Blog

Securities Class Actions 101: An Overview for Directors and Officers

When it comes to financial liability, securities class action lawsuits are one of the highest severity risks faced by directors and officers of public companies. It’s worth understanding what this type of litigation actually involves.

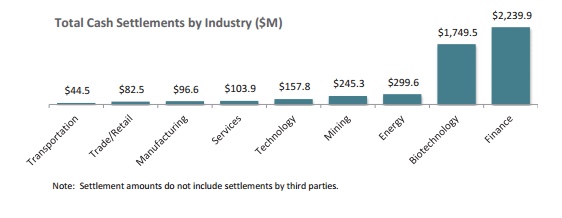

As we saw in the “D&O Databox Flash Report” for 2016, securities class actions are running at a 10-year high for frequency rates, and the settlements were high as well.

In this post, I’ll discuss what you should expect if you are faced with this type of litigation.

What Are Securities Class Action Lawsuits?

Public companies, and the directors and officers that serve them, are subject to liability for material statements and omissions pursuant to the securities laws under the Securities Act of 1933 or the Securities Exchange Act of 1934

Under the Securities Act of 1933, a company, its directors and officers are subject to Section 11 liability for statements made on its registration of its securities (for example, the Form S-1 registration statement a company files with the SEC for its IPO and follow-on offerings).

Under Section 10b of the Securities Exchange Act of 1934, companies, and the directors and officers that serve them, are also subject to liability for their periodic filings in their Form 10-K and Form 10-Q.

What does this mean as a practical matter? When a publicly traded company has a precipitous drop in its stock price, shareholders may sue.

To be sure, there’s no liability associated merely with a stock price drop, and in fact, there’s really no liability associated with making a mistake. The liability arises when plaintiffs can point to a statement made by the company and say it was false and misleading – and because it was false and misleading, they need to be made whole

Consider public companies that routinely host earnings calls and file quarterly reports on form 10-Q. In doing so, statements are made about the company, how its revenues are trending, how the business is going as a general matter, and other similar disclosures.

If things don’t work out the way the company expected, when the company reveals the miss there can be a precipitous drop in the company’s stock price.

This loss in shareholder value may prompt for the shareholder plaintiffs’ bar to bring a securities class action suit on behalf of shareholders. The suit will allege that the company’s directors and officers, and the company, itself violated the disclosure rules of the securities laws. Notably, with few exceptions, ’33 Act claims do not require an intent to defraud.

What’s the Securities Class Action Process?

In terms of the process, securities class actions are like an iceberg. Big. Heavy. Dangerous. And, slow moving at times.

Investigation Phase

Usually the first step in the process commences when a plaintiffs’ law firm issues a press release that says that they are investigating a situation. Anybody can say they’re investigating any company at any time.

All such notices are of concern; these notices should be taken more or less seriously depending on the firm that issues the release. Per the D&O Databox, Woodruff Sawyer’s proprietary database of D&O-related litigation, in 2016, the most active plaintiffs firms when it came to the filing of securities class action lawsuits were:

| Plaintiff Law Firm | No. of Suits |

| Pomerantz LLP | 56 |

| The Rosen Law Firm P.A. | 47 |

| Robbins Geller Rudman & Dowd LLP | 35 |

| Glancy Prongay & Murray LLP | 33 |

Once a company realizes it’s being investigated, it’s a good idea to call your insurance broker. Depending on where you are in the insurance renewal cycle, there may or may not be anything to do at that moment vis-à-vis your insurance carriers.

Finding a Lead Plaintiff

The lead plaintiff for a securities class action lawsuit is going to be someone with a very significant economic interest in the outcome of the case. Whoever has the lead plaintiff as a client becomes the lead plaintiff firm.

When multiple shareholders represented by multiple plaintiff firms file suit, part of the process typically includes consolidating those claims into just one complaint and appointing a lead plaintiff.

That’s the firm that controls the case and also the firm that, upon a settlement, would get the plaintiff’s attorney fees that are a part of this entire process.

Sometimes large institutional investors decide to opt-out of the class. While this is not widely common, it does happen from time to time. It creates disruption to the normal process and makes everything more expensive because now the defendants are defending themselves against both the class action suit and the individual opt-out suit(s).

Filing Suit

As soon as they have a shareholder and a credible complaint to file, the next step is for the plaintiff’s firm to file suit claiming violations under the ‘33 Act or the ‘34 Act, depending on the situation.

As a reminder, ‘34 Act cases can only be brought in federal court. These cases will not appear in state court.

There’s a circuit split on whether ‘33 Act cases can be brought in state court. California is notable for its willingness to hear these cases instead of sending them to federal court.

Next comes certifying the class. You may remember that after the Halliburton decision in the Supreme Court, there is a possibility of challenging class certification as part of the initial defense strategy. Typically however, most courts will decide class issues only after discovery and the class-certification motion.

Notifying Your Counsel and Broker

Once you are served with a securities class action lawsuit, it’s important that you immediately talk to your insurance broker as well as your outside litigation counsel (though, to be sure, this is a better conversation to have when you first become aware of investigations being launched against you).

Your insurance broker needs to be notified so that they can give notice to the insurance carriers. You’ll then have to pick counsel from the carrier’s list of approved lawyers or pick your own and have the carrier approve them.

In some cases, carriers have the right to insist that you choose one of the attorneys they have listed as “panel counsel” for your policy. There are also policies that might reduce your self-insured retention (like a deductible) if you agree to use a firm on their panel counsel list.

In any case, your primary carrier will typically have the right to approve or not approve your defense counsel as well as the rates that they will be paid. Your carrier may also have litigation guidelines that they expect you and your law firm to follow.

Depending on the expertise of your insurance broker and how active they are when it comes to claims advocacy, they may be a good source of information. An active broker can help you understand which lawyers do an especially good job on this type of lawsuit as well as which lawyers your insurance carriers may prefer.

Your insurance broker will also remind you at this stage of things that should and should not be done in order to preserve coverage under your insurance policy. For example, many purport to exclude coverage for any settlement a carrier does not agree to make. Some policies even purport to exclude coverage if you start to negotiate a settlement without a carrier’s permission.

Your outside counsel will tell you how to accept service and process on behalf of all the directors and officers who are being sued, as well as the company.

The Motion to Dismiss

In most cases, the next step for defendants will be to file a motion to dismiss (called a demurrer in California state court).

Per the D&O Databox, about 40+ percent of securities class action lawsuits are typically resolved by the defense with a motion to dismiss, but it may take a couple rounds.

Motions to dismiss are much easier to obtain in federal court than state court due to the federal court’s heightened pleading standards. Often, a court will grant a motion to dismiss without prejudice, meaning that the plaintiff has the ability to amend and re-file their original claim.

When a plaintiff then files the amended complaint, usually the defense will file a motion to dismiss again. This can go on for three or four rounds before the court will finally grant a motion to dismiss with prejudice—meaning that the plaintiff has to stop filing amended complaints.

The good news for cases that are won on a motion to dismiss is that you aren’t paying any money to the plaintiff’s firm or the plaintiffs. The bad news is that you will incur defense fees in the course of pursuing the motion to dismiss. This may include fees associated with your defense counsel’s needing to do some amount of investigation in order to write a good motion.

On the bright side, however, is that in this early motion pleading state, there is no cost associated with discovery if you are in federal court. (Although you may voluntarily give the plaintiffs some limited information as part of your defense strategy to move the case forward.) Unfortunately, there may be discovery in state courts prior. A tension we’ve discussed before for ’33 Act Claims.

Getting rid of a case on a motion to dismiss can take more than a year. If a defense is not successful in winning a motion to dismiss, then the case moves forward to a more aggressive litigation phase.

At this point, there’s often a lot of negotiation around settlement with plaintiffs, even while the motion to dismiss phase is pending.

It’s a tricky negotiation: if the plaintiffs don’t settle and the defense loses the motion to dismiss, the cost of settlement will undeniably go up. On the other hand, if the plaintiffs don’t settle and their case is finally dismissed, the plaintiffs ultimately walk away with zero.

Beyond the Motion to Dismiss

Upon losing a motion to dismiss, the cost of settlement usually goes up. Surviving to this stage means that the plaintiff has overcome a court’s skepticism as to whether the plaintiff has even stated a valid claim. In this next phase, defendants typically have a heightened desire to find a way to settle the case.

The insurance carriers are also motivated because the cost of defense will go up as a company now has to deal with the very expensive process of engaging in discovery and potentially preparing for a trial.

In the worst case, securities class action lawsuits can actually go to trial, but this is exceedingly rare. Per the D&O Databox, in the past 10 years, only 0.4 percent of securities class action lawsuits have gone to trial.

Thus, these cases almost never go to trial. Instead, they get settled.

How Do You Settle a Securities Class Action Lawsuit?

The Insurer’s Role

Once there’s talk about a settlement of any significant size, you’ll need to be in close communication with your insurance carriers. Insurance carriers have a lot of experience with securities class action lawsuits, and they can be a valuable resource when it comes to helping a company think about what is an appropriate settlement for the case at hand.

Remember, too, that many D&O insurance policies require that you talk to your insurance carrier not only about a potential settlement, but also before even entering into a negotiation for settlements.

Negotiations

The settlement process has a lot of complexity all by itself. There will be some amount of direct negotiation between the plaintiff lawyers and defense lawyers.

One of the reasons to work with experienced defense attorneys is that they often know the plaintiff attorneys very well. These attorneys are able to get better outcomes more quickly than if they didn’t have these relationships.

One of the points of negotiation is likely to be who will be a settlement negotiation mediator acceptable to all parties. Your insurance carrier is one of the parties that must find the mediator acceptable.

Mediation

Mediation day is a big day. Participating will be not only the lawyers for the defense and lawyers for the plaintiff, but also representatives from the insurance carriers (and the carriers’ lawyers), either in the room or available by phone.

Part of what the insurance broker and defense counsel does in order to prepare for the mediation day is to ensure that there is a shared understanding of the total amount of insurance company money that the carriers have authorized defense counsel to use for settlement.

All carriers are going to be thoughtful about how much money they are willing to provide given what is a reasonable settlement based on the facts of your particular case.

Part of the reason to work with an experienced insurance broker is that they have the ability to assist defense counsel in working with the carriers to get to the right number.

Sometimes you can have a really good day at a mediation and everything gets settled on that day. Alternatively, you may have a multiday situation where it takes repeated tries to come to a settlement.

Ultimately, most of the cases settle. No one wants to go to trial: trials are very expensive and the outcome is uncertain.

The Settlement

At this point, you’re almost done. A few more things have to happen …

The first thing is finalizing the terms of the settlement with the other side. The negotiation of this paperwork can be significant, and it all has to be approved by the court in multiple stages.

In addition, there is also the process of negotiating the paperwork from the insurer that supports their final payment of the settlement. This is something that you would typically look to your defense counsel to handle, though defense counsel may call on your broker for assistance.

One of the issues that can arise is whether you will give your carrier a release for all future claims against the policy limit. You generally never want to give a carrier a full release of a limit when, in fact, they didn’t pay the full amount of their limit.

There could be an occasion in the future in which you’ll wish you had the rest of this limit, for example, if there is future litigation that somehow relates back to the litigation being settled in the near term.

Class Actions: Understanding the Trends

There have been efforts to reform securities class action suits in the past. Despite some worthy attempts, these past efforts have not eliminated all the frivolous suits.

In a future post, I’ll tackle some additional important topics when it comes to understanding securities class actions, including third-party litigation funding and the proposed securities class action reform.

Author

Table of Contents