Blog

Self-Funded Health Plans: Breaking the Myths to Find Cost Savings

Read on as we dispel myths about self-insurance and learn if this cost-saving approach is the right fit for your organization.

Employees generally know healthcare is expensive, but they often don’t know just how expensive until they're on COBRA and are shocked at the cost. Companies pay around $23,000 per year for family and $8,000 per year for single coverage medical insurance. For even a small, 100-person company, that's a $1.6 million budget. While 3–5% savings doesn’t sound like much, it is a lot when you consider the high starting costs.

But how do you achieve cost-savings on an employee benefit plan? Self-funding may be the answer, providing average savings of up to 10% per year.

Misconceptions about self-funded health plans are a big inhibitor to adoption. We'll tell you right now—the idea that companies must take on more risk isn't true. Read on for more myths about self-insurance and what the real story is behind this cost-saving approach.

MYTH: Only Large Companies Can Have Self-Funded Health Plans

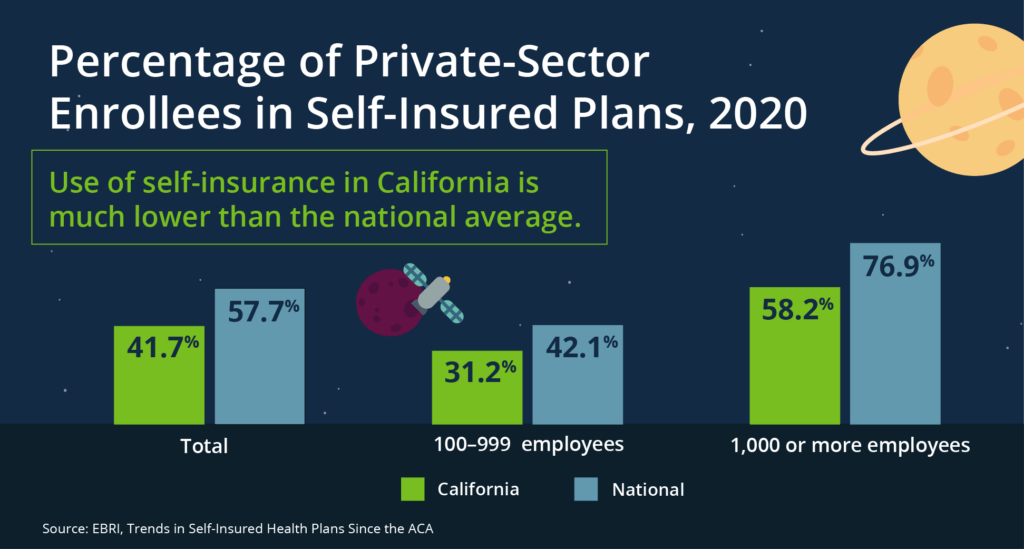

Size is not the determining factor in whether your company should self-fund its health plan. In fact, the real primary consideration is the company's cash flow and how much variability it can withstand. Usually, the smaller your company, the more variability you can see in your budget from one large claim. This is why large companies with a higher cash flow are more likely to be self-funded. But we've found that companies as small as 100 employees can still be good candidates, as you can limit your budget variability using a lower individual stop-loss deductible.

There are very few clients that should not self-fund. One example (although there are exceptions) could be low-margin, high-volume businesses, such as a supermarket, which depend on budget predictability and therefore wouldn’t be able to handle even small cash flow variability.

| What does “self-funded” really mean? Very few companies are fully self-funded and those that are often have somewhere around 50,000 or more employees. The more accurate term is “partially self-funded,” since most companies buy stop-loss insurance to pay for claims over a certain amount. This gives them more flexibility while mitigating their risk. |

MYTH: Self-Funded Health Plans Are Higher Risk Than Fully Funded Plans

The only real risk a company with a self-funded health plan takes on is cash flow variability.

A fully insured program that incurs higher-than-expected claims one year will face a larger renewal the next year—after all, the carrier must make up the cost. If your company experiences a good claims year, it will get a better renewal, but the insurance company is still going to make its profit. If your self-funded program faces a bad claim year, you will pay the increased cost at the time of billing rather than waiting for the renewal. The same happens with a low claim year, when you will see savings throughout the year rather than at renewal. In both instances, you're paying—just at different times.

How do you self-insure while taking on zero additional risk—and limit cost fluctuations? Stop-loss insurance. Fully insured premiums include a “pooling charge,” which is what insurance companies use to pay claims over a certain threshold. Claims over that threshold are not counted toward a fully insured renewal. This is the exact same concept as individual-stop loss insurance in a self-insured program.

In a self-insured program, you can buy stop-loss insurance at the same deductible amount as your “pooling point" in your fully insured program, thus taking on no additional “risk.” Any claims larger than that amount would be covered by the insurance, reducing your cost variability and your risk. Your broker can use data to quantify your risk and determine your stop-loss limit.

Another option is to purchase aggregate stop-loss (ASL), which protects your overall claims budget. For example, if you expect $10 million in claims in one year, you could buy ASL for $12 million, which will protect you from far exceeding your annual employee benefits budget. Since going over the limit is rare, this insurance is relatively cheap—in fact, many companies that have recently transitioned to self-funding drop it after a couple years when they become comfortable with the self-funding process.

MYTH: Self-Funded Health Plans Are More Expensive

Companies that self-fund save money in the long term—usually 8–10% on average. Here's how:

- No state taxes on self-insured plans (although they do pay taxes on stop-loss insurance) Savings: 2-3% (differs by state)

- No carrier margins. Savings: 3–8% depending on the size of company

- No giving your reserves (normally around 10–12%) to the insurance company, which means you can get returns on that cash. Savings: variable

Think about an 8–10% savings in the long term. Healthcare costs continue to trend up—in fact, it's rising 7–8% per year. By lowering your base health plan cost, you have a lower starting point for that increase.

MYTH: Self-Funding Limits Your Plan Options More Than a Fully Funded Package Does

Self-funded plans are significantly more flexible—meaning you can design your plan, decide whether you want to comply with state mandates or not, and carve out portions of your plan to different vendors that specialize in different areas.

Prescription drugs are one area where you can find a specialized vendor and is a major opportunity for cost savings. Drug costs are a significant portion of overall costs and are expected to rise over the next decade with the increasing use and price of specialty drugs. The ability to select a separate pharmacy benefit manager to manage costs and formularies can result in significant cost savings—our clients commonly save 20–30% on their drug spend.

Why Are CFOs Hesitant to Move to Self-Funded Health Plans?

Now that we've dispelled the myths about self-funding, why are company leaders still hesitant to take the leap?

- The CFO and finance leadership are worried about risk management and the perceived increased risk, and tasks like administering a bank account to pay carrier claims weekly or bi-weekly. They're also worried they won't have the ability to accurately forecast costs.

- Human Resources leaders are concerned about administrative tasks, such as Affordable Care Act (ACA) reporting—which can be outsourced. Lack of knowledge about what they need to do is often a deterrent.

But the fact is, if a company can withstand the cyclical variation in its budget, self-funding will save money over the long term.

One of the biggest factors of success when moving to a self-funded program is a knowledgeable broker. The broker should guide you through the process, explain how to virtually eliminate your risks similar to a fully funded plan, and ensure you have the correct calculations and data for adequate coverage. Contact your Woodruff Sawyer account team to learn more about self-funded health plans.

Woodruff Sawyer’s Mission to More series leads you through today’s employee benefits news and serves as a guide for everything from competitive programs to compliance. For more guidance on using data analytics and transitioning to a self-funded plan, sign up for Woodruff Sawyer’s Benefits newsletter, which includes all Mission to More articles.

Woodruff Whiteboard Breakdowns: Self Funding Your Health Plan

Author

Table of Contents