Blog

Homeowners’ Property Loss: Guidelines for Making an Insurance Claim

The recent fires in California had a devastating impact on various communities, with many homeowners losing or facing severe damage to their properties. As residents begin the challenging process of recovery, understanding how to effectively file personal property loss claims becomes crucial.

Filing a personal property loss claim can be a complex and often unfamiliar process. For many, this may be the only claim they ever file, and between balancing work, family, and daily responsibilities, rebuilding and replacing essential belongings can be daunting.

In this blog, we’ll walk you through the key aspects of filing a claim. We provide clear, actionable steps to guide you through the claims process, including helping you understand your policy, providing best practices for working with vendors and your lenders/lienholders, and ensuring you get the maximum return on your claim.

The Insurance Claim Process, Step-by-Step

If your property has been damaged and destroyed, your priority is to secure temporary accommodation. You’ll also need to inform institutions, such as your bank and lenders, the Post Office so it can stop or redirect your mail, and the utility company so it can stop service if appropriate. During the transition process, keep all receipts for meals and groceries, clothing, necessities that you purchase, and any temporary repairs you make to your property. These steps are crucial for starting the process of recovery and insurance claim.

Below are steps to take when filing a claim:

- Identify damage and report it to the agent/broker; take action and board up property to mitigate loss.

- Review your policy, deductibles, and options/strategies with your agent/broker to report to the insurer.

- Report the claim so the insurer can assign an adjuster, begin conducting inspections, and request documentation.

- Collect estimates from vendors/contractors. Select one to complete repairs, and order/purchase essentials (e.g., clothing, incidentals, furniture).

- Request claim payment advances. The amounts vary by loss, policy, insurer preferences, etc.

- Set up temporary housing and evaluate your financial loss; prioritize your needs.

- Prepare a claim summary of costs and backup documentation for review with consultants/experts.

- Once the adjuster reviews the documentation provided, they will present an offer and may ask you to sign a partial proof of loss or subrogation receipt for partial payment to be issued. Proof of loss is not a release, and you may be able to supplement your claim or make additional claims later.

- Reconcile any differences, provide explanations to the insurer, and provide further documentation to reach agreements and settle the claim.

- Sign the proof of loss or subrogation receipt and send it to the adjuster for final payment to be issued.

- Advance or final payments may be based on limits, home appraiser report, or the information the insurer has on file. So long as there is no “release” to be signed, the homeowners may receive a small or substantial advance. If the policy includes additional coverage endorsements such as inflation guard and code compliance coverage, homeowners may receive more than the policy limit.

Understanding Your Policy

To understand how much you’re entitled to and what your insurer will cover, locate the declarations page of your policy. Review the limits and determine the valuation clause of your policy for each coverage.

| As a refresher, here are some key claims terms to know: |

|

Coverage A: Dwelling/Other Structures

This includes the house and attached garage or structures such as patios. Note that some policies label “other structures” as Coverage B.

Review the limits below:

- Building limit

- Dwelling extension/other structures (Limit may be a dollar amount or a percentage of your dwelling amount.)

- Building code enforcement (Limit may be a dollar amount or a percentage of your dwelling amount.)

- Debris removal (Some policies will add 5% as additional coverage if the dwelling limit is exhausted.)

To prepare for restoration, you will need a general contractor, an architect, and potentially an engineer. The general contractor is responsible for obtaining permits, building inspections, etc. Make sure you select a reputable licensed contractor. Notify your lender if you have a lienholder so they can start their process for handling insurance payments that will be issued. Some insurers have agreements with restoration contractors and if you use the insurer’s contractor, there may be an extended warranty for their workmanship.

Request an advance payment from your adjuster. This can be used to pay vendors to remove debris and collect and store parts of structures that still have value and can be repaired without personally financing these costs. Keep track of all expenses and submit these to the adjuster to support the advances issued (you can get more than one advance), and to support/document your “RCV versus ACV” for settlement.

Your policy will pay for you to rebuild with like kind and quality on the same site/lot. It may also allow you to cash out and purchase a similar home within a specified period to permit recovery of the “depreciation.” You also may elect to use the actual cash value (ACV aka fair market value) and rebuild something different on the same site/lot.

One of the first things you can do is reach agreements with your insurer on “as was” or like kind and quality. This will give you a “budget” to use for what you want to rebuild/replace with. Don’t confuse the adjuster by presenting your plans for deviations from what you had before—what you rebuild is between you and your contractor.

Request from the adjuster a “statement of loss.” This worksheet summarizes your coverage limits and what amounts they have documented on your claim based on your submission of estimates to date. This allows you to clearly see your coverages and values calculated to date.

Coverage B: Personal Property/Contents

This includes furniture, clothing, food, jewelry, art, etc. The contents limit may be a dollar amount or a percentage of your dwelling amount.

Complete a list of all your personal property. Go room by room, wall by wall, floor to ceiling, and include closets, dressers/furniture, and contents in drawers, etc. As you enter the door into a room, it helps to follow the same pattern (e.g., clockwise) so you don’t miss items. Have someone input the items you name into an Excel contents inventory sheet (note the item description, quantity, year purchased, vendor, and value paid). Some items may be repaired, cleaned, or salvaged, and you can claim the value to “clean/restore” it instead of its replacement cost if it’s economical to do so, especially for items of sentimental value, heirlooms, etc.

The settlement for your items will likely be based on RCV/replacement cost value, but that’s if you replace the item. At the time of the loss, your initial payment will be based on ACV/depreciated value (fair market value). Later, you will submit the actual replacement receipt copies to the adjuster, and they will reconcile what they paid/ACV versus the actual/RCV and issue a supplemental payment for the depreciation you actually incurred. This two-step process gives you the funds to buy items without having to finance it, then makes you whole by paying the depreciation cost, if incurred.

Submit your preliminary inventory list to the adjuster and request advance payment. Update the list with actual costs, add items you may have missed during the first attempt, and re-submit it to the adjuster for a second advance payment. Continue these steps of submissions until you’re satisfied you have accounted for everything you had, and you have moved back into your restored home. All your possessions have value, including used items (food in the pantry, half-used roll of toilet paper or tube of toothpaste, etc.)

IMPORTANT: Retain physical custody of damaged inventory and business property for insurance adjusters to inspect. Do not throw anything away without first making a list and taking photos, then checking with the adjuster on the status of the insurance claim.

Identify a location to store the inventory and/or personal property; rent a space if necessary.

Coverage C: Additional Living Expense (ALE)

This includes the cost for a temporary rental home/apartment/hotel, extra costs for eating out versus cooking at home, etc. The ALE limit can be actual costs up to 12 months, actual costs up to 24 months, or a stated value. The limit may be a dollar amount or a percentage of your dwelling or contents amount.

The ALE coverage is to maintain your standard of living. You’ll continue to be responsible for your mortgage, so the rental of a house, furniture, etc., is an “additional living expense” beyond your normal living expenses.

Furniture and clothing should be prioritized, but don’t replace everything right away. You will not need everything for now, and you don’t want to incur costs storing items. Purchase some clothing and immediate personal items to use at your rental. You may purchase a few pieces of furniture for use at the rental if it’s not furnished and move those items to your home when it’s rebuilt.

Coverage D: Fair Rental Value – Loss of Use

This applies if you rented out a room, studio, etc., and lost rental income. In some policies, this is synonymous with the coverage for “additional living expenses” (ALE) above. In a large loss, this limit may be exhausted very quickly, so plan ahead. You may need to use some of the funds from your contents coverage to pay for your rental expenses until your home is replaced/rebuilt.

Working with Vendors: Get Detailed Reports and Costs

Any reports from general contractors, engineers, electricians, and plumbers should be detailed and identify the scope of work and costs. Their estimate must be in a “line item” format, not lump sum values. The breakdown of costs must be clear, such as for tear-in/access, pipe/wiring materials, labor for pipe/wiring repairs, back-fill after the repairs, etc. Invoices for materials and timesheets may also be requested. If you request a breakdown in an Xactimate estimate (estimating software) or similar format, they usually accommodate. Most contractors who do insurance-related work know what Xactimate is. Some contractors use “time and materials” estimates; if so, you should request the timesheets and materials invoices.

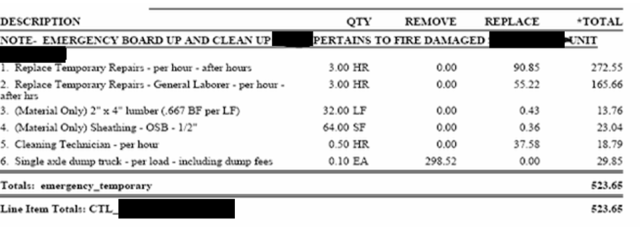

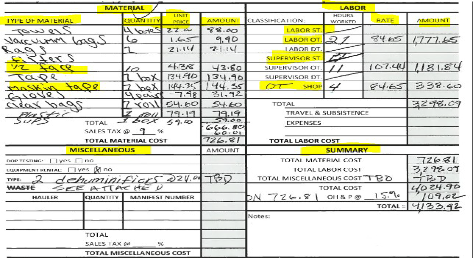

| Good Examples: A line-item estimate should contain detailed descriptions, quantities, activities, rates, etc. Time and materials estimates should include key parts highlighted. Note the level of detail and specificity in the examples below: |

|

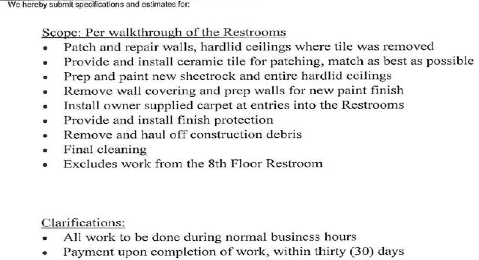

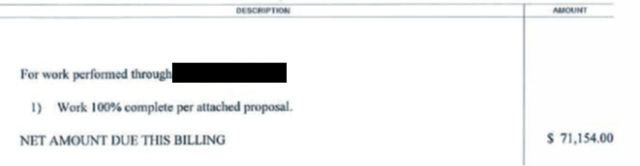

| Bad Examples: The examples below do not include details such as quantities, the thickness of drywall, tile grade and amount, how many dumpsters of debris and dumpster size, etc. The lack of detail can lead to a long, arduous claims process and oftentimes results in a lesser payment due to the insurer’s inability to validate expenses. |

|

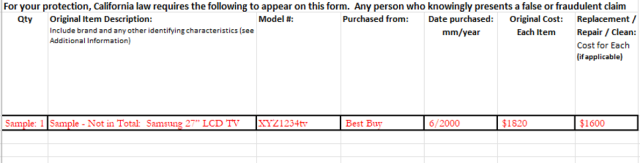

| Contents - Personal Property Inventory List Example: The example below shows the level of detail adjusters are looking for. In a large loss, the adjuster may accept grouping of similar items such as “10 books”, “eight dresses,” etc. However, in smaller losses, a more detailed inventory may be required. The more detailed you are, the easier it is later to reconcile if there is a misunderstanding about the quantity or description. The replacement value should be today’s value with tax and shipping to your location. For ease of tracking, we recommend a separate excel tab for each room. The age/condition is used to determine how much depreciation the adjuster will apply to establish the ACV payment. |

|

| Keep detailed records of your submissions to the adjuster, send them copies, and save the originals. Take notes of your discussions, agreements, disagreements, etc. Follow up in writing where appropriate. |

How to Recover the Full RCV

When items are claimed on a replacement cost value (RCV) policy but not replaced at the time of the claim submission, the policy pays the actual cash value (ACV)/depreciated value at the time of settlement. Then, the depreciation cost is paid after you submit the replacement invoices. You may upgrade or downgrade, but the funds should be used for similar items for the recoverable depreciation to be paid to you.

To arrive at ACV, the adjuster will use the traditional method, starting with the amount it would cost to repair or replace any covered property, at the time of loss or damage, with property of like kind and quality. They will then calculate depreciation based on the age and condition of the property to arrive at the actual cash value.

Replacement Cost — Depreciation = Actual Cash Value (aka Fair Market Value)

You have the option to request that actual cash value be determined based upon the fair market value of the property, although it has been our experience that this often results in a lesser recovery than the method described above. If the parties cannot agree on a value, the policy has an “appraisal” provision that may be used to establish a settlement value. The appraisal clause will specify the steps and procedures to arbitrate the settlement.

In addition, you typically have 180 days (about six months) from the date of loss to make a claim for the recoverable depreciation withheld in the settlement of the claim. To do so, forward copies of all photographs, invoices, receipts, and documents to support that the property has been repaired/replaced and the actual costs incurred in doing so. Once received, the adjuster will contact you to discuss the resolution of your RCV claim, which will entail reconciling what was previously paid/ACV up to the difference incurred/RCV.

If the repairs will take a year or more to complete, send a letter within 180 days from the date of loss, stating the intent to perform the repairs, and/or request an extension for the depreciation to be recoverable at some point in the future.

If you no longer have a personal need to repair/replace the damaged items, you can spend the ACV settlement as you deem appropriate, but you won’t recover the depreciation. Depending on the situation, some exceptions can be negotiated with the insurance company and should be memorialized in writing.

Finalizing Your Property Insurance Claim

In summary, make sure to present all estimates for work to be done and submit your inventory documentation and ALE expenses to the adjuster for review. The adjuster will validate the full cost of the repairs/replacement, reconcile against what the policy allows, and provide an updated statement of loss and supplemental payment for any legitimate differences, if warranted.

If any portion of your claim is not covered, the adjuster will advise and cite the policy language that applies. If your vendors charge more than the reasonable going rate allowed by the adjuster, get a second bid or you may be responsible for the portion the policy does not cover.

Ideally, in the end, if everything is submitted and the depreciation is paid as part of the final/closing payment, you are out only your deductible and any costs that are excluded or unreasonably excessive.

Author

Table of Contents