Blog

An Avalanche of SPAC M&A Deals Predicted for Q1 of 2021: Lawsuits Certain to Follow

A portion of this article was published in ABA’s Business Law Today Month-in-Brief

As of December 21, 2020, 15 SPAC business combinations were announced and eight closed in December of 2020, including Trine Acquisition Corp.'s $580 million merger with Desktop Metal, Inc., a technology company that designs and markets 3D printing systems. Considering the record-breaking number of SPACs that have gone public via an IPO in the second half of 2020, with 53 completing an IPO in October alone, the pipeline for SPAC mergers is bound to break records in the first and second quarters of 2021.

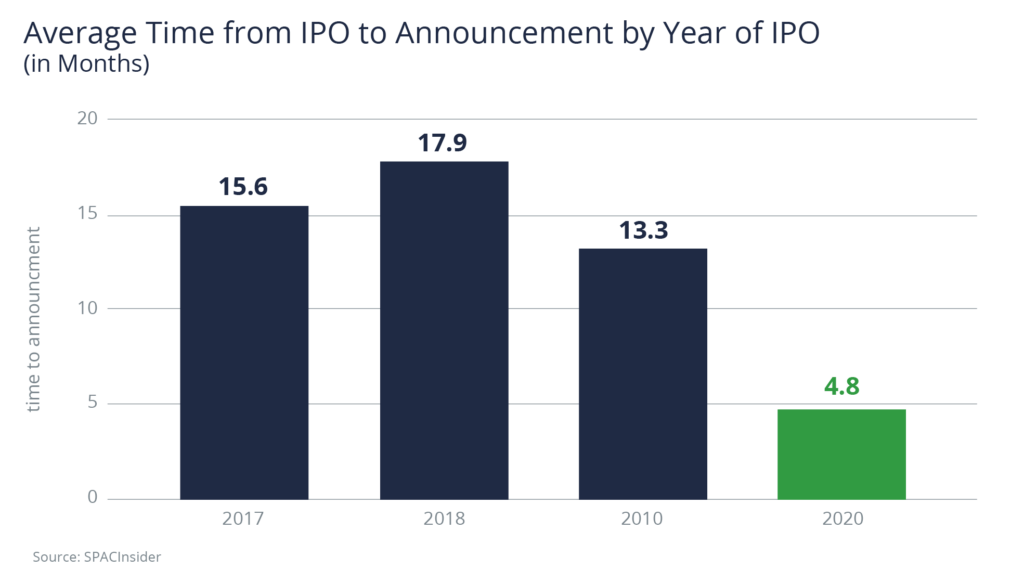

According to SPACInsider.com, SPAC teams that completed their IPOs in 2020 took a much shorter time to announce a deal (4.8 months on average) than teams that completed IPOs in previous years.

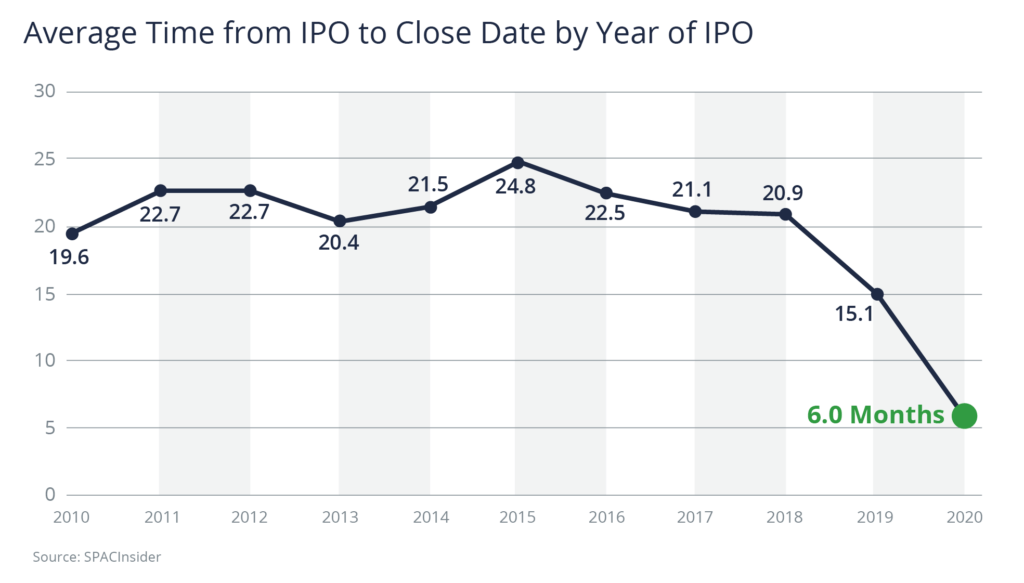

Time from IPO to closing the deal has gone down dramatically as well. It is now averaging about six months, down from about two years in the previous years.

But what is even more interesting is that a new, more sophisticated, nimbler, and faster breed of SPACs seems to have emerged in the second half of 2020. SPACs that completed an IPO in the second half of 2020 are taking about three months to announce deals. This considerably faster timeline, coupled with lightning-fast closing times, has led some, including the plaintiffs' bar, to start questioning the thoroughness of the diligence being conducted by the SPAC teams and the extent of the disclosure in their SEC filings.

The Trine/DeskMetal announcement, for example, prompted two lawsuits to be filed in the United States District Court for the Southern District of New York following Desktop Metal's filing of the proxy statement/consent solicitation statement/prospectus with the SEC. Both cases, Waqqad v. Trine Acquisition Corp., et al., No. 1:20-cv-10056, filed on December 1, 2020; and Peay v. Trine Acquisition Corp. et al., No. 1:20-cv-10137, filed on December 2, 2020 made similar allegations of insufficient information disclosed to the shareholders. Desktop Metal's 8-K states that the company believes these actions to be without merit and that no supplemental disclosures were required. However, in an attempt to declaw the litigation, Trine and Desktop Metal made additional disclosures in the 8-K to supplement the disclosure in their proxy statement and to address information called for in the lawsuits.

Notably, other lawsuits brought against SPAC-driven business combinations involved allegations of SPACs rushing to close deals days ahead of their quickly expiring deadlines in an effort to avoid having to liquidate the SPAC and return SPAC capital to investors. Those lawsuits contented that the SPAC sponsor team's incentive to close on any business combination rather than having to liquidate the SPAC, and the resulting lack of proper or rushed due diligence process, led to failed or wildly disadvantageous transactions and losses for investors.

With the latest trend of shortened search periods for SPACs, quick deal announcements and equally quick closings, the argument that SPAC sponsor teams were pressured to close on a bad deal falls away, but the claim that insufficient diligence was conducted and that there were holes in public disclosure, which could have led to investor losses, may continue to stick. One thing is almost certain, with the sheer numbers of SPACs aiming to announce and close deals in Q1 and Q2 of 2021, we will be seeing more lawsuits, meritless or not, being brought against SPACs in 2021.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents