Blog

SPACs: From Hot Mess to Cool as Cucumbers

As published in the American Bar Association’s Deal Points Newsletter of the Mergers & Acquisitions Committee, Volume XXVI, Issue 2, Spring 2021

SPACs have been a bit of a hot mess lately. Hot in that they’ve been the hottest thing to hit Wall Street this year. A mess in that the exuberance around them is yielding irrational investor behavior, resulting in Securities and Exchange Commission’s (SEC) scrutiny, and questionable business combinations, resulting in an influx of plaintiffs’ lawsuits. All this as already pointing to a looming market correction and will end in sad stories of dashed dreams and hefty legal settlements. As insurance brokers who specialize in SPAC IPO and De-SPAC transactions our job is to think about how to protect our clients from disaster and how to best minimize their pain. Some of the following pain minimization techniques through the use of insurance are worth considering for all participants in the SPAC market.

Directors’ and Officers’ (D&O) Insurance

The fact that a SPAC’s stock will be publicly traded after the IPO makes the SPAC’s management team and its directors and officers vulnerable to lawsuits from investors. SEC statements, enforcements and investigations aimed at SPACs are also becoming more frequent. SEC’s latest warnings, for example, focused on SPAC projections, accounting treatment of warrants and celebrity-backed SPACs, and its inquiries were addressed to several investment banks working on SPAC deals. D&O insurance, of course, is designed to mitigate risk from the outcomes of such actions that might fall on individual directors and officers and the companies they serve.

The interesting and often overlooked fact is that D&O insurance may not be able to respond in all situations and that other insurance products, like a representations and warranties (RWI) policy, may be able to cover risk areas where a D&O policy falls short.

Reps and warranties insurance is M&A transaction insurance that protects the insured against breaches of representations and warranties in a purchase or merger agreement. It gets triggered when the reps in the agreement prove to be incorrect. It is used widely in private company M&A and is a standard market risk mitigation tool in almost all private equity-backed deals and 50% of strategic deals.

In the SPAC world, RWI is becoming more popular as more PE-backed SPACs are entering the market. Some recent and known SPAC combinations that used a reps policy include the acquisition of Immunovant by Health Sciences Acquisitions Corporation and the acquisition of Virgin Galactic by Social Capital Hedosophia.

Common SPAC Litigation Scenarios

Let’s look at a few typical litigation areas for SPACs and see which scenarios would potentially be covered by a D&O policy and which would benefit from a combination of a D&O policy and an RWI policy.

- After the SPAC’s IPO, its shareholders can sue the SPAC and its Ds and Os for damages the shareholders incur due to material misstatements or omissions in the SPAC’s S-1 registration statement. This is a classic scenario for a D&O policy to cover.

- Between the announcement of the business combination an its closing, a SPAC’s shareholders may sure it for failing to make adequate disclosures in the proxy statement that it distributes to them to approve the deal. Shareholders could also bring a suit alleging that the SPAC team conducted shoddy due diligence as it evaluated the target thereby breaching the Ds’ and Os’ fiduciary duties. The SPAC and its Ds and Os, the combined entity and the target’s Ds and Os could also be sued for the same reasons after closing. The SPAC’s and the target’s D&O policies will be tasked with responding in these situations directly, but an RWI policy purchased by the SPAC ahead of the combination can also help. First, the use of an RWI policy creates a good argument against failure of fiduciary duty. Having a third party ratify and confirm one’s due diligence, which is a requirement in obtaining an RWI policy, could provide a firm defense of the Ds’ & Os’ position. Second, if there is a problem with the target the RWI could potentially make the SPAC whole, thus mitigating any loss of value.

- The SEC may investigate a SPAC and/or the combined entity and bring enforcement actions against their Ds & Os. In these scenarios the D&O policies would respond by covering the Ds and Os for the costs of SEC investigation.

- Plaintiffs can bring a securities class action against the newly combined public entity after the combination. This kind of a lawsuit is usually triggered by a significant drop in the price of the entity’s stock and is essentially the same kind of lawsuit that would be brought against any public company. This scenario would trigger a response by the combined entity’s D&O policy. Discovery of seller’s fraud, as we saw in the case of Akazoo for example, could be one of the reasons for a major stock drop. However, this kind of fraud could be rectified by a robust RWI policy and the existence of the RWI policy could avoid or mitigate a massive stock drop in the first place.

- Creditors of a company that becomes bankrupt after a business combination with a SPAC may sue the bankrupt company’s Ds & Os and even the original Ds & Os of the SPAC. A D&O policy would respond in this situation.

- The SPAC or its shareholders or the shareholders of the combined entity may bring a fraud claim against the target’s Ds and Os when the true value of the target is revealed to be dramatically lower than its projected valuation going into the business combination. While

the shareholders would not be able to recover under the D&O or the RWI

policy, the RWI policy may provide recovery to the SPAC and if that recovery is

substantial, it may make the need for recovery under the D&O policy

unnecessary.

How Do D&O and RWI Policies Respond in These Situations?

A well-designed combination of D&O policies for the SPAC, the combined entity and the target should respond to most of the above-mentioned scenarios. For scenarios two, four and six, however, having an RWI policy in place can bolster the defense against (1) allegations of breach of fiduciary duties by the Ds and Os and (2) allegations of incomplete or rushed due diligence.

The process behind obtaining an RWI policy helps. As part of that process, the underwriter hires its own counsel to review the diligence done by the SPAC’s team around the target’s financial conditions and business operations. The underwriter and their counsel typically specialize in the industry of the target and see dozens of similar kinds of acquisitions a year. Having access to all of these deals, they are able to quickly hone in on possible risk areas and areas where diligence is not done to market standard. Having this third-party additional set of eyes reviewing the SPAC team’s diligence and getting a thumbs up to proceed makes a very good case against allegations of insufficient diligence. And the additional effort the SPAC team puts into going through the underwriting process to obtain an RWI as well as the benefit of the coverage the RWI provides to cover costs of breached representations in the merger agreement may be used to counteract allegations of breaches of the SPAC team’s fiduciary duties.

Current Market Approach

More SPACs are folding RWI into their acquisition strategies. In 2020, out of about 65 De-SPACs, 10 used an RWI policy in their deals. With more PE-backed SPACs coming to market, SPAC use of reps and warranties insurance in 2021 is bound to increase. Serial SPACers are also discovering the benefits of an RWI policy in not only providing additional protection for the transaction, but for making the acquisition process smoother and more efficient.

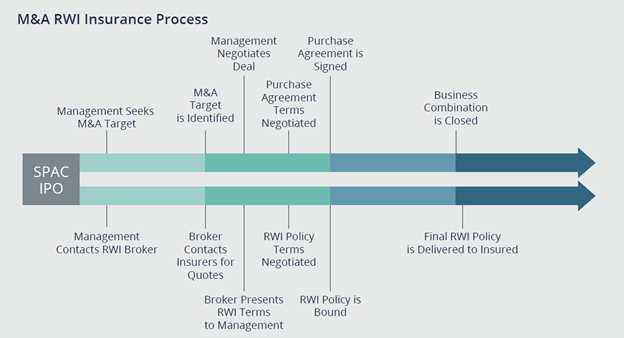

The good news is that while in early 2020 most RWI insurers were not familiar with SPACs, in 2021 they are becoming more comfortable with the SPAC structure and more willing to offer coverage. They also typically do not differentiate between a SPAC and a non-SPAC acquisition for a plain vanilla policy and a straight-forward merger. With over 20 insurers competing against each other in the RWI market, a good broker that specializes in SPAC RWI will be able to find several attractive options for coverage. An RWI policy can be placed fairly quickly and runs alongside the deal as is illustrated in the following diagram:

Opportunities for grievances and lawsuits against a SPAC, a SPAC-combined entity and their Ds and Os abound, and the creativity of the plaintiffs’ bar is being spurned by the extreme rush of activity in the SPAC market. Sometimes a D&O policy provides all the needed protection but sometimes a combination of a D&O policy with an RWI policy is a much better and effective alternative. While not a standalone protection against most typical SPAC litigation risks or an alternative to a D&O policy, an RWI policy could go a long way towards bolstering the SPAC’s defenses and minimizing damages for the SPAC’s sponsors, management, and shareholders.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Authors

Table of Contents