Blog

Understanding the Rising Tide of R&W Claims: A Mid-Year Review

Now that we are halfway through 2023, it’s a good time for a representations and warranties (R&W) claims trend update. Overall, the rate of claims has been relatively consistent with previous years, while the number of claims has increased.

This increase is largely attributable to the surge of mergers & acquisitions (M&A) activity in 2021. However, we have seen interesting shifts emerging in the timing of claims noticed, types of claims filed, and areas insurers will expect heightened diligence to be conducted in the future.

|

In Brief:

|

Insureds Are Noticing Claims Later

As a reminder, reps and warranties insurance policies are nonrenewable claims-made policies that have a six-year policy period. Historically, most claims have been noticed within the first year after binding. However, in 2022–2023, there was an increase in the number of claims noticed between 12 to 18 months post-close. Likewise, some carriers indicated a rise in claims noticed in the sixth year, post-signing, probably because policies bound in the years when the first significant increased use of the product are approaching their expiration dates.

Financial and Material Contracts Claims Are Costly

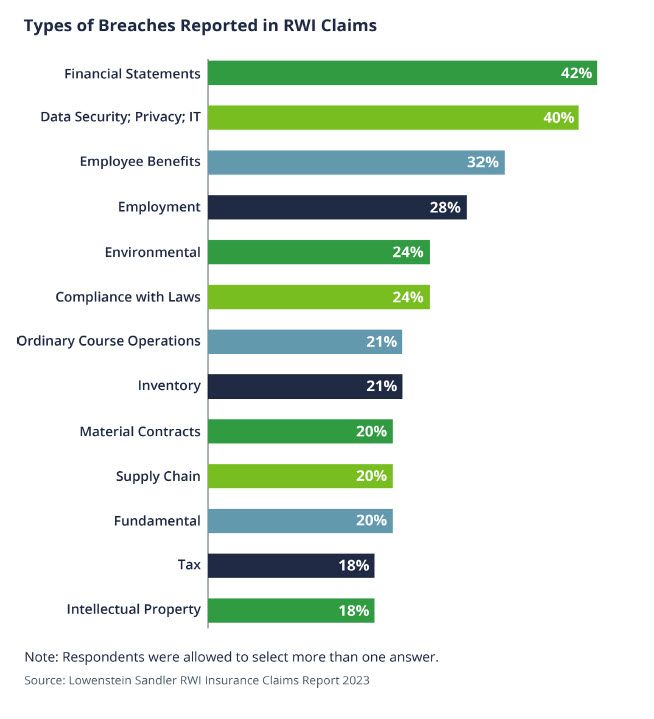

First-party, or indemnification, claims (where the insured brings a claim directly to the carrier) remain more common than third-party claims. However, third-party claims are on the rise for 2023 and likely will continue to uptick. Of the first-party claims most frequently cited, breaches of the financial and material contracts reps continue to involve the greatest potential for loss. These are the claims most likely to exceed the self-insured retention (SIR), which is the portion of cost the insured must bear before the R&W policy responds. Below are some instances and examples of these kinds of breaches.

Breach of the Financial Statements

Reps might state that financial statements must be true and correct and comply with generally accepted accounting principles (GAAP).

Woodruff Sawyer Example: A buyer purchased a chain of waste disposal and compost manufacturing facilities. The sellers indicated they had adequate insurance coverage. However, post-close, the buyer was informed that the target’s facilities were grossly underinsured, as the sellers manipulated their financials to obtain lower premiums. In response, the buyer obtained adequate property insurance with much higher limits and correspondingly higher premiums. Had the buyer been aware of the need to purchase higher limits, the additional cost of insurance would have materially lowered the purchase price. This client alleges a breach of financial statements and insurance representations.

Breach of the Material Contracts Rep

This could apply if a vendor is unable to provide its goods or services to the insured, and it affects the business’s ability to deliver its final product to customers.

Woodruff Sawyer Example: The target’s former VP of marketing underreported forecasted revenue in an effort to reduce oversight into his acquisition of contracts. This lack of oversight resulted in multiple breaches of contract, largely due to the target’s failure to obtain bank guaranties required to maintain contracts with numerous government partners. In the short term, the underreporting forced the target to pay much higher commissions to business partners than budgeted. In the long term, the breaches put the target at risk of losing contracts with both partners and clients due to supply chain disruptions. Our client, who acquired the Target alleges a breach of material contracts.

Expect Heightened Diligence for Cyber Policies

Data security/privacy breaches are almost as numerous as breaches of financial statements and material contracts. Carriers are increasingly concerned about the adequacy of cyber coverage, and buyers should expect insureds to require heightened diligence in this area.

As evidenced in our financial statements example above, it's crucial that buyers understand the far-reaching implications of insurance diligence. In the haste of M&A deal flow, buyers can neglect to conduct adequate insurance diligence on the target company. Likewise, many purchase agreements lack clear and concise insurance representations by the sellers. This can make filing a claim difficult to justify.

Here are some crucial questions for any buyer to ask before signing:

- Does the target company have an adequate insurance package?

- Do the limits available match up with the values reported by the company?

- How are these values being confirmed?

- Is the target company lacking any insurance product that an expert would consider necessary?

Given that RWI policies sit in excess of underlying insurance, an experienced broker can be of great value.

Carriers Are Seeing More Compliance with Laws Claims

Another notable trend is the high percentage of compliance with laws claims. While carriers have not yet compiled formal reports for 2023, they are consistently reporting an increase in compliance with laws claims.

One example is if the seller failed to obtain a needed permit before taking any actions that require one, such as new construction.

Woodruff Sawyer Example: The insured discovered that a plaintiff filed suit against the target, a debt collection platform, alleging non-compliance with several state laws, including laws regarding fair debt collection, fair business practice, tort law, and elder abuse statutes. This client alleges the target did not comply with laws.

While compliance with laws is now one of the most numerous types of claims, the potential loss exposure is much less severe than with breaches of financial reps or material contracts. We are seeing most of these claims fall well within the SIR. However, while the claim usually falls within the retention, R&W policies have an aggregate retention, which is eroded by each covered claim. This means that while there is not likely to be a payout for a non-compliance breach, reporting these claims is still beneficial.

Insureds that bound policies in 2021/2022 and are submitting non-compliance claims may well be able to erode the SIR at an accelerated rate, still leaving plenty of years in which they can submit future claims and potentially attain a much quicker payout.

Condition of Assets Claims: A High Exposure to Loss

Similarly, 2023 has marked a significant increase in condition of assets claims. The rise in such claims is not yet a trend, but it is of particular interest to insurers given that these breaches have the potential for high exposure to loss. For example, if an expensive piece of equipment needs repair, the insured suffers the cost not only of the repair/replacement of the equipment but also of the reduction in operations while the equipment is unusable or faulty.

A condition of assets claim may not only involve the cost of the equipment, but also any ongoing costs associated with the loss of revenue. Energy and manufacturing sectors are at particular risk. This is therefore an area, especially in these sectors, where insurers will likely require the insured to conduct heightened diligence prior to closing in the future.

Retain Experts to Assist with Your Claim

Remember that R&W claims can take some time to resolve. These claims are complicated and often costly, and the carrier will have many questions for the insured and counsel to address before they can come to a conclusion and issue a payout.

Most of the time, experts are retained by both the insurer and the insured to assist in proving that a breach occurred and to calculate the damages sustained. It also is helpful to remember that if the insured were seeking to be made whole directly from the seller, it would not be any easier.

Contact your Woodruff Sawyer Transactional Risk Group and its claims specialists to learn more about claims trends and how they may affect your R&W insurance policy.

Authors

Table of Contents