Guide

Reps & Warranties Insurance: Our 2024 Guide

Representations and warranties insurance (RWI or R&W) is now an established component of the merger and acquisition (M&A) toolbox for both private equity and strategic buyers.

This coverage is used in about 75% of private equity transactions and 64% of larger strategic acquisitions.

Woodruff Sawyer’s Guide to Representations & Warranties Insurance 2024 Edition explores trends in this growing marketplace and offers insight and analysis.

Get instant access to the Guide now and continue reading for some highlights.

Why Is R&W Important?

R&W insurance is a breach-of-contract coverage designed to enhance or replace the indemnification given by the seller to the buyer. In other words, R&W covers loss caused by any breaches of the seller’s representations, whether it involves issues with their customer contracts, employment agreements, or intellectual property.

Broad coverage and competitive pricing have been the theme for 2024. Here are the top nine advantages of having R&W insurance.

- Quicker profits. R&W can reduce or remove escrow for an M&A transaction, allowing the seller to either reinvest, realize, or more quickly distribute the proceeds they receive.

- Less conflict. The indemnity package is usually the most contentious part of any merger or acquisition negotiation. R&W helps eliminate contention and provides everyone with a cleaner, faster, safer deal.

- More accountability. A seller who backs up their promises with an A+ rated policy removes the concern that an accountable party should pursue if/when a claim arises.

- Streamlined negotiations. Using insurance as a security backstop against any breaches or unforeseen costs often makes for a quick and easy negotiation process.

- Enhanced diligence. A team that provides an impartial review of previous due diligence is a valuable contributor to the process. This step can also potentially serve as a defense when other shareholders accuse a buyer of not doing adequate diligence.

- More choices. A buy-side policy allows the buyer to purchase a limit of their choosing without needing the seller to agree to the same amount of liability.

- Peace of mind. An R&W policy helps protect a less experienced buyer from what they don’t know about and can’t predict.

- Increased competitiveness. Increasingly, an offer to buy R&W is becoming table stakes in a transaction. A lack of understanding of the product could be costly for bidders.

- Post-close protection. A strong RWI policy with robust limits can be a bulwark against claims of inadequate diligence and give the buyer a chance to be made whole in the event of a problem arising post-close.

Current Market Insights

RWI underwriters are getting creative to remain competitive in a saturated market without simply dropping premium rates in a race to the bottom.

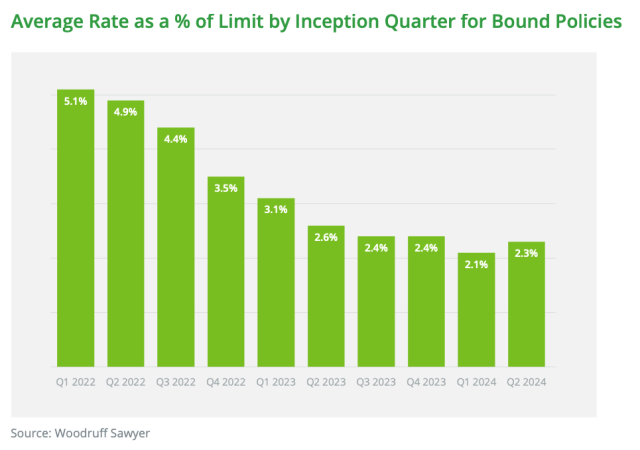

While premium rates remain at an all-time low, the market has found a floor at around 2%–2.5% (down from 3.5%–4% in 2022). However, new underwriters are still entering the market, so competition remains high.

There are currently 28 underwriters vying for your affection in the US market. On any given deal, we will receive, at a minimum, roughly 10 non-binding indication letters (NBILs). Often, the decision comes down to certain intangibles like previous experiences and longevity in the market.

What’s New in RWI

The use of a derivation of the traditional RWI product is growing in popularity for secondary transactions. These deals have proven useful to both limited partners (LPs) and general partners (GPs) who are looking to manage their portfolios during a stale or sluggish economic market.

GPs use secondaries to offer liquidity to their legacy fund investors while holding on to promising portfolio companies that need more time to mature. According to a recent report by Lazard, the estimated aggregate secondary deal volume in 2023 reached almost $110 billion, with GP-led deals taking almost 45% of the market share.

The number of carriers quoting these deals has increased over the last two years, with 10 to 15 quotes coming in for each transaction. There are fewer carriers with lengthy experience in this space, and some are only quoting excess coverage. However, many are getting more exposure to these kinds of deals, so we expect more carriers to become more knowledgeable in this kind of coverage.

Claims Trends

From mid-2020 through mid-2022, we saw a large uptick in the number of policies and limits bound, so it stands to reason that the number of R&W claims received by insurers has increased in the past year.

Statistically, claims are most likely to arise within the first 12 to 18 months after a policy is bound since the first audit cycle of the target company’s finances may bring to light certain breaches—leading to the current increase in claims.

The two largest categories in which claim payouts are (1) breaches of financial reps, and (2) customers and contracts. Those two categories account for almost two-thirds of claim payments, with compliance of laws coming in at a distant third.

Choosing a Specialty Broker

Although R&W insurance has existed in various forms for several years, we have seen a recent shift in its use and format. Four years ago, six long-term, stable markets wrote R&W in the US. Today, there are 26, and each market is different.

When picking an underwriter, terms and conditions and pricing matter, but so does the makeup of the team. Here are some questions to consider.

- Do they have insurance professionals as well as those with M&A experience?

- Does the underwriter manage a general agency? How long has it been underwriting?

- How committed is the underwriter to this space?

- How does the agency or underwriter handle claims, and what experience does it have with claims to date?

Woodruff Sawyer believes that clients are best served by a team that is dedicated to R&W and has access to broader resources that can review all your organization’s insurance needs and present a holistic solution.

As a complex, growing marketplace, R&W requires a dedicated insurance broker who understands this type of coverage and is backed by the resources to handle all insurance lines and questions that can arise during and after a transaction.

Read the full Guide for additional details about retentions, exclusions, program structure, and more.

Author

Table of Contents