Blog

Mind The Gap: State Forum Selection Provisions

Companies that are serious about managing director and officer litigation risk have been adopting choice of forum provisions. Such provisions continue to permit shareholders to sue directors and officers if shareholders want to do so.

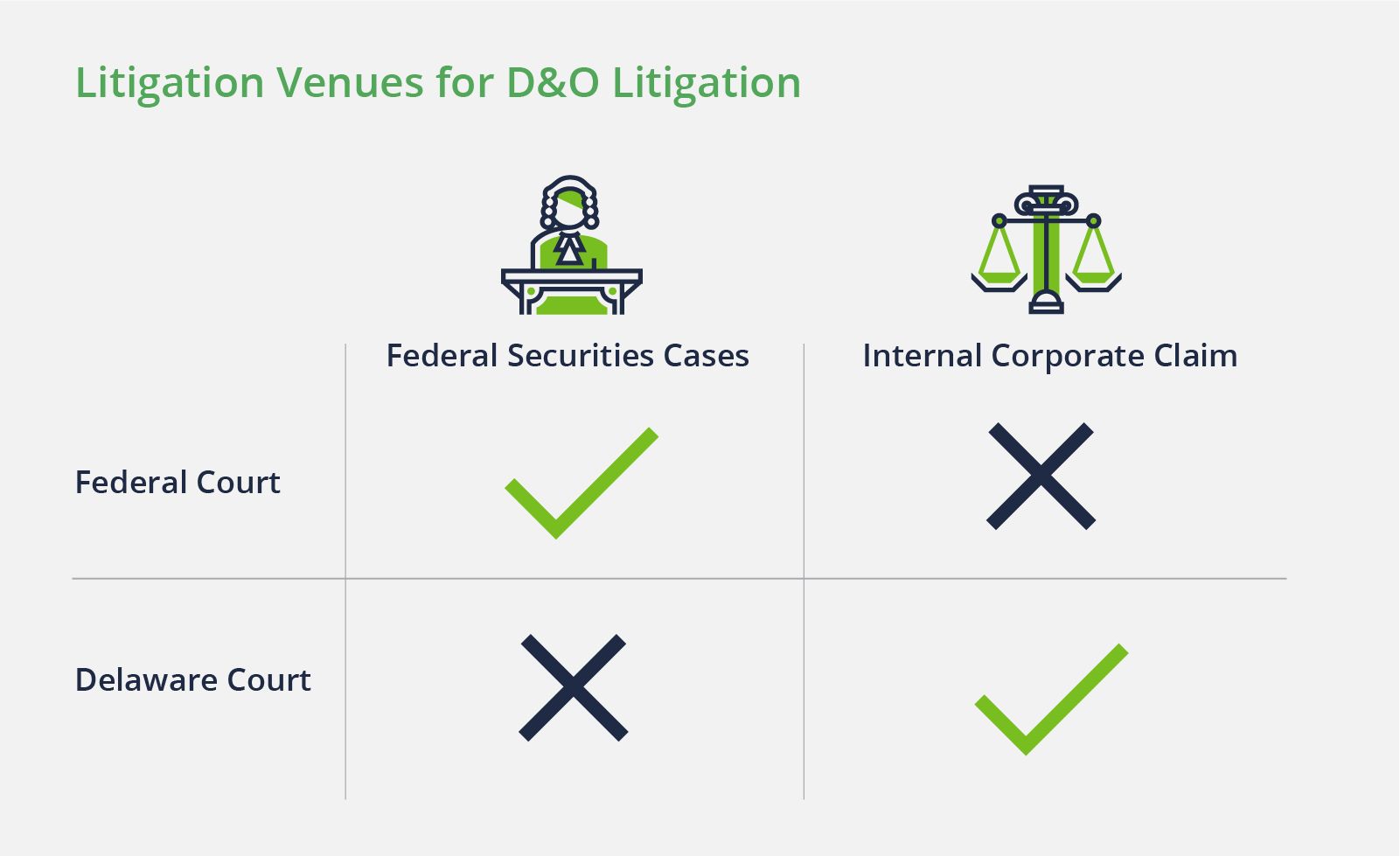

At the same time, these provisions cut down on duplicative litigation. Federal forum provisions keep federal securities laws in federal court, while state forum provisions keep state corporate matters in state court.

Not everyone is happy with this efficiency. When it comes to state forum provisions, The Gap case is one such example where the plaintiff vigorously fought the validity of forum selection. Notwithstanding the plaintiff's objections, the court decided in favor of The Gap.

Fortunately for the plaintiff, though, the decision has not created any gap in the plaintiff’s ability to seek the redress they need.

A Review of The Gap Derivative Suit

I’ve covered The Gap’s derivative diversity lawsuit (Lee v. Fisher) previously.

The outcome of the federal district court’s decision was that The Gap won a motion to dismiss because the plaintiff attempted to bring a derivative lawsuit in a federal court, and The Gap had state choice of forum bylaws that stated derivative suits must be brought in a Delaware court only.

This was despite the fact that, among other claims, the plaintiff cited Section 14(a) of the Securities Exchange Act of 1934, and such a claim can only be brought in federal court. (Section 14(a) claims allege omissions and misrepresentation in a corporation’s proxy statements.)

As I wrote previously:

The court rejected plaintiffs’ argument against dismissal of the case, including the 14(a) claim. The court noted that the absence of the ability to bring a 14(a) claim in Delaware state court does not mean that absolutely no remedy is available to plaintiffs in Delaware state court. As such, dismissal was proper.

Plaintiffs appealed the district court’s dismissal to the Ninth Circuit. Plaintiffs lost again when the Ninth Circuit affirmed the district court’s dismissal. Plaintiffs then asked for an en banc review by the Ninth Circuit (which means that a broader panel of judges review the case).

The Gap's En Banc Review: The Plaintiff's Arguments

In June 2023, the Ninth Circuit conducted an en banc review of the case. There were a number of arguments presented to the en banc court.

First, the plaintiff argued that The Gap forum selection bylaws were void because they violated the Exchange Act’s anti-waiver provision, which states “[a]ny condition, stipulation, or provision binding any person to waive compliance with any provision of this chapter or of any rule or regulation thereunder, . . . shall be void.”

The court disagreed, stating that the plaintiff still had the option to bring a case against The Gap under Section 14(a) through a direct action in federal court.

Next, the plaintiff argued that The Gap’s forum-selection clause is unenforceable because an enforcement would violate the federal forum’s strong public policy of allowing a shareholder to bring a Section 14(a) derivative action.

The plaintiff cited a Supreme Court Decision in J.I. Case Co. v. Borak (1972) as proof. But upon further review, the court noted that “a close look at Borak in its historical context and in light of subsequent Supreme Court developments ... compels the conclusion that Borak does not establish a strong public policy to allow shareholders to bring § 14(a) claims as derivative actions.”

The court then stated that the plaintiff did not “carry her heavy burden of showing the sort of exceptional circumstances that would justify disregarding a forum-selection clause.”

Finally, the plaintiff argued that the bylaws were invalid under Section 115 of the Delaware General Corporation Law (DGCL). Section 115 states that bylaws cannot prohibit internal corporate claims to be brought only in Delaware.

Of this, the court said the plaintiff’s derivative action was not, in fact, an internal corporate claim:

Because the Delaware Supreme Court has indicated that federal claims like Lee’s derivative § 14(a) action are not “internal corporate claims” as defined in Section 115, and because no language in Boilermakers Local 154 Retirement Fund v. Chevron Corp., … Section 115, or the official synopsis that accompanies Section 115, operates to limit the scope of what constitutes a permissible forum-selection bylaw under Section 109(b) of the DGCL, the en banc court concluded that The Gap’s forum-selection clause is valid under Delaware law.

The En Banc Court's Decision

Ultimately, the en banc court decided that the federal district court’s original decision to grant a motion to dismiss on the grounds of The Gap’s bylaws was, in fact, proper.

In other words: The plaintiff is not allowed to bring a derivative suit in federal court due to The Gap’s state choice of forum bylaws, and the plaintiff is also not allowed to bring a Section 14(a) suit in state court, because a Section 14(a) case can only be heard in federal court.

Note that this outcome still leaves plaintiffs with the ability to bring their federal court claim in federal court. They just have to do it as a direct suit and not a derivative suit.

This decision effectively created a split between the Ninth Circuit and the Seventh Circuit whose decision in Seafarers Pension Plan v. Bradway rejected Boeing’s state forum bylaws and allowed derivative Section 14(a) claims in federal court.

Takeaways

Some people erroneously believe that this decision leaves investors with no recourse to hold directors and officers accountable. This couldn’t be further from the truth.

Investors can still bring breach of fiduciary duty suits derivatively in Delaware and claim that the proxy is misleading—they just can’t rely on Section 14(a). In addition, as mentioned earlier, if plaintiffs do want to cite Section 14(a), they can file a direct suit in federal court.

When corporations adopt forum selection bylaws in their charter, they ensure that plaintiffs have appropriate venues for remedies, but not needlessly duplicative, expensive venues.

This is a responsible, pro-shareholder position. After all, it’s shareholders who pay defense costs, not to mention the cost of D&O insurance. The latter will be more expensive when duplicative litigation remains a threat.

Author

Table of Contents