Blog

Aggressive Growth in Reps Insurance – What It Means for You

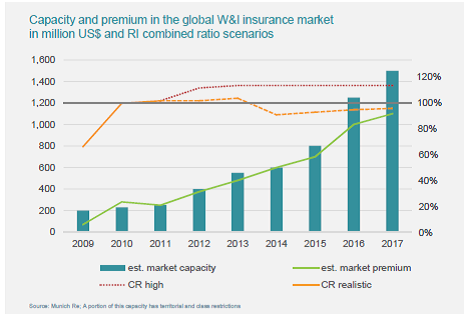

Reps and Warranties Insurance (RWI) has seen massive growth in the last three to four years. In fact, between 2011 and 2016 there has been a roughly 440% increase in submissions (Munich Re April 2017).

Growth has produced more choice and availability which drives innovation, price control and broadening coverage.

However, high growth also comes with growing pains. In today's post, I will advise you on how to get the best out of the changing situation.

New Underwriters & Brokers. How to Pick the Right One

A growing market has attracted many new entrants. Choice is good, but comes with lots of variability in quality on both the underwriting side and the broking side.

Questions to ask potential providers:

- How long have they been working in this sector?

The RWI product has been around for twenty years. It exploded about four years ago. We are seeing brokers and underwriters with less than two years of experience. Ten or more years would be best with less than five being positively dangerous.

- Do they understand your business and sector, or are they just M&A specialists?

Base wordings have been heavily negotiated for several years by the top law firms and brokers, so strong standards are place. The bigger issue is deal-specific exclusions. A deep understanding of the risks facing the industry that you and the target company are in is helpful in removing these exclusions. If you’re a parts manufacturer, a great tech broker may not be as useful as one with a lot of manufacturing experience. Also, look for a firm that is a full service broker with access to experts in all lines. While it’s necessary to work with a broker that does reps and warranties all day every day, they may have limited ability to help you if they can’t pick up the phone and connect with environmental, P&C or healthcare specialists.

- How long has the underwriter been writing?

Underwriters should be evaluated in the same way as brokers. Sometimes, a company has been in a sector a long time, but the people doing the underwriting have not or vice versa. Do your homework on the various teams involved.

- Will the provider still be around when you need them?

The cheapest provider is the one most likely to get burned and leave the sector. Not a problem for an annual policy but a policy that lasts six years needs an underwriter who will still be there for the duration.

How to Prepare for Rising Prices

While competition keeps prices low and broadens coverage, there comes a point where growth is unsustainable and prices rise.

How can you prepare?

- Be aware it's coming. If you’re thinking of using reps and warranties insurance, make sure you get up-to-date pricing data from your broker before you write that LOI.

- Think about minimizing the effect. Higher retentions have a big impact on premium. The market standard right now is 1% of transaction value but does it need to be that low for your deal?

- Keep competition working for you. There is a tendency once you’ve done a deal with a carrier to fall into the “better the devil I know” trap. Even if you have a preference, doing a thorough marketing exercise and nailing down your terms before going to legal review will ensure you are getting the best terms and pricing in a changing market.

In summation, this is a great time in the reps insurance market for innovation and growth. However, a hot market means someone is likely to get burned. Make sure it’s not you.

Author

Table of Contents