Guide

Guide to Representations & Warranties Insurance

As representations and warranties (R&W) insurance becomes increasingly mainstream, get this comprehensive look at this facet of coverage.

Over the past decade, representations and warranties insurance (RWI or R&W) has become an established tool in the merger and acquisition (M&A) toolbox for both private equity and strategic buyers. In fact, RWI is used in an estimated 75% of private equity transactions and 64% of larger strategic acquisitions.

We have good news for buyers: Broad coverage and competitive pricing are the keywords for RWI in 2023.

Learn more in Woodruff Sawyer’s updated Guide for this evolving coverage.

Read the full Guide to R&W Insurance

What Is Reps & Warranties Insurance?

R&W insurance is a breach-of-contract coverage designed to enhance or replace the indemnification given by the seller to the buyer. In short, R&W covers loss caused by any breaches of the seller’s representations, whether it involves issues with their customer contracts, employment agreements, or the secret recipe of their product (i.e., intellectual property or IP).

The indemnity package is usually the most contentious part of any merger or acquisition negotiation. R&W steps in to eliminate contention and provide everyone with a cleaner, faster, and safer deal.

The RWI Underwriting Market Has Grown Significantly

The RWI underwriting market has grown substantially in the last two years. It was not too long ago that there were only three or four markets writing this type of risk. By mid-2023, there were 26 markets, with one new market already this year and two new markets last year. We believe this growth will level off, but there is certainly a thriving and competitive marketplace.

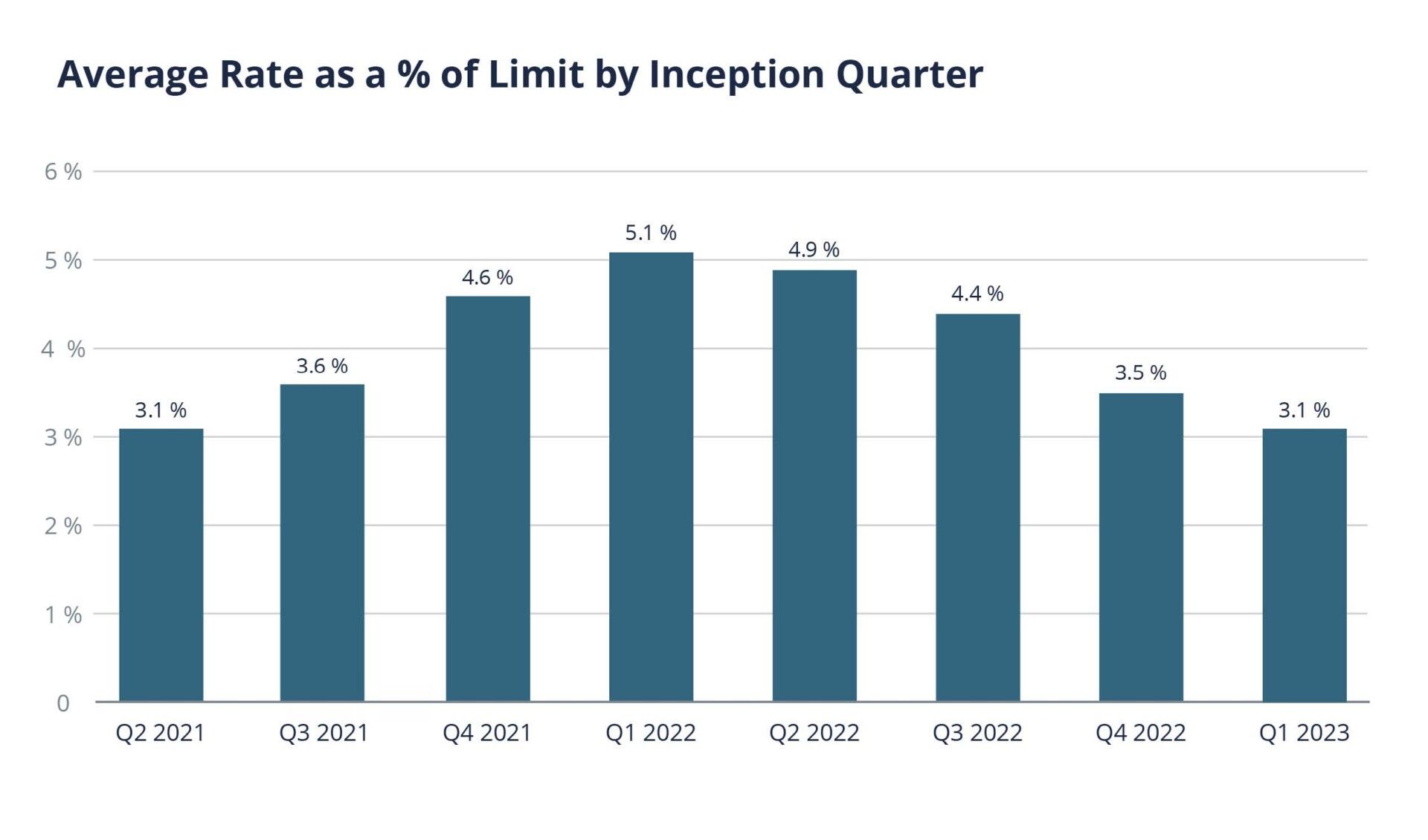

Changes in Premiums From 2022 to 2023

The changes we saw at the end of last year are eroding further as 2023 progresses. As of June, standard rates are now running 2%–3% of the limit bought. (For analysis, read our blog post, M&A Insurance: 2023 First Quarter Roundup.)

We see this trend as very good news for our clients and those needing RWI. The average number of quotes went through the roof, and the premium prices are on par with the beginning of 2018, if not slightly more competitive.

The lowest quote we have seen so far this year is 2%, a return to 2018 in terms of pricing.

How Does Reps & Warranties Insurance Work?

The Typical Policyholder

While either buyer or seller can be insured, 97% of the policies placed are buy-side, protecting the buyer from any breaches of the seller’s representations. Here are five buy-side details:

- Buy-side policies have additional fraud coverage that sell-side policies can’t provide.

- The insured buyer can pick a coverage limit and survival period (i.e., the period for which the policy is in place) beyond what the seller is willing to give.

- With this coverage, the buyer can avoid suing their newly acquired management team. If any breaches or misrepresentations come up, they can go directly to the carrier.

- Buy-side policies allow the buyer to offer lower escrows or more competitive terms in an auction.

- The insurance can replace distressed company indemnification with A+ rated indemnification.

How Underwriters Assess M&A Risk

When drawing up the R&W policy, underwriters evaluate:

- The nature of the sale purchase agreement (SPA) terms and conditions

- The nature of the specific warranties being given in the context of the transaction

- The quality of the due diligence

Exclusions

While the insurance is designed to cover all warranties, certain exclusions are standard:

- Forward-looking warranties (sales projections, etc.)

- Purchase price adjustments

- The availability or usability of net operating losses or R&D tax credits

- Areas of coverage that are difficult to get, such as Foreign Corrupt Practices Act (FCPA) violations, union activity, underfunding of pensions, wage and hour violations, etc.

- Known issues

Placement Process and Timing

Placing R&W coverage is a two-part process:

- The initial non-binding indication occurs one week after receiving the target financials, draft sale and purchase agreement, and any information memorandum that has been prepared by the seller. Underwriters provide initial indications on premium, retention, areas of concern, or heightened risk. This costs nothing.

- Underwriting requires a $30,000–$45,000 up-front “diligence fee.” Underwriters and their counsel are granted access to the data room and begin reviewing the diligence reports and the disclosure schedules. It involves a two- to three-hour diligence call with underwriters, deal team members, and third-party diligence providers. Twenty-four hours after the call, underwriters provide a draft policy and follow-up questions, if any.

How Pricing Is Determined

The policy retention or deductible is expressed as a percentage of overall transaction size. The minimum for mid-size deals is 0.75% of the transaction.

For larger deals above $500 million in enterprise value (EV), it’s more common to see a 0.5% retention, which can be in the form of a seller’s escrow, the buyer’s deductible, or a combination of the two. A 0.75% retention drops down to 0.5% after 12 months, regardless of the size of the transaction. Those starting at 0.5% may not see a further drop.

Premium is expressed as a percentage of the limit of coverage bought and is not related to transaction size. As of June, premiums range from 2%–3% of the limitation of coverage. It’s worth noting that minimum premiums are running around $100,000 for ordinary deals with $3–$5 million of limits requested.

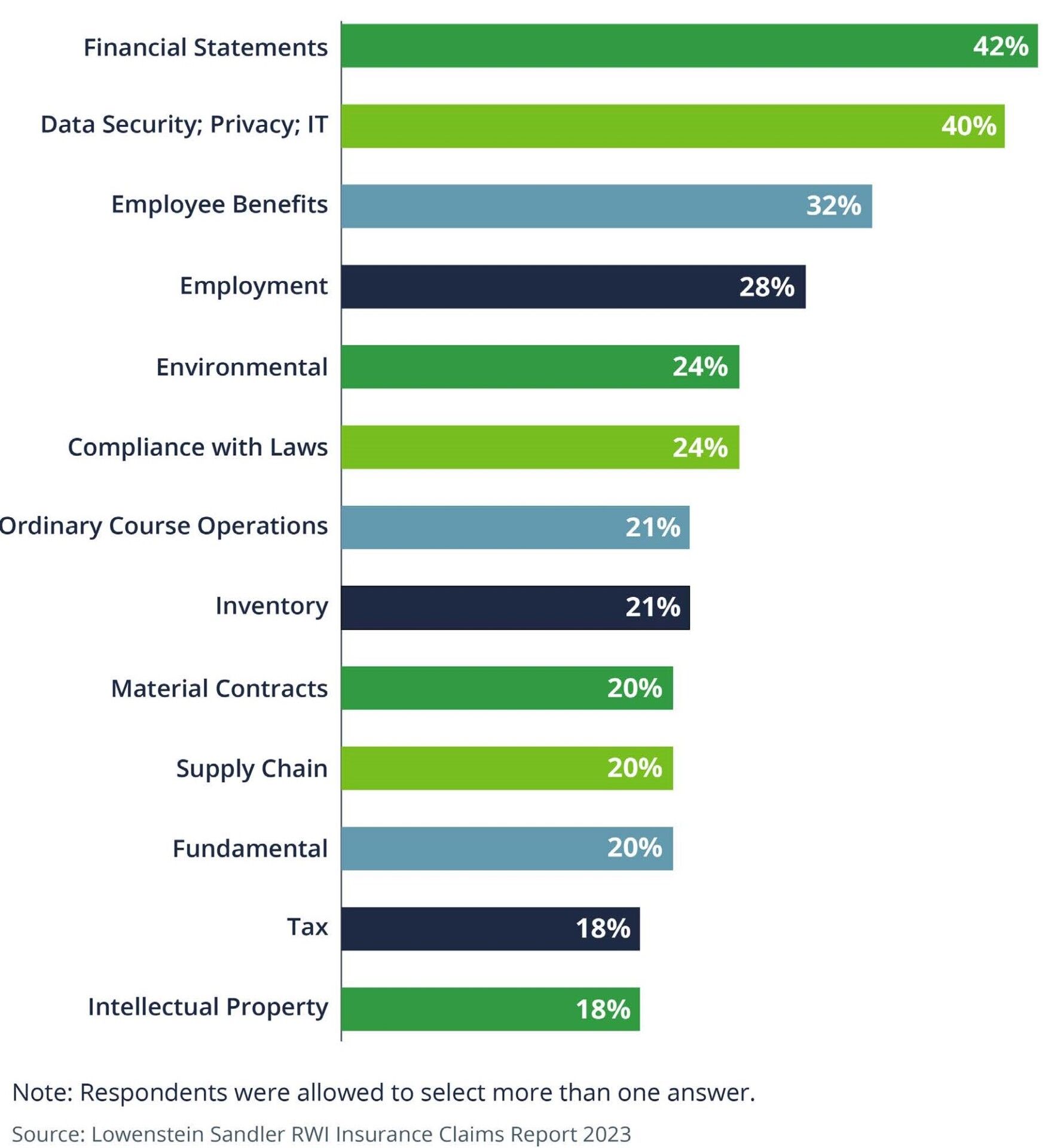

Claims Trends

Halfway through 2023, we've found the rate of claims has been relatively consistent with previous years, while the number of claims has increased. This increase is largely attributable to the surge of M&A activity in 2021. However, we have seen interesting shifts in claims, including:

- Claims are being noticed later than usual, between 12 and 18 months post-close.

- First-party, or indemnification, claims (where the insured brings a claim directly to the carrier) remain more common than third-party claims. However, third-party claims are on the rise for 2023 and will likely continue to uptick.

- Data security/privacy breach is a top RWI claim. Carriers are increasingly concerned about the adequacy of cyber coverage, and buyers should expect this to be an area of heightened diligence.

Find out more about RWI claims trends in an upcoming blog.

Choosing a Specialty Broker

R&W insurance is a complex and fast-growing marketplace. It requires a dedicated insurance broker who understands this type of coverage and is backed by the resources to handle all insurance lines and questions that come out of a transaction.

Woodruff Sawyer believes that clients are best served by a team dedicated to reps and warranties insurance, with access to broader resources that can review all your organization’s insurance needs and present a holistic solution.

Read the full guide for additional details about retentions, exclusions, program structure, and limits.

Author

Table of Contents