Guide

From Private to Public: Getting the D&O Insurance Process Right [Report]

Good news: IPO activity is finally picking up again. Woodruff Sawyer’s latest Guide to D&O Insurance for IPOs and Direct Listings is here to help.

According to PwC, US IPOs already raised more than $29.3 billion through Q3 2025. This marks a 31% increase over the same period last year.

In September alone, 13 IPOs raised more than $8 billion, which made it the busiest month for new listings since November 2021.

Industry commentators predict there could be a historical surge of IPOs in 2026, as late-stage companies have taken a wait-and-see approach until now:

"The potential volume of IPOs in 2026 could be significant. With 601 companies now meeting traditional IPO criteria (just in the US), the backlog has more than doubled since 2021. If even a quarter of these companies go public, we'd be looking at a historic surge in listings."

While anticipating their debut, late-stage private companies are focusing on the foundational readiness needed to go public.

Doing an IPO well means aligning all aspects of governance and accounting to legal and more, so that the moment you go public, you are in tip-top shape across every dimension.

And critically, that includes your insurance program.

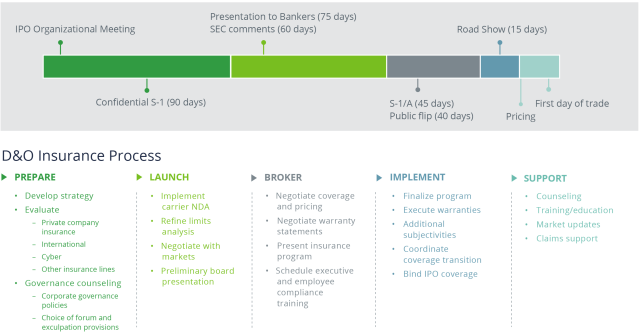

However, placing D&O insurance for IPOs is nothing like routinely renewing a policy. It is a process with its own milestones, and each step must correlate with the broader IPO calendar.

Source: Woodruff Sawyer, a Gallagher Company

Our 2026 Guide to D&O Insurance for IPOs and Direct Listings helps map the insurance placement lifecycle alongside the IPO timeline, so you can execute with confidence.

In this article, I will highlight just some of the steps involved in placing D&O insurance for IPOs. For more details on each step in the process, be sure to download your copy of the Guide.

But first, we can briefly look at the current conditions in the D&O insurance market for IPOs.

The State of D&O Insurance for IPOs

Woodruff Sawyer’s Market Rate Pricing Index™ uses the year 2018 (a pre-hard market year) as the baseline for changes in D&O insurance rates.

As of Q2 2025, premiums have continued to fall, and pricing is back to 2019 levels. And that means better pricing for IPOs.

Eighty-one percent of Woodruff Sawyer’s new public company clients experienced a decrease in premiums in the first half of 2025, according to proprietary data featured in our 2026 D&O Looking Ahead Guide.

In fact, there used to be a large gap in pricing between IPO companies and mature public companies. However, that gap closed in the first quarter of 2024, and the trend continues today.

Additionally, 60% of D&O insurance underwriters predict that self-insured retentions will remain the same, with only 17% anticipating an increase, according to the D&O Looking Ahead Guide.

Overall, this shift towards a more favorable pricing environment is welcome news, particularly for companies eyeing an IPO in 2026.

Next, we will get into the strategic steps IPO companies need to consider when placing public company D&O insurance.

Step 1: Preparing the Strategy

The preparation phase is where IPO readiness and D&O insurance strategy intersect.

Ideally, preparation begins six months or more before going public, giving the company plenty of time to coordinate.

Key steps in this stage include reviewing a company’s private company D&O insurance. You want to ensure adequate coverage to help avoid unnecessary complications later when transitioning to a public company D&O insurance program.

This is also a good time to perform a governance inventory—and maybe even a tune-up. You want to be ready with essentials like insider trading policies and corporate communications policies, both of which can be considered the fire sprinklers of D&O risk.

The Guide provides more information about these foundational steps so your company is better positioned for the right coverage when it is time to engage the insurance markets.

Step 2: Launching the Program Placement Process

By the time a company reaches the next phase in placing the insurance program, timing is everything. Each decision should track closely with the IPO calendar.

If the company is filing confidentially, your insurance broker will first coordinate non-disclosure agreements (NDAs) with insurance carriers to keep sensitive information protected while allowing them to evaluate your risk profile.

In this phase, you will look more closely at coverage design, conduct board briefings, and facilitate employee training on public company topics and procedures.

With your governance framework and internal readiness in place, it is time for your broker to take the lead in the next step: negotiating the coverage.

Step 3: Brokering the Insurance

In the broker phase, the insurance program moves into active negotiation. Coverage terms can be very favorable when negotiated by a skilled broker.

This stage also brings into focus different technical aspects of the coverage, such as higher-limit warranties.

When handled well, this phase translates months of planning into a tangible protection plan for Ds and Os.

Next, the focus will turn to coordination and ensuring the coverage is executed at exactly the right moment in the IPO process.

Step 4: Binding the Coverage

At this stage, the IPO is nearly across the finish line.

This phase is all about ensuring the transition from private to public D&O insurance happens seamlessly, with no gaps in coverage during one of the most visible moments in a company’s life.

Now you are ready to bind coverage and get ready for the most exciting milestone yet—the first day as a public company.

Get the Guide to D&O Insurance for IPOs

Going public is one of the most complex transitions a company can make.

The 2026 Guide to D&O Insurance for IPOs and Direct Listings is designed to walk leadership through every phase of the insurance placement process.

Inside, you can take a deeper dive into the topics covered in this article and more.

Download the 2026 Guide to D&O Insurance for IPOs and Direct Listings.

Disclaimer: The views expressed in this publication are solely those of the author; they do not necessarily reflect the views of AJG. Further, the information contained herein is offered as general industry guidance regarding current market risks, available coverages, and provisions of current federal and state laws and regulations. It is intended for informational and discussion purposes only. This publication is not intended to offer financial, tax, legal or client-specific insurance or risk management advice. No attorney-client or broker-client relationship is or may be created by your receipt or use of this material or the information contained herein. We are not obligated to provide updates on the information contained herein, and we shall have no liability to you arising out of this publication. Woodruff Sawyer, a Gallagher Company, CA Lic. #0329598

Author

Table of Contents