Blog

Pay Before Side A: Why Some New Yorkers May Have to Pay Before Their D&O Insurance Responds

Insurance can get a bad rap because it’s so technical, allowing for a lot of foot faults when it comes to coverage. The state of New York has upped the “gotcha” game with a quirky law: If you’re a director or officer of a New York company and something triggers the D&O insurance policy’s Side A coverage, you may be personally responsible for paying up to $10,000 in order to benefit from the first million dollars of coverage. See N.Y. Reg. 110 (11 NYCRR Sec. 72).

This law has been in effect for more than a decade, and there doesn’t seem to be a lot of reason for it.

Indeed, even insurance carriers are inconsistent about applying this section of New York law, something they typically must do through an endorsement of their regular D&O insurance policies. This includes sometimes applying the endorsement when it is not required.

Who is subject to the requirement? The requirement applies to two groups. The first is all domestic New York corporations; that is, corporations formed under the statutes of the state of New York. The second is those privately held foreign corporations that derived more than half of their business income from within the state of New York during the last three fiscal years. “Foreign” corporations, as defined by New York Business Corporation Law Sec. 102(a)(7), are essentially corporations organized under a different state law, such as Delaware.

Everyone else is exempt. This includes publicly traded companies not organized under New York law (looking at you, Delaware and other state corporations). Also exempt are privately held firms not organized under New York law if a majority of revenue for the last three years came from outside of New York (the converse of the revenue rule for foreign corporations). However, the requirement still applies to New York-formed subsidiaries.

Side A Basics and New York Law

A typical D&O insurance policy is a combination of corporate balance sheet protection and protection for directors and officers. The relevant insuring agreements are referred to as “Side A, Side B, and Side C.” Side A is reserved for directors and officers, Sides B and C for the corporation.

Standalone Side A policies also exist and are reserved solely for the protection of directors and officers. Why? Typical D&O insurance policies with Sides A, B, and C only have one pot of money to cover everything. The concern is that if all the funds are used to protect the corporation, there won’t be anything left for directors or officers.

This short video further explains standalone Side A policies.

Most public companies opt to purchase the traditional policy with Sides A, B, and C, and then purchase a standalone Side A policy for extra protection. This helps to attract and retain the very best directors and officers, and make sure they are protected in the event they are named in a lawsuit.

In a traditional D&O policy, Sides B and C—which protect the corporation—have self-insured retentions (SIRs). SIRs are similar to deductibles.

When a policy has a SIR, the policy beneficiary must pay that retention before the policy will start to respond. However, the Side A policy is a classic example of a D&O insuring agreement that typically has no SIR. Unfortunately, some New York companies are, by state law, an exception to this normal rule.

The New York law requires that directors and officers of affected companies (i.e., those that are not an exception) must pay a specified minimum for a self-insured retention prior to the policy responding. The minimum individual SIR ranges from $100 to $5,000.

The law does provide a cap on the aggregate self-insured retention to be paid by policyholders. For example, directors of companies with more than $20 million in assets will not, in the aggregate, pay more than $50,000 in SIRs.

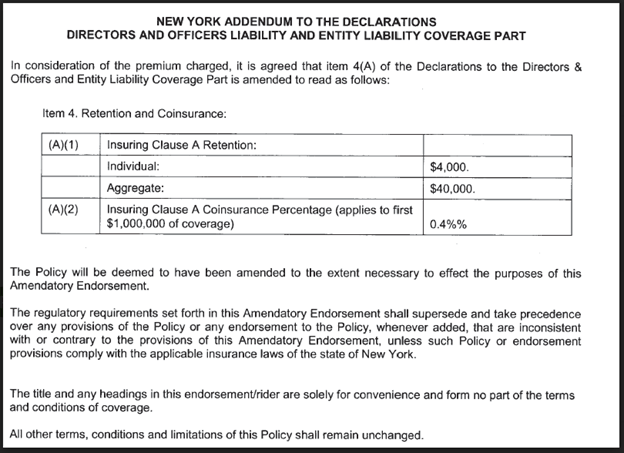

A typical New York-compliant endorsement reads as follows:

Sample Side A Endorsement, New York

In addition, there is a coinsurance requirement for the first $1 million of coverage. The co-insurance amount currently ranges from 10 to 50 basis points.

Fifty basis points is the minimum amount for directors of New York corporations subject to the rule if the corporation has assets that exceed $20 million. This means that after a New York director pays the $5,000 self-insured retention, the director must pay an additional $5,000 to get the full benefit of the first $1 million dollars of insurance coverage.

Is This a Big Deal?

Whether or not any directors or officers consider paying a self-insured retention or co-insurance as a big deal depends on (at least somewhat) the amount of money in question. Having said that, not all directors and officers are wealthy.

Moreover, this issue will only arise when something bad is already happening, and for some reason indemnification is not available. This could be the settlement of a derivative suit or corporate bankruptcy.

Forewarned is forearmed, of course. At a minimum, if your company has substantial ties to New York, you will want to find out if your D&O insurance policy contemplates a self-insured retention and co-insurance for individual directors and officers making claims under Side A.

Anyone accepting an appointment as a director or officer of a New York company will want to be aware of the issue to avoid being surprised at the worst of times.

Woodruff Whiteboard Breakdowns: Sides A, B & C of a D&O Liability Insurance Policy

Authors

Table of Contents