Blog

What’s Driving Benefits Renewal Hikes and How Can You Prepare?

This article will discuss the factors driving the premium increases and provide steps employers can take now to prepare for the changes ahead.

With many healthcare renewal costs expected to have significant increases in 2024, some even by 20% or more, employers are facing an uncomfortable decision. How should they adjust employee benefits to accommodate the significant expense?

This article will discuss the factors driving the premium increases and provide steps employers can take now to prepare for the changes ahead.

| At-a-Glance Read time: 5 minutes |

||

|---|---|---|

Why Are Healthcare Costs Soaring?

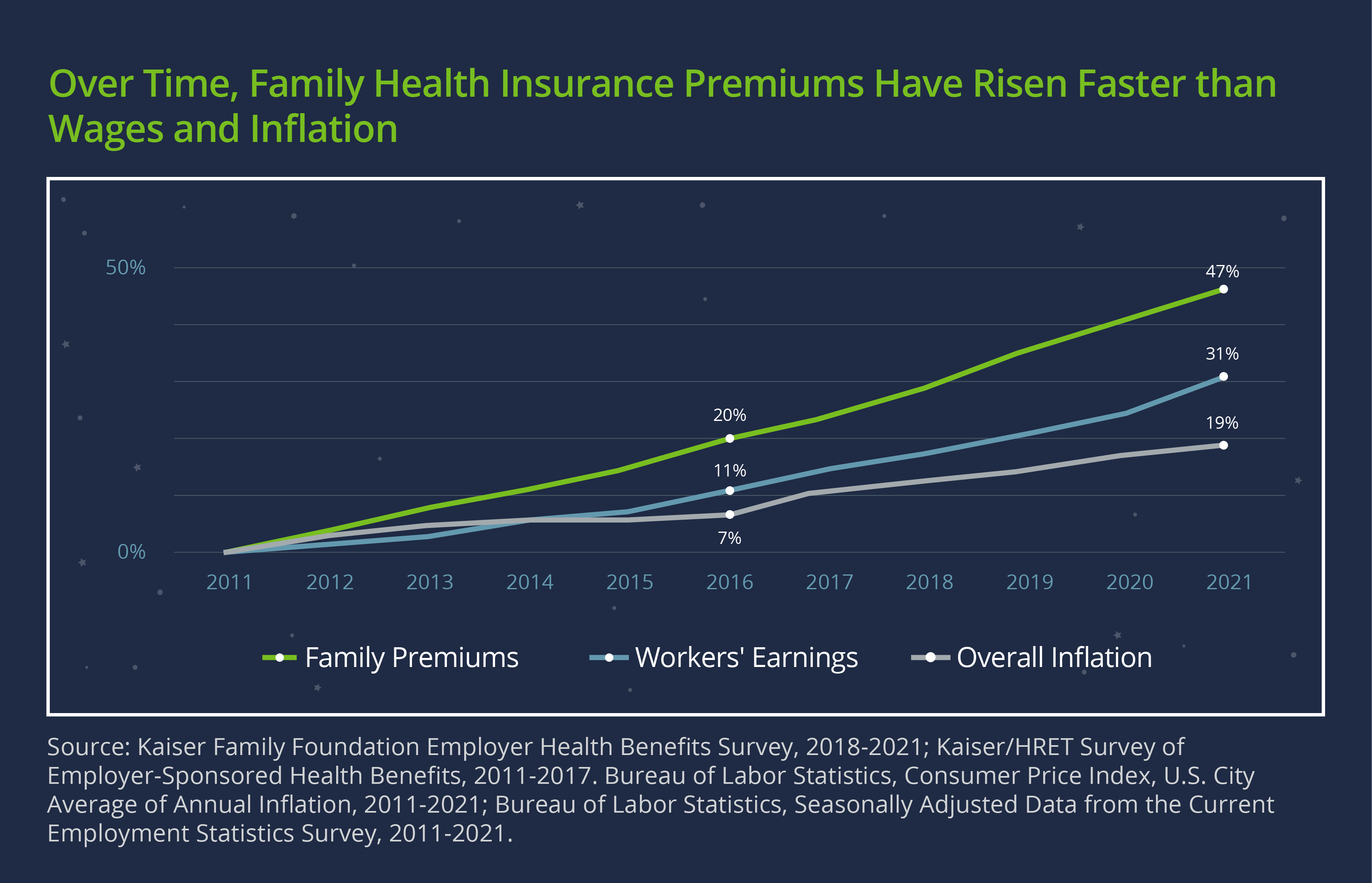

Over the past decade, family premiums for employer-sponsored coverage jumped 47%, according to a report from the Kaiser Family Foundation. That rate outpaced both wage growth (31%) and inflation (23%) over the same period. New projections show an even higher spike for 2024—for example, while Kaiser’s typical renewal is around 5%, some employers could see an increase of up to 25%. Other carriers are projecting increases of up to 40% or even 50% for some companies.

As you might expect, COVID-19 and the economic situation are the primary factors behind the expected premium increases. Let’s take a closer look at these and other reasons.

1. COVID-19

Although the COVID-19 public health emergency is over, its long-term impact on the risk pool and premiums remains uncertain. The pandemic drove down utilization starting in 2020, a period that was followed by rising inflation. This combination meant that while the cost of goods and labor was increasing, carriers didn’t increase premiums due to lower use. Now that usage is going back up, insurance carriers are playing catch-up to make up for inflation.

Additionally, the payment responsibility for COVID-19 vaccines, boosters, and tests shifting from the federal government to insurance carriers contributes to the higher premiums. This expense could be offset by reduced carrier coverage of new at-home tests.

2. Inflation

It’s no secret that inflation has made a major impact on the US economy in recent years. Since 2021, we have seen annual inflation rates between 6.5%–7%—the highest since 1981.

Inflation and other economic factors will increase negotiated provider payment rates and premiums. In an email to its customers, Kaiser Permanente pointed to the pandemic, inflation, supply chain issues, and staff shortages as some of the reasons for its commercial rate increases.

3. Utilization

Kaiser’s integrated care model (where it serves as both the insurer and provider of services) acts as a predictor of what we can expect to see from other insurers.

“Care volume increased significantly throughout 2022, particularly in outpatient services,” according to Bill Freygang of Kaiser Permanente. “We continue to experience this increased demand for services that members put off during the pandemic.”

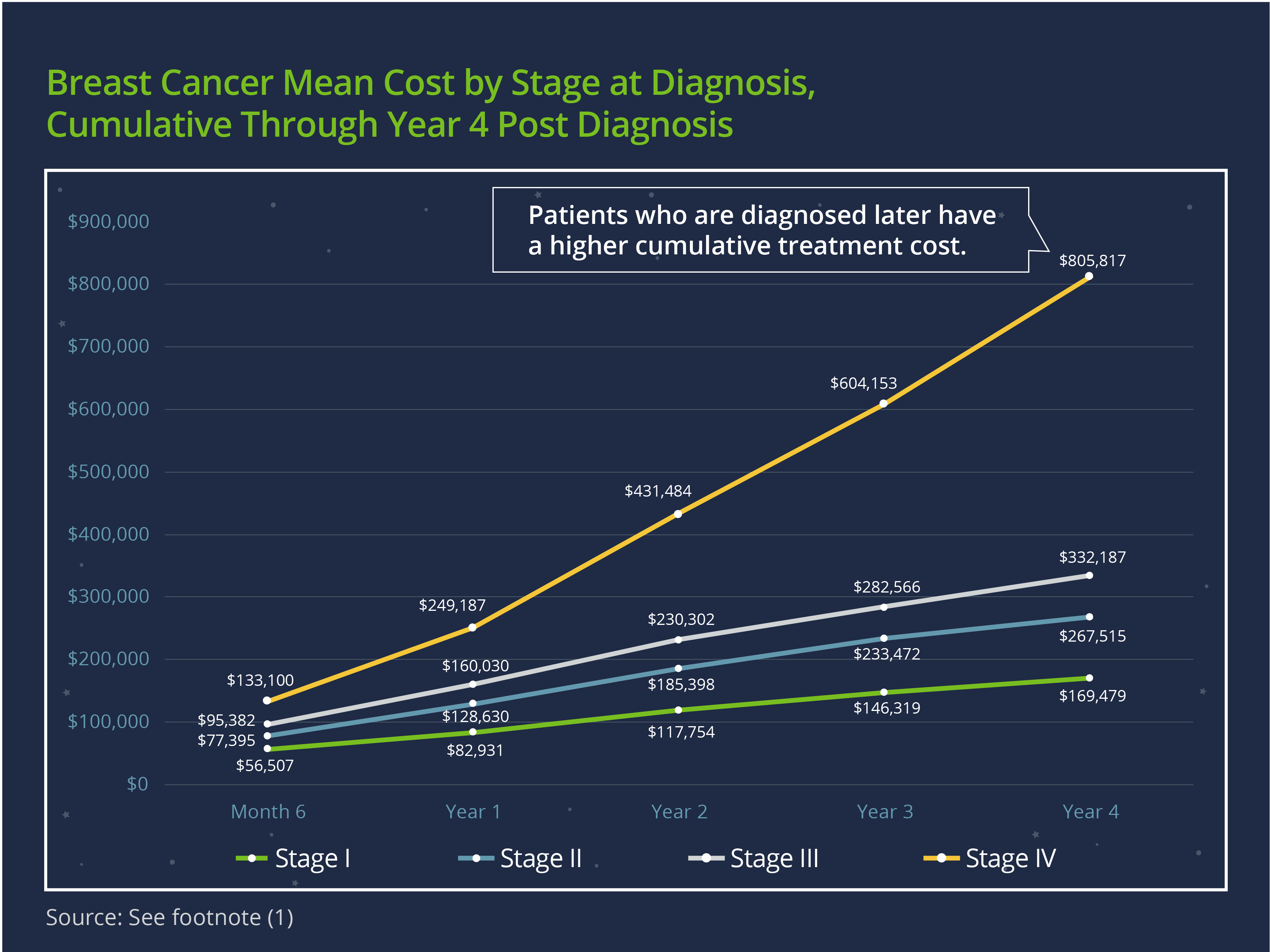

Delayed care often means increased healthcare costs, as diseases that would have required simpler treatment were left to progress until they required more extensive and expensive treatment. One example is cancer—a study1 found that mean costs (both annually and cumulatively) of cancer treatment increased by stage of diagnosis across cancer types. The graph below shows the stark difference between breast cancer treatment costs by stage at diagnosis.

What Steps Can Employers Take to Prepare?

The impact of the new rate increases will differ depending on how much or how little companies have prepared. Some companies will feel the effect less than those that based their estimates on low utilization and little to no renewal increases.

Many companies used the lower premium increases of recent years as an opportunity to increase their point solutions offerings. They focused on a variety of specialty areas like mental health, fertility, caretaking, and employee perks. The 2024 increase in premiums will drive more focus on assessing the use and impact of those solutions versus their budget impact.

Here are some steps companies should take now to reduce the impact of the new healthcare cost increases:

1. Leverage Data Analytics

We recommend that employers work with a data-savvy consultant to focus on the financial impact of increased premiums on plan selection. This expertise can help you leverage your data to make the best decisions for your plan in this market landscape. Plus, access to critical data can help point to why utilization rates have changed.

Fully funded plans may have limited data access, but a good consultant can help companies leverage the data they have and dig into what solutions are working best for their employee base.

Some companies currently under fully funded models would benefit from a self-insured feasibility analysis to see if self-funding might be the right solution for their business. Under a self-funded benefits model, companies get more in-depth access to their usage data and more flexibility in building out their benefits plans to meet the needs of their employees and budgets.

2. Consider Voluntary Benefits

Some companies may find value in their point solutions but may no longer be able to cover them as employer-sponsored. One option is to continue to offer the benefits on a voluntary basis so employees still have the option to participate, albeit at their own expense.

Plan for the Future

We expect another increase in healthcare rates in 2025—though less substantial than in 2024—across various carriers. Companies planning further out will need to consider how this may affect their programs and costs.

The team at Woodruff Sawyer can help clients choose the benefits plans and funding options that meet the needs of their employees and budget through our expert knowledge base and data analytics approach. Reach out to your representative to keep up to date.

Our Mission to More series offers guidance from leading specialists on what employees want and how employers can adapt to the new benefits universe. For more guidance on trends and emerging benefits solutions, sign up for Woodruff Sawyer’s Benefits newsletter, which includes all Mission to More articles.

1November McGarvey, Matthew Gitlin, Ela Fadli, and Karen C. Chung, "Increased Healthcare Costs by Later Stage Cancer Diagnosis," BMC Health Services Research 22, 1155 (2022)

Author

Table of Contents