Blog

Inflation, Recession, and IPOs: An Economic Update with Nasdaq

How accurate is all the talk about never-ending inflation and an inevitable, brutal recession in 2023? Maybe not that accurate. The data seems to be telling a very different story.

Earlier this month, Woodruff Sawyer hosted its annual State of the Economy webinar with Nasdaq. The webinar featured Phil Mackintosh, Nasdaq’s chief economist, and Jack Cassel, Nasdaq’s head of new listings. During the webinar, we discussed inflation, recession concerns, unemployment, IPOs, and more.

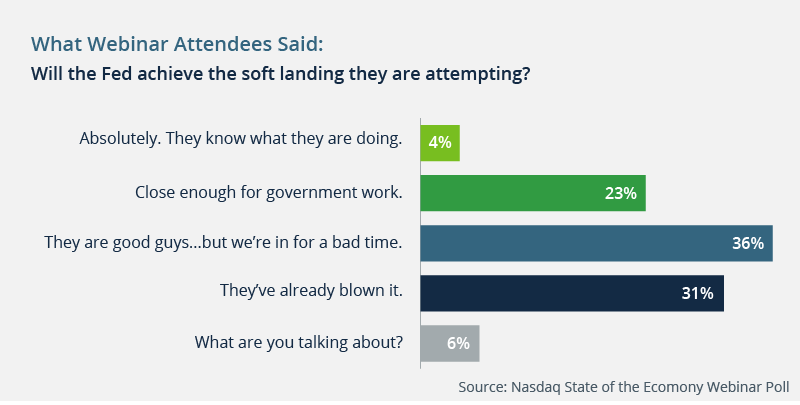

Our webinar participants are also skeptical of dire recession predictions, as demonstrated by this poll:

Read on for takeaways from the event—and more results from our webinar polls.

Headline Inflation Seems to Have Peaked

As of early December, inflation was at 7.7%, down from 9.1%. Reviewing the data, Mackintosh is predicting that the interest rates, now at 4%, will likely peak at 5%.

Pandemic stimulus checks, which created extra demand for goods, contributed greatly to US inflation. However, once COVID-19 vaccines came out, people stopped buying as many goods and started buying services again. Services are a much bigger component of the economy, which is why inflation hasn't fallen significantly.

Signs of Recession in the US Are Still Muted

Notwithstanding economic headwinds, we may have a small recession or avoid one altogether, experiencing a slowdown instead. The risk of a recession is much higher in Europe than it is in the US.

The stock market has stabilized since last year, and the current bear market isn't as bad as it was during the beginning of the pandemic or the financial crisis in 2007–2009.

We May See a Correction in the Housing Market

Mortgage rates have gone up significantly, from 3% to 7%—that means if you're trying to get a mortgage now, your housing affordability is going to be reduced by half. Mortgage applications have decreased dramatically. The data show that home inventory is increasing, and sellers are reluctant to sell right now.

Manufacturing, Which Rose at the Beginning of the Pandemic, Is Slowing as the Services Sector Grows

In good news compared to what was happening during the pandemic, supply chains are normalizing. Indeed, companies have excess retail inventory (with the notable exception of motor vehicles and vehicle parts). Companies are starting to provide discounts, which will help with goods disinflation. With this excess retail inventory and dry order books, many companies are projecting negative growth in Q1 2023.

The Labor Shortage Remains a Problem, and Unemployment Is at a Multi-Decade Low

The labor shortage remains significant, with as many as two to three million workers missing. This may be attributed to an aging workforce that in some cases took early retirement during the pandemic. In addition, US immigration policies seem to be inhibiting the supply of both low-wage and highly skilled workers. Still another factor contributing to the persistently low unemployment rate may be new types of jobs—a reported 2 million people are now "influencers," many earning enough money to support themselves outside of the traditional employment economy.

The consequence? Wages are still going up, increasing the cost of business operations, especially for companies with the lowest wage earners. On the plus side, however, this type of wage support may help with income inequality.

Of course, tech layoffs have made the headlines recently. These are front of mind for many people, likely in part because the layoffs are coming from high-profile companies. The total number of layoffs, however, has really not impacted overall unemployment figures.

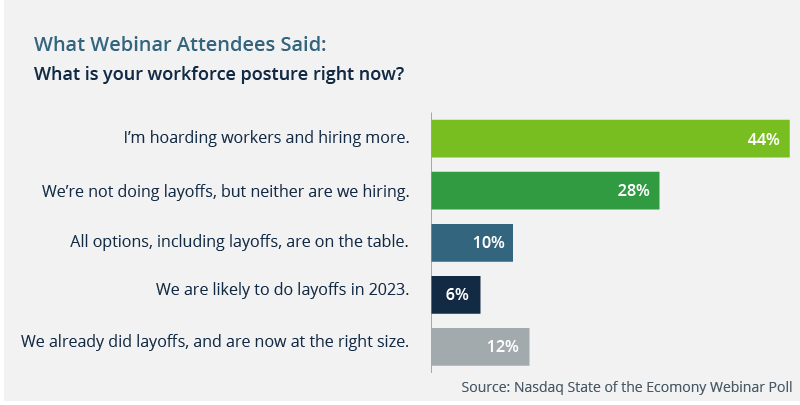

The results of the webinar participant poll tell a similar story:

CEOs Fear an Earnings Recession

Companies' profit margins are good, and earnings have been strong—even close to record levels. Nevertheless, CEO confidence is low. CEOs are clearly concerned about reductions in earnings and stock valuations.

Third-quarter earnings saw a slight growth of 2.4%, but this was mostly due to the energy sector, which grew by 138%. In fact, seven out of the 11 sectors in the market are already reporting earnings contractions. Without energy, overall earnings fell by 5.2%.

The IPO Cadence Is Down, But Not Dead

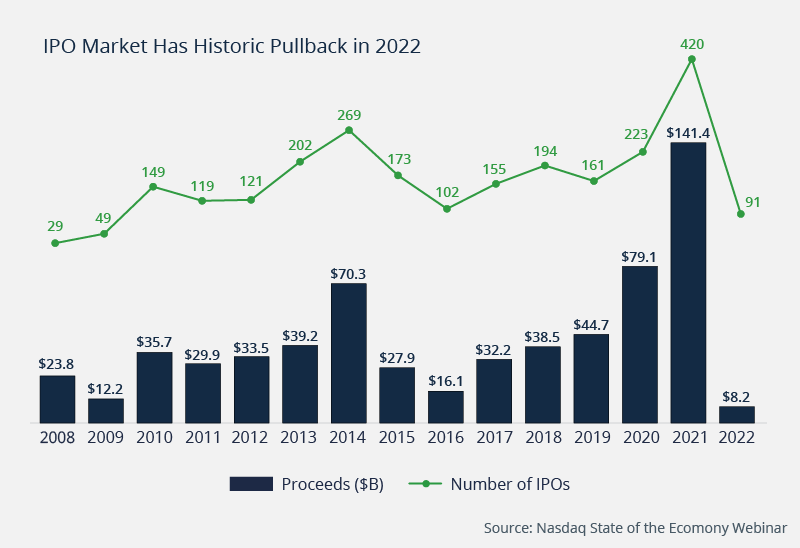

The decrease in IPOs in 2022 compared to the previous year was significant. Investor demand for IPOs in 2022 was at best tepid. In addition, according to Cassel, 30 or 40 companies that would have IPOed in 2022 accelerated their timing and went public in 2021 instead.

In 2023, we certainly won’t see the highs of 2020 and 2021, but we will have IPOs. Expect IPO volume to revert to the more “normal” levels experienced in 2017–2019.

Previous downturns in the IPO market have seen a V-shaped recovery. We saw this after the dot-com crash, the global financial crisis, the China crash and Brexit, and the COVID-19 selloff. Each time, the government has been able to stimulate the economy by printing money. Unfortunately, inflation concerns will prevent the government from doing the same this time, so Nasdaq is expecting a somewhat more prolonged recovery.

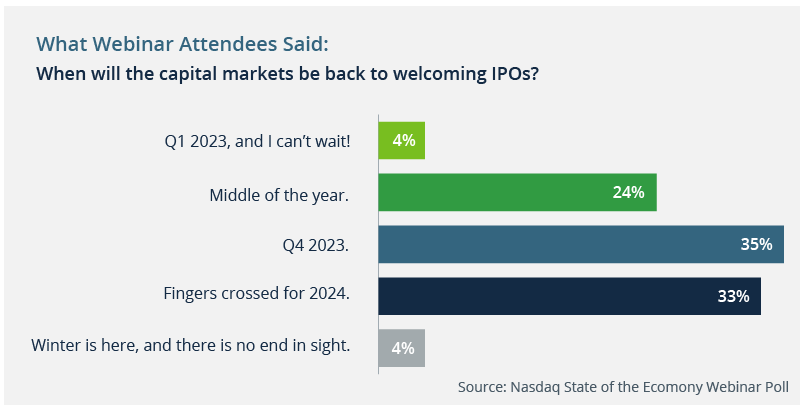

Our webinar participants agreed:

Investor Interest Has Shifted From Growth to Sustained Profitability

Investors have pivoted away from favoring growth at all costs. Companies are reacting by looking internally at their cost structure, some taking steps to reduce headcount, reduce real estate, and provide flexibility in their pricing models to retain customers.

Having said that, there has been good activity when it comes to fundraising and valuations in the biotech and pharmaceutical sectors. Investment in enterprise technology companies has slowed, although valuation remains high.

The Economy and Your Insurance Premiums

The webinar was intended to be an economic update for our clients and friends. Of course, many will also be curious about what 2023 will bring in terms of insurance premiums for next year. Read our 2023 D&O Looking Ahead Guide and our 2023 P&C Looking Ahead Guide for more information on this topic.

For more information on the State of the Economy, watch the full recorded webinar.

Author

Table of Contents