Blog

Automobile Insurance Rates are Rising

Commercial Automobile Liability is quickly becoming a challenge due to rising claims costs, stemming from heightened frequency and severity of losses. As a result, insurance carriers are analyzing auto exposures more closely and seeking higher rates across industries.

There are several factors contributing to rising claim costs and higher automobile losses

More traffic & inexperienced and/or distracted drivers:

- Cumulative miles driven in 2016 increased 5.6% compared to 2015, and continue to rise. In addition, less-experienced drivers are at the helm for a good portion of those miles.

- The qualified experience shortage of commercial drivers results in a limited selection pool. Drivers completing unfamiliar routes or lacking practice behind the wheel translates to more accidents.

- With the competition companies are facing for experienced drivers, there is a temptation to let risk management best practices slip, like proper driver screening and training.

- The increase in incidences has highlighted the proportion of distracted driving accidents. An estimated 25% of accidents involve drivers talking on a phone or texting.

- Because gas prices are low and employment rates are rising, more people are driving, and for longer distances.

Rising medical and automobile repair costs:

- Medical care costs are climbing more than 1.5 times faster than other costs. Changing physical medicine fee schedules in some states also drive up the costs. In California, for example, the increase in the cost of physical medicine from 2014 until now (2017), has increased by over 60%.

- Rising sales of new cars and trucks mean that when newer automobiles need servicing or repair, the costs are higher because these parts are more complicated to diagnose, fix, or repair. The largest repair costs come from replacing the computer technology that is common in newer vehicles, with garages struggling to obtain the special equipment and training required to perform the repairs.

Automobile Statistics

The Department of Labor statistics on automobile fatalities are showing increases:

- 50% of all traffic deaths occur within 25 miles of home under 40 mph.

- 33% of all traffic deaths are alcohol-related.

- Seat belts reduce serious and fatal injuries by 45-65%.

- Seat belts enhance survival by more than 50%.

- In San Francisco alone, 24 pedestrians and five cyclists were killed in 2015.

- Inattentive driving and/or excessive speed are often a root cause of rear-end accidents, and account for 30% of all collisions.

- A total of 38,300 people were killed in motor vehicle accidents in 2015, the highest since 2008.

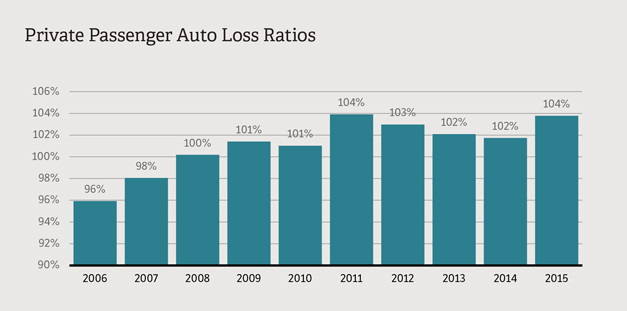

Source: NAIC data, sourced from S&P Market Intelligence, Insurance Information Institute

What can be done to mitigate these losses?

Automobile risk control measures are key in helping to reduce accidents:

- Implement a fleet safety program and follow proper fleet maintenance procedures.

- Enforce company policy for use of company vehicles including personal use limitations, who can use company vehicles, hours of operation, etc.

- Regularly check employees driving records and take appropriate action if driving records are not acceptable.

- Use telematics devices to monitor employee driving habits and usage of company vehicles.

- Provide driver safety training for employees. Important topics include defensive driving, distracted driving, speeding, DUI, need for rest breaks, what to do if the vehicle breaks down, etc.

Auto losses can cause disruption to your business through injured workers, damaged vehicles and equipment, and unnecessary distractions. Furthermore, such losses can impact other coverages outside of your auto policy, inclusive of Excess Liability and Workers Compensation. Raising awareness among your employees about the risks associated with operating vehicles and maintaining effective driver training can go a long way towards preventing auto accidents.

Though increased auto premiums and higher auto losses are becoming the norm, implementing sound risk management techniques can help you buck that trend and keep your firm running smoothly.

Table of Contents