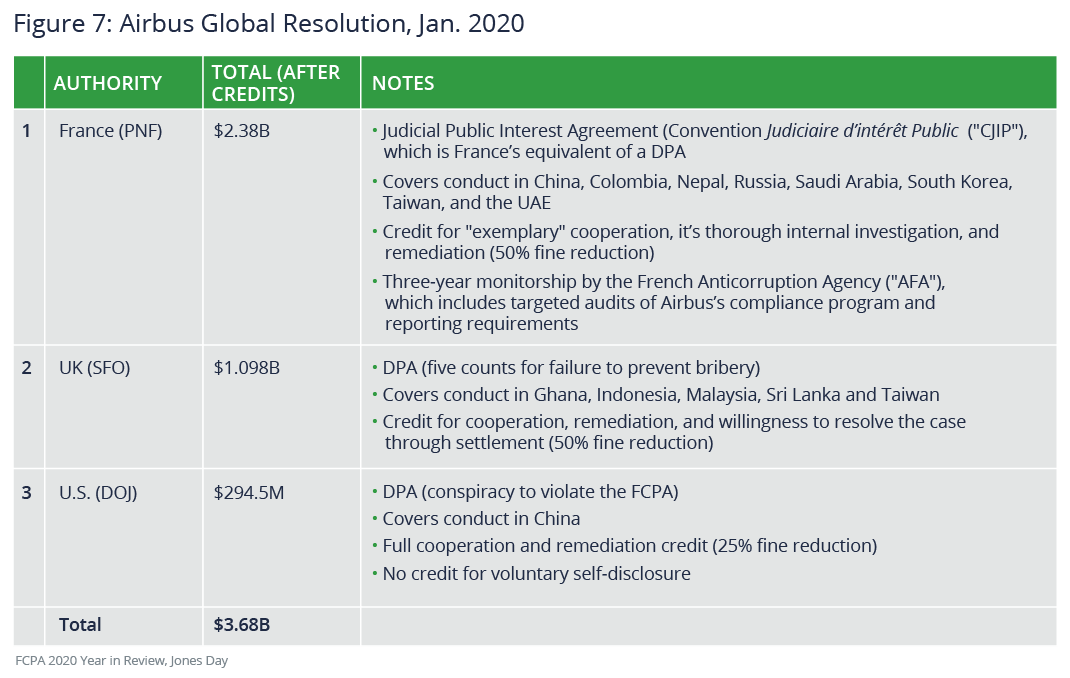

Goldman Sachs

In 2020, Goldman Sachs Group, Inc. paid out the largest FCPA settlement in history at $1.66 billion for its conduct related to underwriting bond deals for the Malaysia-owned fund, 1Malaysia Development Berhad. The case involved $1.6 billion in bribes to high-ranking government officials in Malaysia and Abu Dhabi by former senior employees of Goldman Sachs.

Fallout from the scandal included accusations of $700 million being stolen from the Malaysian economic development fund (for which Goldman had sold bonds). The money was reported as stolen by an advisory to the fund who purportedly used some of the money to, among other extravagances, bankroll the film, The Wolf of Wall Street.

Much of the $700 million ended up in the bank account of Malaysia’s prime minister, who was later convicted of abuse of power for participating in the scheme.

Novartis

Pharmaceutical company Novartis International AG paid $345 million to resolve a case in which the company and its subsidiaries were charged with improper payments and benefits for public and private healthcare providers in Korea, Vietnam, and Greece for prescribing or using their products.

This case involved quid pro quo schemes from 2009 to 2015 related to post-approval drug studies as well as international travel to educational gatherings.

Impact of COVID-19 on FCPA Enforcements

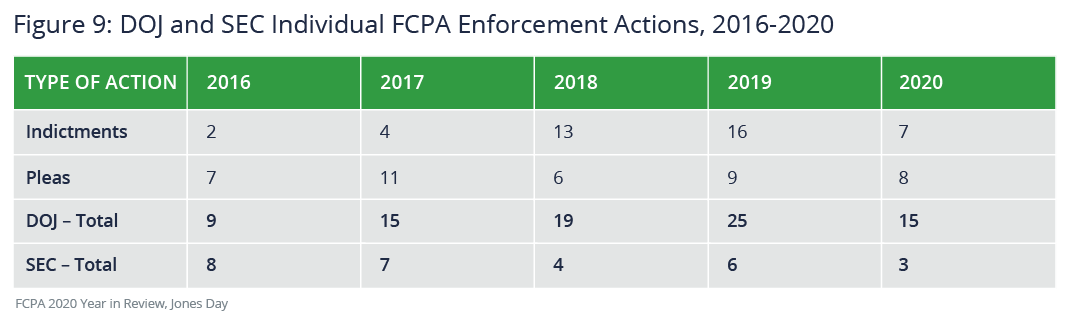

Despite record settlements, the pace of 2020 enforcements slowed compared to the prior year. According to the Jones Day report, for cases where the investigations were complete or near complete, there weren’t any delays in enforcements.

However, the pandemic did slow ongoing investigations due to “slowed data and document collections outside of the United States, witness interviews, company meetings, and other investigation tasks,” as well as other reasons.

To the extent that the pace of ongoing investigations may have slowed due to the global pandemic, this is likely to be temporary at best. Expect the pace of investigations to pick back up to normal levels once the pandemic starts to ease.

Next Steps

Notwithstanding the pandemic, the DOJ and SEC want companies to ensure it is business as usual when complying with FCPA. In July 2020, the two agencies published the second edition of its Resource Guide to the Foreign Corrupt Practices Act-–a long-awaited document since the first was published in 2012.

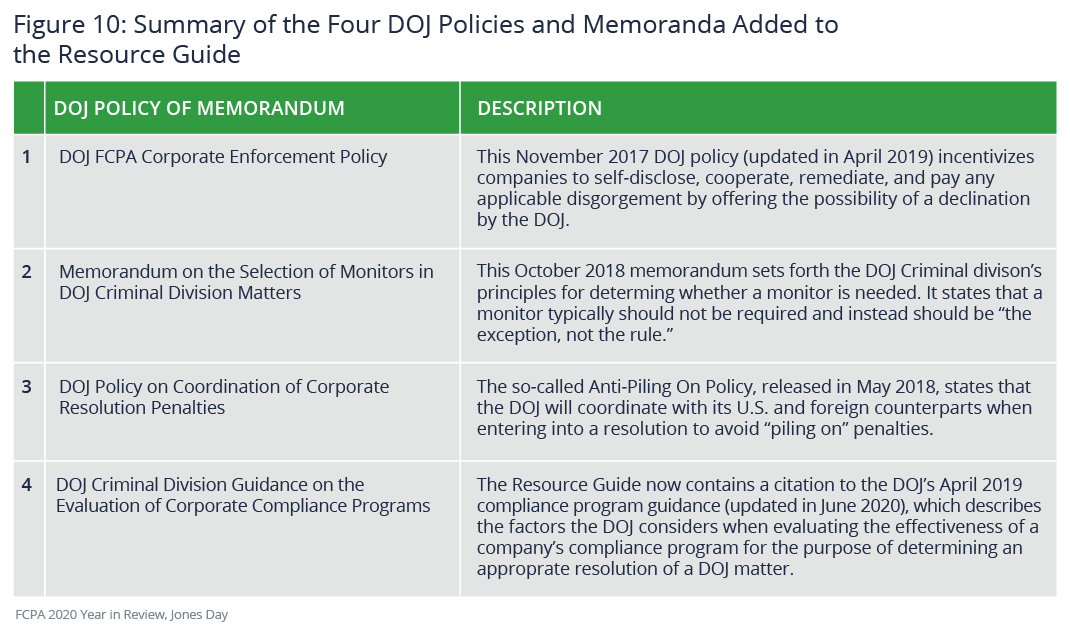

The Jones Day report includes a useful summary of what has changed from the original document to the second edition:

The report also goes into more detail about those changes. Corporate compliance departments will benefit from familiarizing themselves with these new guidelines.

It is worth noting as well that the DOJ recently issued its second FCPA advisory opinion in six years. This is a timely reminder that, at least occasionally, the DOJ will provide guidance on tricky FPCA issues on an anonymous basis.

Companies will want to continue to prevent FCPA misconduct by:

- Reviewing policies and procedures regularly and updating them in accordance with any regulation changes.

- Understanding FCPA cases and settlements to better understand how the company would respond in a similar situation.

- Thinking about what circumstances your company might self-report an FCPA violation to the DOJ pursuant to the “FCPA Corporate Enforcement Policy.” The Jones Day report emphasizes instances when, due to prompt and voluntary self-disclosure, companies only suffered light penalties or were not prosecuted at all by the DOJ.

It is also important to remember that the SEC continues to focus on its whistleblower program. That program was amended in 2020. One key amendment focused on getting more money to whistleblowers faster. Certainly the SEC has not been shy to date about getting rewards to whistleblowers: In fiscal year 2020, the SEC paid a record-breaking $175 million to 39 individuals.

Keep in mind that the SEC wants its whistleblower program to complement but not replace internal controls. That said, organizations will want to review their compliance programs. Many complaints can be addressed internally before they escalate to the SEC if a company has a strong program that makes tippers feel they are being heard and will not face retaliation.

It is obvious that regulators continue to shine a spotlight on FCPA, and multinational companies headquartered in the US need to ensure they are prepared.

Author

Table of Contents