Report

Q1 2024 Commercial Insurance Market: Competitive Cyber and D&O, Higher Casualty Premiums, and More Capacity in Property

Commercial insurance pricing trends in the first quarter of 2024 followed many of the same patterns as last year. Insurance buyers can still expect competitive premiums in D&O and Cyber despite several insurers publicly saying they are practicing "pricing discipline." Insurers continue to be concerned about excess casualty. Although premium increases aren't extreme, excess casualty buyers should expect them.

We've noticed positive signs in the property market—additional capacity is having a positive effect on premiums. However, severe weather events throughout the nation and the National Oceanic and Atmospheric Administration's (NOAA) prediction of an "above-normal" Atlantic hurricane season this year are on everyone's minds.

In this Q1 2024 Commercial Lines Insurance Market Update, we review insurance rates and pricing trends in the D&O, cyber, casualty, and property segments. Read on for a summary of our key insights or download the full report below.

D&O Market: Competition Expected to Continue; Carriers Seek Price Discipline

With an oversupply of insurance capacity and few IPOs, insurers continue to compete for public directors and officers (D&O) renewal business, driving rates and retentions down for most companies. Loss costs are increasing for insurers and several market-leading carriers are seeking price discipline, but new capacity continues to put downward pressure on overall rates.

Some notable litigation statistics: In 2023, the annual aggregate settlement dollar amount paid out was the highest it has been in 10 years. The likelihood of a public company being sued is up in 2024, as it was in 2023, after years of downward trending since a record high of 5% in 2019.

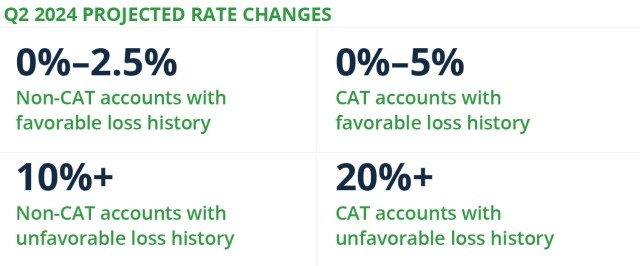

Property Market: Additional Capacity Leads to Softening Rates

The property market is in a transition period following last year's solid results. Increased supply continues to put downward pricing pressure, unlocking opportunities to leverage competition among carriers.

Carriers remain disciplined with risk quality, valuation, and CAT exposure as areas of focus. Wildfire risks and the predicted above-normal hurricane season are at the top of carriers' minds. Risk differentiation is crucial to achieving optimal outcomes, with a heightened focus on secondary CAT perils and exposure to severe convective storms.

Global conflict continues to result in regional capacity restrictions. While the conflict in the Middle East has resulted in capacity being withdrawn from that market, capacity is available, albeit pricing is expensive.

Cargo and Stock Throughput: Competition Positively Impacts Insureds

Restrictive underwriting guidelines have been lifted, and markets are now willing to consider challenging risks. While underwriting discipline prevails, clients are being afforded coverages previously denied during the hard market.

The conflicts in Eastern Europe and the Middle East are causing supply chain disruptions and re-routing of cargo shipments. As a result, requests for increased policy limits and enhanced, client-tailored coverages continue to be of vital importance to this market.

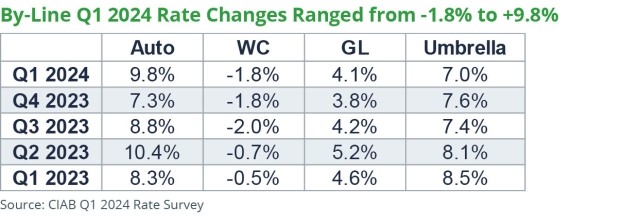

Casualty Market: Challenges Continue Amid Some Positive Signs

The casualty insurance market faces difficult conditions in 2024 despite positive signs for certain lines of coverage. Primary casualty insurers continue to seek rate increases on general liability (GL)/auto overall for the 26th consecutive quarter to keep up with loss trends.

High interest rates and insurer investment income are keeping workers' compensation (WC) competitive and profitable. Given its healthy capacity, the high excess market remains stable and competitive. Lead umbrella insurers continue with rate increases due to sustained large claim activity and limited competition.

Large verdicts and liability settlements continue to impact the market as carriers experience adverse development on historical claims. Legal system abuse, which includes things like litigation financing and creative plaintiff tactics, continue to put upward pressure on settlements as insurers rush larger payouts to avoid unpredictable juries.

Cyber Market: Increased Competition and More Frequent Attacks

Increased competition continues to drive lower pricing in the cyber market. However, cyberattacks are more frequent and more costly than ever. The level of underwriting scrutiny can vary significantly across different insurers, but it remains high.

Coverage restrictions remain for some in areas like non-breach privacy (GDPR, CCPA, BIPA) and “systemic risk,”, and there is significant focus on the application of the war exclusion for nation-state-backed cyberattacks.

Some other notable trends: Ransom claims activity set record highs in 2023—with both frequency and severity increasing to record levels. Insurance buyers must demonstrate proper controls around obtaining consent and providing adequate disclosure to obtain non-breach privacy coverage. And although artificial intelligence (AI) risk is a hot topic and can impact the severity of your loss, the use of AI is more of a privacy risk than a cyber risk.

For more insights into the insurance trends and pricing changes of Q1 2024, download your copy of the Commercial Lines Insurance Market Update.

Author

Table of Contents