Blog

Traveling in the COVID-19 Era: What You Need to Know About Travel Insurance

Travel is one of the many aspects of our lives that have been altered by the pandemic. In recent months, due to the spread of the novel coronavirus, we have had to cancel or postpone everything from business meetings to family reunions and transatlantic flights to summer road trips.

A study by Temple University found that 58% of Americans feel that travel insurance is "more necessary" than it was before COVID-19. The travel insurance industry is adapting to meet the changing needs of travelers. New coverages exist, and new exclusions and deletions are popping up. In this insight, we will examine what travel insurance covers, and, even more importantly, what it may not cover.

Here are some of the common risks that can be mitigated by purchasing specialty travel related insurance. These coverages can be structured in various ways to protect the entire family, or an individual, at reasonable prices.

Medical Care or Evacuation While Traveling

Medical emergencies can arise at any time, whether due to a prior condition, sudden illness, or injury. Some statistics show that nearly one in 30 trips results in some sort of medical emergency. However, having access to quality medical care while traveling abroad requires prior planning.

Consider this scenario: While exploring in a remote area of the Mexican Baja on a once-in-a-lifetime excursion, your spouse experiences a rapid onset of severe chest pain and develops a high fever. The closest medical facility is a one-room clinic, and there is a severe language barrier between you and the staff. How can you be certain you will be afforded a high level of care? Is there an alternative that will allow you to see a specialized physician back home?

Depending on your specific situation, there are policies that can provide round-the-clock medical assistance and evacuation services, transitioning your emergency care to state-of-the-art equipment and doctors back in the US. There are also medical transport and travel security membership programs for travelers who are frequently abroad.

If Your Trip Is Canceled or Interrupted by Coronavirus

Weather, terrorism, employment, medical emergency, and an uncertainty caused by the COVID-19 pandemic are all reasons that trips may be postponed or cancelled.

A hypothetical scenario could be that to celebrate your mother's 75th birthday, you plan a long-postponed tour of Italy. Three days before the planned departure, you become ill and must be quarantined in the US. You must cancel the trip. How can you recoup the nonrefundable costs you have incurred?

With the right trip interruption coverage, you can rest assured that your travel costs will be reimbursed. In this line of insurance, many options exist. As always, make sure you have a good understanding of what is and what is not covered. You may purchase trip cancelation insurance as a separate policy, or you may have coverage as part of your credit card or another membership-related plan.

Coronavirus Spreads the Unexpected: Trip Delay/Baggage Issues

Flight delays cause many travelers to miss connecting flights, cruise departures, and lost or delayed baggage can create unanticipated expenses and heartache.

For example: You arrive in Hawaii for a second honeymoon, but your luggage does not. What are some solutions to cover your immediate expenses if the luggage is delayed for a day or two, missing for an extended period, or stolen?

Rather than relying on the airlines to reimburse you, purchasing a trip delay and baggage insurance policy is a simple choice. Specialty policies offer the most robust coverage options, but some credit card companies also provide a basic level of reimbursement for lost baggage. Keep in mind that most credit card provisions do not reimburse for baggage delays when you are returning to your primary destination.

Credit Card Travel Insurance Versus Stand-Alone Policies

While travel-related insurance services are a perk of some credit card memberships, be sure to check your terms and conditions prior to your trip. Many credit card companies have eliminated some of their travel coverage provisions due to the pandemic.

You will gain the most robust coverage with stand-alone policies from reputable carriers. Stand-alone travel insurance policies are traditionally primary, making your credit card trip cancellation and interruption coverage secondary. That means your credit card will cover whatever costs your independent travel insurance does not cover

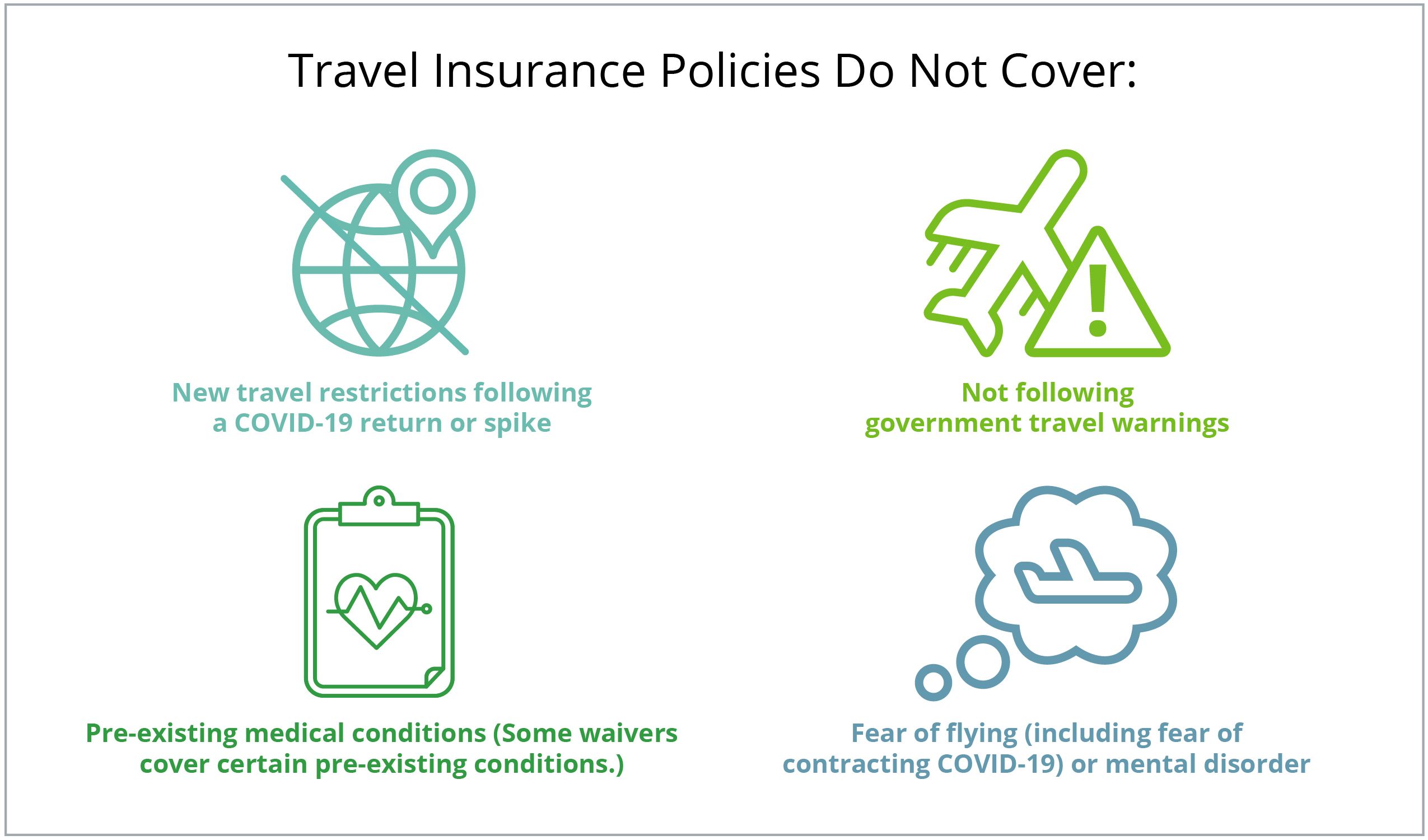

Prior to 2020, most travelers did not consider infectious outbreaks when they made their plans. The pandemic has changed that. Be sure to read the fine-print of your policy carefully.

In 2018, consumers spent almost $3.8 billion on travel insurance, according to the US Travel Insurance Association, up 40% from 2016. Those policies covered more than 65 million people, and 90% of them included trip interruption and cancellation coverage.

The typical travel insurance policy costs between 4–10% of the cost of your trip, according to InsureMyTrip.com. If you are going to be traveling frequently, you may be better served by an annual policy that can be structured for families and based on the estimated number of trips in a year. Cancel-for-any reason policies, which typically allow you to cancel your trip up to 48 hours before your scheduled departure, are typically more expensive.

How will the travel industry continue to respond to the new COVID-19 reality? Providers are developing policies to offer coverage for some of the impacts of a future pandemic. However, it is too early to know what these policies will look like or how much they might cost. Having a seasoned expert on your side can also help you reduce and insure your risk.

Woodruff Sawyer's dedicated private client practice will continue to keep you updated on this evolving pandemic situation. Whether you are anxious to reschedule that vacation or needing to travel for business again, we always wish you safe travels.

COVID-19 continues to evolve quickly, impacting businesses and personal lives alike. Woodruff Sawyer has established the Coronavirus Resource Center to provide guidance and answer your pressing questions related to risk mitigation and insurance.

Author

Table of Contents