Blog

Remote Work Presents Employers with New Challenges

The pandemic has encouraged employees to move house, causing headaches for employers. Freed from a commute and office-related commitments, remote-working employees reassessed their lifestyles during 2020. Many people have chosen to move to less congested, more rural areas to avoid COVID-19, or move in with family members because of economic downturns or new childcare commitments. The housing market continues to boom as families need even larger homes for work, school, and family responsibilities.

Employers are still grappling with the economic and cultural issues brought on by a decentralized workforce. Because remote employees are often on the move, employers should expect new responsibilities that may otherwise take them by surprise.

Employees Are on the Move

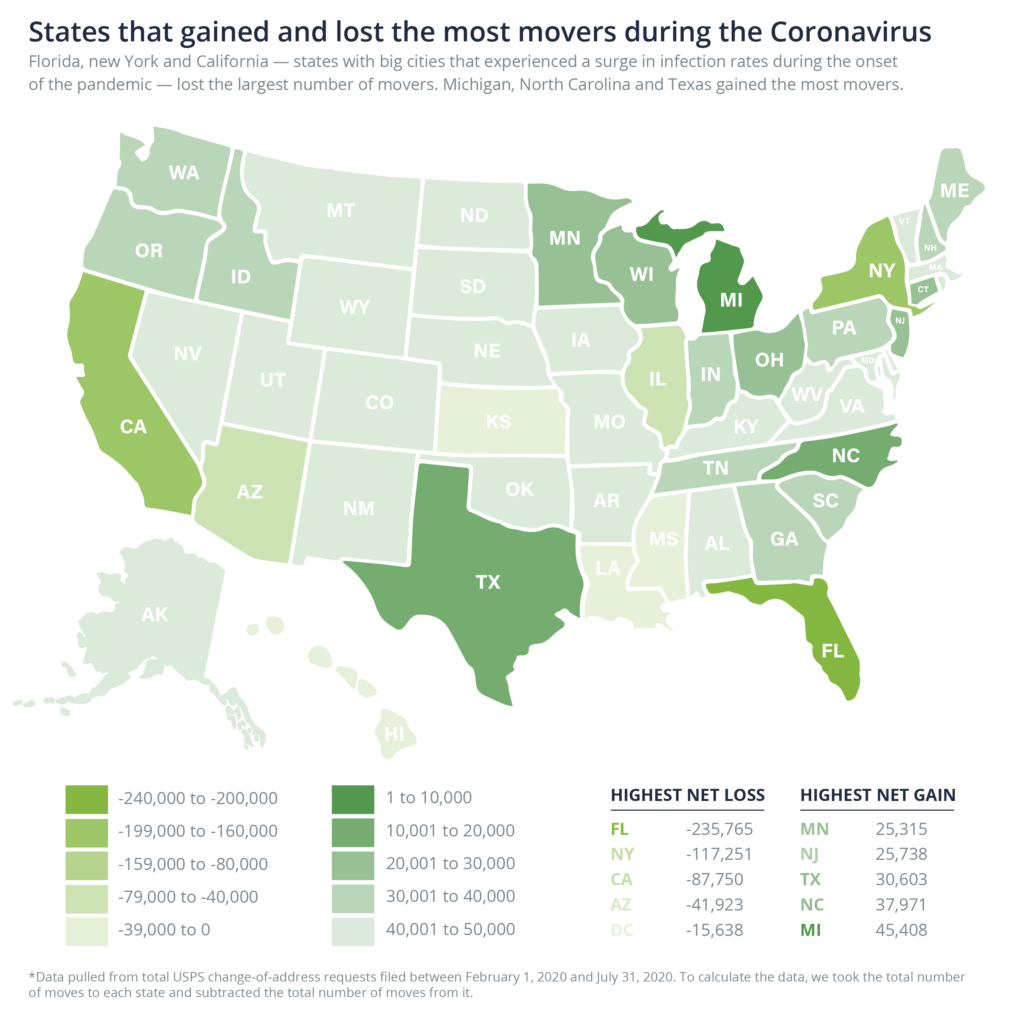

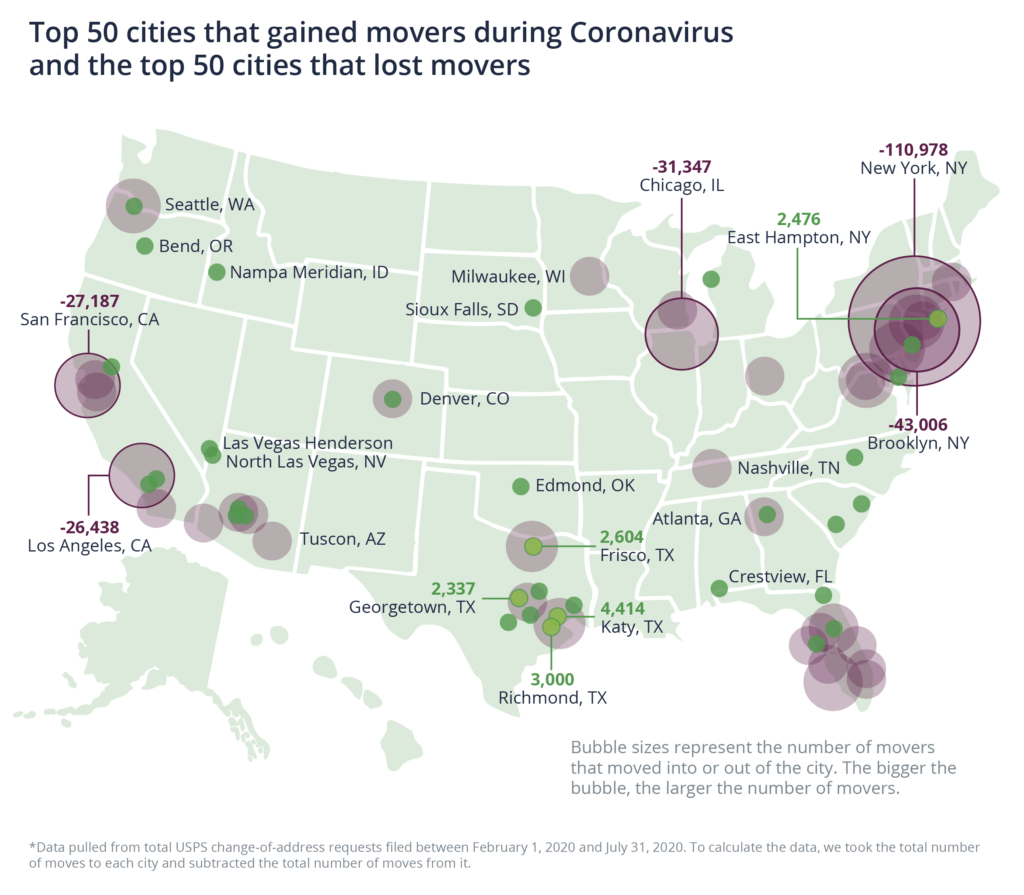

After the initial onset of the pandemic, the USPS recorded that nearly 16 million Americans moved between March and July 2020, with temporary address changes up over 26% from 2019. The trend shows that people are moving out of congested areas such as Los Angeles, San Francisco, and other large metropolitan areas, with smaller towns and less congested states receiving an influx of new residents. California saw a significant drop in the number of residents, as the surrounding states of Oregon, Idaho, Washington, and Nevada gained residents.

In need of new talent and an economic boost, some cities have offered incentives for people to move. Tulsa, Oklahoma offers $10,000 and a coworking space for remote workers. The Northwest Arkansas Council offers $10,000 and a bicycle for tech workers over the age of 24 to relocate and enjoy the Ozarks. Topeka, Kansas provides up to $10,000 for remote workers who purchase a home, and Lincoln, Kansas offers free homesites for willing homeowners. Benton Harbor, Michigan recently received more than 300 applications for the twenty $15,000 housing incentives that helped boost their economy and tax base. Given the lower cost of living and record-low mortgage interest rates, remote workers have greater incentives to move out of expensive cities.

As employees explore their lifestyle options, employers are tasked with staying compliant, keeping their workforce engaged, and offering leading benefit options.

Reinventing Company Culture

Employers enjoyed a boost in productivity as employees worked from home, but some business leaders worry about fostering an innovative workplace where employees can work safely both onsite and remotely. While 100% remote work won’t last forever, most employers expect to have a hybrid model that includes occasional office work and work-from-anywhere (WFA) models.

Employers should create a remote work policy that includes details about work-from-anywhere (WFA) arrangements, including who is eligible and what hours they must be available. Employers can also address one of the biggest challenges remote employees face: technical issues. IT assistance and security protocols should also be outlined, including equipment, software, mobile app, and access policies.

Home office expense reimbursements are now common. At the beginning of the pandemic, some employers offered to reimburse employees’ internet bills. However, as remote work has become prevalent, employers are now offering one-time payments of $500–$1,000 for desks, chairs, and computers, or monthly stipends for ongoing home office expenses.

As hybrid models emerge, employers will define how workers will work together to remain safe while still interacting. Employee engagement is still essential but will be carried out in new ways like virtual events and remote mentoring.

The year 2020 taught employers to be agile, invest in the right people, and remain positive about 2021. Check out Part 1 of our Looking Ahead Guide for more ways that employers are navigating work from home.

Multi-State Employer Health Plan Issues

Your health plan participation and rating is largely based on employee demographics. As employees move, either permanently or temporarily, you will face a greater number of health plan issues. Does your health plan offer coverage if employees move to a new state? Will employees have access to in-network providers or only out-of-network services? What about prescription plans and other covered benefits? And finally, will employee participation in your plan drop, jeopardizing the status and the renewal of your health plan?

While Kaiser and similar insurers offer consistent coverage across some states, every health plan is unique. Unless employees tell you in advance of their move, you may not find out about the impact to your plan until it’s too late. That’s why it is important to remain in touch with your employee benefits consultant to ensure that you stay on top of your plan performance, claims, and eligibility.

Employers are adapting their total reward structure as they balance remote and hybrid work models. One survey indicated that nearly 30% of employers are providing additional benefits like backup daycare or daycare subsidies. Over 60% of surveyed employers believe that retirement and financial wellbeing programs, as well as health and wellness programs, are important, but also agree they need to evolve to better support employees in a changing workplace.

Employees moving? Your Woodruff Sawyer benefits consultant can review the impact of employee moves.

Managing Employee Leave

Employee leaves are tricky. FMLA and other federal regulations apply to employers with more than 50 employees, but state leave laws are unique to each state. If you’ve downsized and are near the 50-employee mark, are your employees eligible for FMLA? If you have an employee that moved, permanently or temporarily, to another state, which state regulations take precedence

As employees decide to relocate, employers must track their residences to stay compliant with federal, state, and local laws. Whether it’s a temporary move to stay with parents in another state or a permanent relocation thousands of miles away, employers are on the hook to track where and when employees are working. That means your HR department will have double duty, understanding multiple state laws and filing complex forms as they update HRIS systems. Your life and disability carrier may have an FMLA leave-tracking tool for you to use. In addition, Woodruff Sawyer benefits consultants can show you tools that track FMLA regulations by state to keep you informed of changes.

Compliance Posters

Just because no one is working at your office doesn’t mean you can avoid hanging compliance posters in the breakroom. You will still need to subscribe to an electronic labor law poster service that provides all mandatory state, federal, and OSHA posters, including federal minimum wage, workers’ compensation, and more.

Printed, laminated, emailed, or intranet-based posters are available from numerous vendors for a minimal price tag, keeping you compliant and your employees informed, wherever they are. Your Woodruff Sawyer account management team can keep you advised of compliance poster resources that will keep your employees informed.

Compensation, Payroll, and Tax Issues

While Facebook and Slack announced that they will allow employees to work remotely indefinitely, they are also considering pay cuts for employees who move to lower-cost-of-living areas. A Willis Towers Watson survey supported this approach, with nearly half of employers indicating they are looking at developing total rewards programs based on where an employee lives.

No matter where your employees live, employers face the sticky issue of staying compliant with federal and state payroll and tax regulations, especially as employees move more frequently. In general, wherever your employees reside and perform work is where you will have to file payroll taxes, creating extra work and expense for unsuspecting employers.

Paying the correct minimum wage can be difficult, especially if you have more than one law that applies to your employees. For example, if your employee works remotely from a Bay Area city with higher minimum wage laws than the California minimum wage, you might need to pay the higher wage to that employee.

You can make sure you keep on top of tracking time for non-exempt employees by providing timeclock tools that indicate where and when they perform work, including overtime rules, which can vary by location. Exempt employees who are paid on salary should not have their time tracked, but should have consistent hours of availability for work-related duties.

Workers’ compensation can also create complex issues for employers of remote workers. State laws differ, as does how workers’ compensation plans are funded. How do you determine if your remote employee was injured while working? Setting clear guidelines of remote-worker job duties and hours can help clarify these complex issues.

Disability and unemployment are also issues that vary by state and require close navigation. You’ll need to work closely with your payroll provider to address how to manage salary, tax changes, residency, and other issues for employees. Following the guidelines for paying out-of-state employees guidelines and addressing pandemic-related employee moves are essential for state and federal compliance.

Remote Work is Here to Stay

Employers will develop new workplace models throughout 2021, choosing a combination of remote and onsite work policies. Communication remains important to keep employees productive and to stay informed of where they live and how they perform their work.

Woodruff Sawyer employee benefits consultants can keep you advised of important benefit plan challenges you might face as a result of your changing remote workforce.

Table of Contents