Blog

Reps and Warranties Insurance: Merely a “Deal Facilitation Tool” or a real Risk Transfer Mechanism?

Reps and warranties insurance is a powerful tool for private company M&A—but does this insurance actually pay claims? Yes it does, per Emily Maier, leader of the M&A practice here at Woodruff Sawyer. Emily discusses the latest data on reps and warranties insurance claims the guest blog, below. — Priya Cherian Huskins

Reps and warranties insurance, particularly in the US and most especially on the West Coast, was just a novelty for too long. More recently, however, the rise of reps and warranties coverage is well documented. Reps and warranties insurance is now a standard part of private equity transactions and an increasing part of the strategic buyers and sellers’ tool kits, as I discussed here in Smart Business Magazine.

But is it really insurance? In other words, are there claims and do they get paid? These questions are just a way to express the real question: is reps and warranties insurance merely a “deal facilitation tool” or a genuine risk transfer mechanism?

The answer is yes, it’s genuine risk transfer. Like with other types of insurance, claims are made and paid. AIG, as one of the biggest providers of insurance in this space has helpfully just released a report that provides a quick overview of their claims experience in this growing coverage arena.

AIG’s Report

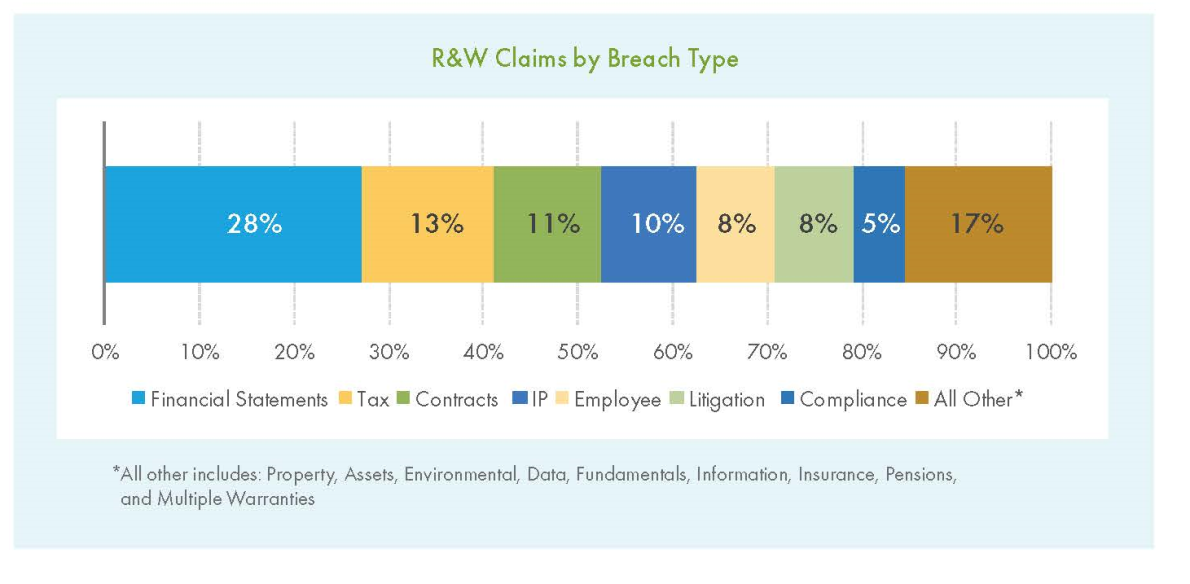

Some of the findings are more surprising than others. In Europe we have historically seen a narrower set of representations and warranties breach claims compared to the US. That US cases seem to have a “throw-the-kitchen-sink-at-it” mentality is hardly a shock. That it’s only in the US where we see efforts to make claims related to IP, data and insurance breaches is a little more unexpected. I doubt it will take the rest of the world long to catch up.

Common Wisdom versus Data

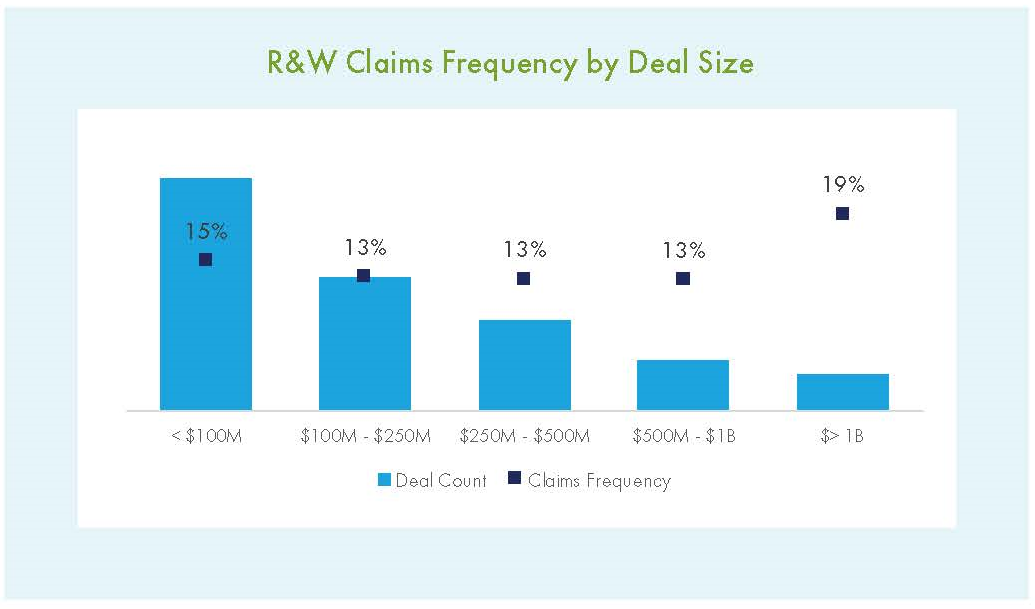

It’s long been believed that the smaller deals generate the most claims. The rationale behind this bit of “common wisdom” was that smaller deals involve less diligence. I have long argued against this view. While there may be less diligence, there are also smaller dollar amounts attached to smaller deals. This means there is “less to lose.”

AIG’s report bears out my theory—and disproves common wisdom—by showing that bigger deals experience the most claims, with 19% of claims coming from deals over $1bn in size, even though there are far fewer deals of this size compared to smaller deals.

Source: AIG

Timing of Claims

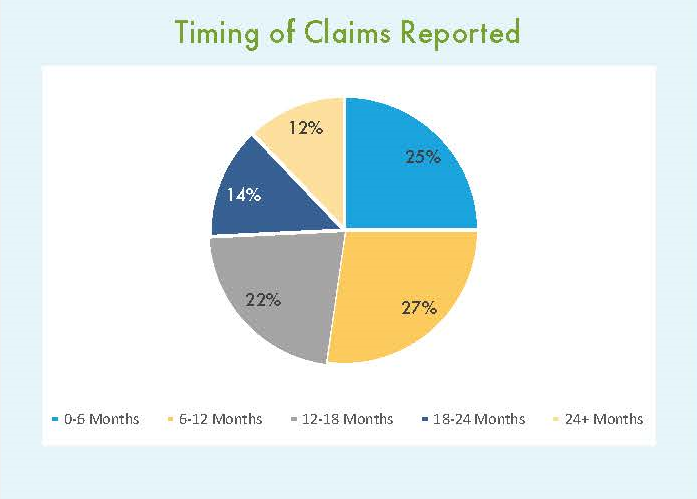

Whilst the whole report is worth a read, the last fact that caught my eye is the length of time it can take for a claim to be discovered. No one would be surprised that a majority come before or during the first audit cycle after a deal closes. However, what is surprising is that as many as 25% comes after the first 18 months.

Source: AIG

AIG’s report is a useful confirmation of my own expectations and experience when it comes to reps and warranties insurance. It also helps bolster the case that reps and warranties insurance is not just a “deal facilitation tool.” Reps and warranties coverage is a genuine and prudent risk transfer mechanism.

Questions? Comments? Interested in learning more about reps and warranties insurance or other deal facilitation tools? Contact Emily Maier, Group Leader—Transactional Solutions.

Author

Table of Contents