Guide

P&C Looking Ahead Guide for 2025: Experts Expect Stabilized Rates

After years of sustained rate increases, 2025 offers a brighter outlook for commercial insurance buyers. We expect premiums to stabilize or rise modestly, varying by line of business and industry. Increased market competition has gradually tempered rate growth, and while hurricanes Helene and Milton were devastating, their insurance losses were lower than anticipated.

In our annual P&C Looking Ahead Guide, we dive into additional factors driving these trends, provide projections for 2025, and discuss specific industries in the middle market in more detail. Here are the highlights of the report. You can download the complete Guide by clicking on the thumbnail in the header.

Three Promising Trends Affecting Commercial Lines Insurance

After seven years of severe pricing increases coupled with limited coverage availability, we see a light at the end of the tunnel. In 2025, we expect flat pricing to low single-digit increases that vary by line of business and industry.

The three factors affecting commercial insurance prices are:

- Industry profitability continues to improve despite significant natural catastrophe losses. This improvement is due to insurers collecting more premium for the risk on their books after seven years of increased rates.

- Economic inflation is easing. Lower inflation will ease loss costs in the property segment and help the struggling commercial auto market.

- Insurers continue to report rising investment income. Insurers are still maintaining underwriting discipline, but higher investment income provides an earnings cushion that can lead to more competitive premiums.

Property: A Softer Market Ahead

We continue to experience rate improvement in the commercial property insurance market through the first 10 months of 2024.

In 2024, carriers have grown by expanding their participation in programs, writing new business, and considering occupancies that previously caused hesitation. In addition, most carriers remain profitable despite an increase in the frequency of catastrophic events and insured losses.

Another key factor affecting pricing in 2024 was the lack of pressure from the reinsurance market. As a reminder, in 2023, the reinsurance market mandated higher retentions and increased rates. This increased insurance carriers’ operating costs, which they passed to clients.

Looking ahead to 2025, we anticipate rates will continue to trend downward. Property insurance markets want to achieve growth. Profitability, absent any major events in the last month of 2024, will encourage carriers to write more new business and expand capacity on existing business. Additionally, new market entrants, primarily in the form of managing general agents (MGAs), will generate increased competition, further contributing to reduced rates.

By combining risk management with relationship-building and a strategic marketing effort, insureds position themselves for the best possible outcomes.

Casualty: Creative Risk Financing in the Age of Social Inflation

Innovation is often born out of hardship. Liability claims costs continue to pose unprecedented challenges to risk managers and stewards of corporate insurance programs. For the past several years, we've warned about the impact of social inflation—the growing frequency of large liability claims driven by changing societal, legal, and economic dynamics. In response, savvy insurance buyers are developing innovative insurance programs that balance taking on extra risk with maintaining strong traditional coverage. These programs often use actuarial data to carefully manage risk and attract underwriters.

Looking ahead to 2025, the need for smart casualty insurance design is greater than ever. The number of “nuclear” verdicts (damages over $10 million) is rising. Additionally, social inflation has pushed US casualty claims costs up by 57% since 2013, according to Swiss Re.

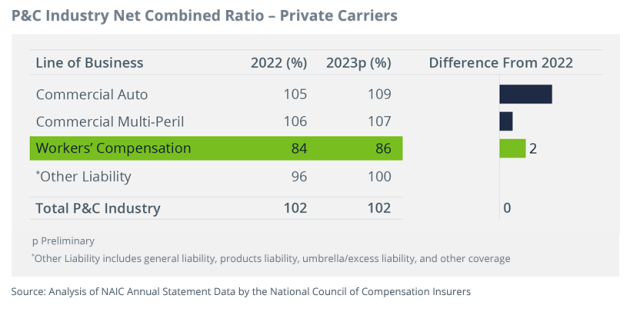

Social inflation, along with intense insurer competition, led to another year of poor underwriting results for US casualty insurers. Combined ratios for commercial auto, other liability, and commercial multi-peril all deteriorated in 2023 and exceeded 100, indicating that insurers are expected to pay more in claims costs and other expenses than the total premium collected.

Read the full Guide for rate predictions and trends for all major lines of casualty insurance:

- Commercial auto

- Commercial general liability

- Umbrella and excess liability

- Workers’ compensation

Industry Focuses

Each industry faces unique challenges when it comes to insurance coverage and costs. Our Guide dives into these industry specifics and explains the trends driving costs and coverage for 2025.

- Technology: Fierce carrier competition and insurer profitability in the tech sector are driving favorable market conditions.

- Healthcare: Although we anticipate continued rate increases in the medical professional liability insurance market in 2025, the increases will likely be moderate for most segments.

- Manufacturing: The insurance market for the manufacturing sector achieved relative stability in 2024, a trend we expect to continue into 2025.

- Life Sciences: We expect the generally soft property and casualty insurance market for life science to continue into 2025, although larger property portfolios continue to be a challenge.

- Retail: The retail and e-tail insurance market continues to be relatively stable, with abundant capacity available for companies with solid operational track records, commitment to loss control, and better-than-average claims records.

- Real Estate: Commercial real estate owners focused on safety, upgrades, and sustainability should continue to see positive insurance results in 2025. For multifamily units, insurers remain selective, favoring newer, high-quality properties with modern safety features and located outside catastrophe-prone regions.

For more expert data, analysis, and predictions, download the full P&C Looking Ahead Guide for 2025.

Author

Table of Contents