Guide

Looking Ahead to 2025: Private Equity Risk and Insurance Trends

In last year's Looking Ahead Guide, we predicted the 2024 deal landscape would improve over 2023 year-end results in terms of number of closed buyout transactions, transaction values, and exits. This forecast proved accurate, as we see signs of an improving landscape after a stronger Q2.

However, there is still a long way to go for 2024 deal flow to reach the levels seen in 2021. The first two quarters of 2024 suggest we may be at the bottom of the downturn.

Looking forward to Q4 2024 and into 2025, we believe that while the deal landscape may continue to evolve and new structures develop, deal flow will increase compared to 1H 2024. We also think the private equity buyers will still look for ways to significantly improve each portfolio company operationally to improve EBITDA margins before taking the asset to market.

This article provides an overview of our Private Equity Looking Ahead to 2025 Guide. You can read the full report here. Plus, watch the Looking Ahead Guide webinar for more insights.

The Importance of Due Diligence

Insurance due diligence (including post-close diligence) will continue to be a critical workstream as deal teams and operating professionals seek ways to improve and maximize EBITDA margin and mitigate risk to their investment assets.

Insurance and employee benefits due diligence often takes a backseat to operational, legal, financial, or accounting diligence. However, acquirers and investors may leave themselves exposed to increased risks that could negatively impact EBITDA in the short term and diminish the long-term value of the asset.

We observe several trends are emerging in the middle market private equity deal landscape.

Focus on Value Creation

As deal flow remains below 2021 levels, private equity firms continue to put stronger efforts into improving operational efficiencies. With funds holding more assets for longer periods, portfolios are getting larger, and there is more time to positively impact EBITDA at an operational level.

This trend supports our belief that private equity professionals can increasingly focus on smaller (or larger) incremental ways to improve a company's margins. One of those ways is with business insurance and employee benefits programs.

Deal Structure

With the leveraged buyout (LBO) market facing uncertainty, private equity firms are looking to alternative deal structures to get deals across the finish line in 2024. So far this year, we have seen an uptick in add-on acquisitions, take-privates, and corporate carveouts/divestitures compared to 2023. Growth equity deals also continue to be an attractive way to put capital to work. Each of these transaction structures involves a different skill set in terms of insurance and employee benefits due diligence—as well as post-acquisition brokerage implementation strategy.

RWI Market

The representations and warranties (RWI) marketplace continues to see high levels of competition in 2024. We expect this activity to continue throughout 2025 as deal flow gains steam again.

However, despite the uptick in activity, pricing and retention remain at market-low levels, meaning the landscape may shift slightly as deal flow increases. We expect it to remain steady due to increased capital and new entrants in the market.

Fierce Competition in the Transactional Market

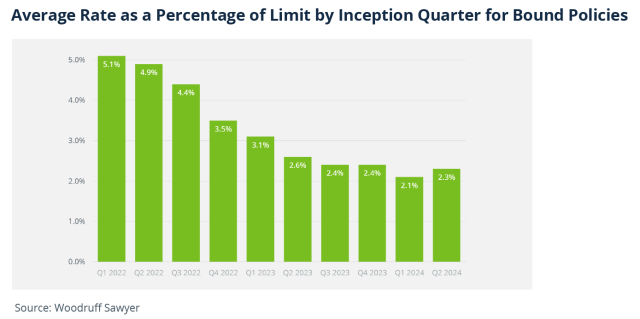

As the RWI market continues to adjust to reduced deal flow and smaller deal sizes, there is fierce competition from carriers. We're seeing rates dropping to between 1.9%–2.5% on average. This trend means that it's a good time to get RWI, especially for deals that underwriters historically have been more cautious about.

Here are the top transactional insurance trends we're watching.

RWI in Secondaries

The increase in the use of RWI for secondaries continues, and we don't see the trend changing. There is also an increase in so-called "hybrid" secondaries, where the secondary has a wider set of operational reps and warranties being added to the previously sought basic ones. We have seen substantial growth in market appetite for secondaries, and most will now offer coverage for excluded obligations.

Price Drops

The market continues to be highly competitive. While we thought pricing couldn't drop much more this year, it has, with offers of lower than 2% coming regularly.

Low Retentions

Downward pressure is still being applied to retentions as well. Last year, we saw 0.5%, but the retention rate didn't always drop after 12 months. Now we see 0.5%, with a drop as low as 0.1% after 12 months. Zero retention on true fundamentals is now the standard, rather than the new idea it was in 2023.

Claims Activity

We expected that an uptick in claims activity—a standard phenomenon across all insurance lines in a downturned economy—would cause more dissatisfaction with claims handling because insureds are making more speculative claims attempts. Some underwriters have started to push back on legitimate claims over minor technicalities, while others continue to be positive in handling claims. We expect this trend to impact how clients choose an underwriter.

Read the Guide and Watch the Webinar for More |

|

The Private Equity Looking Ahead to 2025 Guide covers pricing trends and much more. Get instant access to the full Guide here. Plus, watch the on-demand webinar, as our experts discuss what’s on the horizon in 2025 in terms of insurance and risk management for private equity firms and strategic acquirers. |

Authors

Table of Contents