Blog

Insurance Claims Best Practices: 5 Tips for a Seamless Claims Process

The frequency and cost of commercial claims have increased in recent years, and we expect this trend to continue.

The frequency and cost of commercial claims have increased significantly in recent years, and given rising inflation and the legal landscape, we expect this trend to continue. While we know many would prefer not to focus on claims (until you need to file one), a partial settlement or denied claim can negatively affect your organization’s bottom line. It's crucial to think about steps you can take now to maximize your claim recovery. Here are five tips that can help make the claims management process as seamless as possible.

1. Understand Your Policies

1. Understand Your Policies

Who is covered? Is your policy claims-made or occurrence-based? Do you have sublimits or endorsements that may affect coverage? What are your deductibles? Be familiar with your policies and what they may or may not cover to help your organization better manage its risk and be prepared when claims occur.

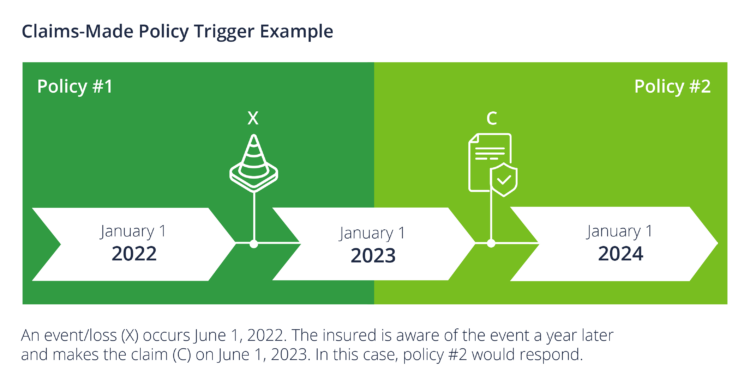

The difference between occurrence-based and claims-made policies is one that cannot be stressed enough, especially when it comes to noticing a claim. With an occurrence policy, coverage is triggered during the policy period in which the event (X) occurred. With a claims-made policy, coverage is triggered during the policy period in which the claim (C) is made.

In the example above, if the loss/event (X) occurred in one policy period, but the claim (C) wasn’t made until the next policy period, knowing which type of policy you have would be of utmost importance. With a claims-made policy, you would file a claim under policy #2; with an occurrence-based policy, you would instead file a claim under policy #1. Distinguishing this is important, especially if you've changed carriers, have made changes to your policy, or are approaching your limits for a given year. We encourage you to review your policies throughout the year and let your brokerage team know if there are any changes to your risk profile or if you need clarification about your existing policies.

2. Create a Culture of Preparation

Although you don’t know if or when a claim will occur, planning for losses thoughtfully and deliberately before they happen can save you trouble down the road. This preparation includes creating a business continuity plan for property losses, an incident response plan to address the handling of cyber losses, and guidelines for all other types of claims.

To reduce stress in times of crisis, you should know:

- Who within your company should be involved in claims

- How claims will be addressed

- What information should be gathered

In addition to planning for incident response, organizations should ensure they are doing all they can to prevent incidents from occurring in the first place. The best claim is the one that never happens. Ongoing employee training, employee handbooks, and comprehensive safety programs have proven instrumental in preventing and minimizing claims.

3. Document! Document! Document!

The statement, “If it isn’t documented, it didn’t happen,” couldn’t be truer when it comes to claims. Key employees should be trained to document and investigate incidents thoroughly and in a timely manner.

Documentation includes:

- Gathering relevant documents

- Completing incident reports

- Taking photographs

- Obtaining witness statements

- Retaining surveillance video

- Keeping track of what is damaged

Collecting all available information right when an incident happens can help your insurer handle your claim more efficiently and accurately. From a liability standpoint, the initial investigation allows your insurer to better defend you if a third party pursues a claim against you.

| The key to good documentation is ensuring that employees state facts, minimize commentary, and remain objective. The devil is in the details when it comes to claims, so be sure that you are collecting as much information as possible. |

4. Mitigate the Loss

Do what needs to be done to minimize the claim and protect yourself but be sure to keep track of actions taken and costs incurred after a loss happens. When it comes to retaining vendors, however, we recommend that you first speak with your Woodruff Sawyer consultant and insurer unless it is an emergency. The same goes for counsel; your insurer typically won't reimburse you for any costs incurred prior to notifying the insurer. Don't pay out of pocket for something that may be covered under the policy.

5. Involve Woodruff Sawyer Promptly

Late notice to an insurer is one of the most common coverage issues, but it is easily avoidable in most cases (especially with claims-made policies). When an incident happens, discuss it with your Woodruff Sawyer claim consultant immediately. We can help you determine what policies may apply, notice the claim(s), and support you throughout the life of the claim(s). If a coverage issue arises, we can help you work with the insurer and advocate on your behalf.

We know that the insurance world can be overwhelming, and we hope these tips help you prepare for claims to come. While this is an overview of some of our best practices around claims, Woodruff Sawyer has created a comprehensive guide to claims that can serve as a useful tool for even the most experienced risk manager. If you have questions about claims or would like a copy of the guide, contact your Woodruff Sawyer representative.

Woodruff Whiteboard Breakdowns: Understanding Occurrence and Claims Made Policies

Author

Table of Contents