Blog

Best Practices: Making Sense of the Commercial Property Claims Process

Whether it’s caused by nature, human or mechanical error, or an unfortunate combination of all three, property damage of any kind is stressful. You already know that prompt action can help mitigate any dangers to your employees and customers and minimize disruptions to your business.

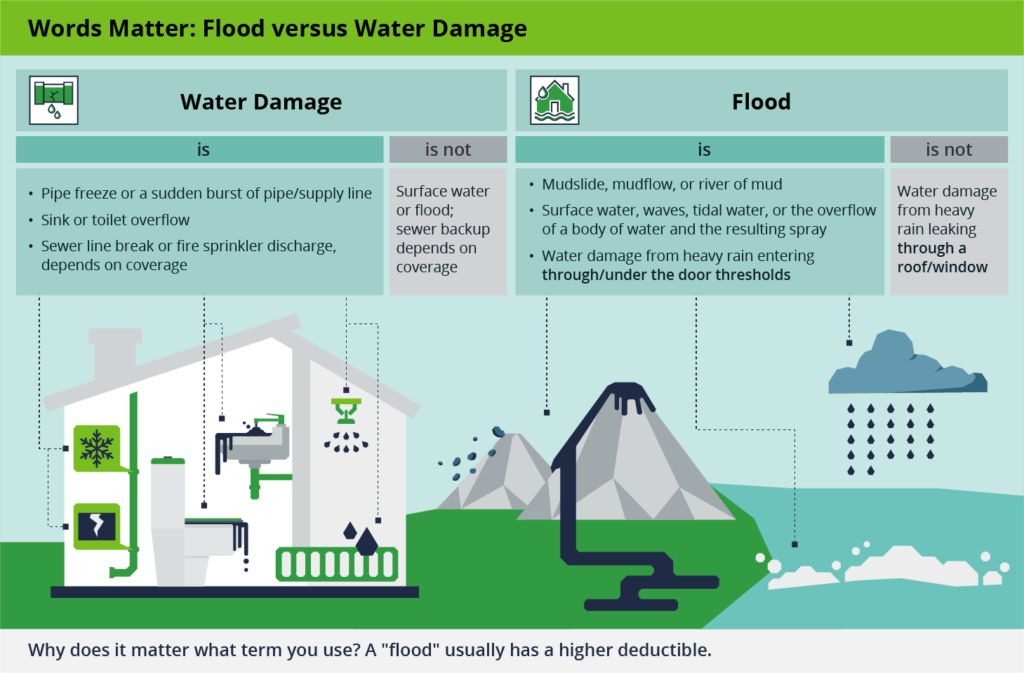

You probably also know that timely and effective reporting can ensure a smooth insurance claims process. However, insurance policies are complex legal contracts, and their language can be confusing. For example, policy terms and word definitions don’t always mean what they mean in everyday use.

We’ll walk you through the claims process, so you know what to do and when to do it if you need to file a property claim. Note that the claim investigation includes every communication. There are no “off the record" comments, so it’s important to engage your broker claim consultant in the beginning of the process to properly word your claim notice in alignment with policy coverages.

The Claims Process: 4 Steps to Take

1. Gather Information for Your Broker

Contact your broker as soon as possible after the incident, discussing and providing the following information:

- An inventory of all items that are damaged, including model/serial numbers, brands, age/condition of the items, original invoices, if available, and photographs

- Evidence of damage, including items that may have caused the loss, such as pipes, wires, water heater, HVAC unit, dishwasher, stove, etc.

- Photos or video of the damage and repairs

- Copy of your property lease (if applicable)

- Copies of any investigative reports (such as plumbing or fire reports)

- Copies of all receipts and invoices related to the damage

Keep in mind that you have a responsibility to protect all property from further damage. If you need to complete any repairs prior to inspection, notify your claim representative immediately. If someone is injured when the property damage occurred, render aid if appropriate and gather information about the parties injured and witnesses to relay to the adjuster.

2. Communicate with All Impacted Parties

Claims always go more smoothly when everyone has an opportunity to participate early in the decision-making process.

Throughout the entire process, you need to keep everyone affected by the incident informed of any progress, changes, and developments. In addition to your broker and insurer, reach out to board members, employees, property managers, landlords, and tenants.

3. Provide Information to the Claim Adjuster

We recommend your broker claim consultant participate in any calls with your claim adjuster. Your adjuster will investigate the cause and timing of the loss and review your policy to determine coverage.

Once there is confirmation of coverage for all or part of the claim, the adjuster will conduct an initial investigation/analysis of the damages. The investigations will be done concurrently; however, the coverage must first be confirmed before the adjuster will measure the value of the loss.

Submit your contractor or vendor estimates and invoices to the adjuster and claim consultant for their review. The adjuster may contact your contractor or vendor to discuss the scope of loss and pricing. If you don't have a contractor, your insurer or claim consultant may have a vendor network to assist you, and your claim consultant may also have resources to share.

4. Involve Your Claim Consultant in the Process

The adjuster may engage a “consultant contractor” to prepare a competitive bid. In this situation, we encourage you to bring your claim consultant into the discussions, as they tend to become technical on coverage matters and repair methodologies.

Another reason to involve your claim consultant is that many items on a claim are negotiable or are dependent on steps being completed before the full policy benefits are paid. For example, even though your policy states it pays “replacement costs,” the insurer may only pay the “actual cash value” (ACV) or “depreciated value/fair market value” initially until repairs are completed.

Many clients are unaware that the depreciation amount is negotiable. Your claim consultant does, and they can assist with interim submissions and requests for partial payments/advances along the way.

How Long Should You Wait Before Filing a Claim?

Some of our clients worry about waiting to file a claim, concerned that the insurer will think they are reporting a stale claim. You don’t have to wait to incur costs and obtain invoices before filing a claim, but you do need sufficient information.

Take emergency mitigation measures while you gather the information and decide whether to report the claim. Insurers don’t want to know about losses below the deductible, and some will not even set up a claim file nor assign an adjuster if the notice doesn’t have enough information.

Ask your emergency response vendor for an estimate of damage while they are onsite on the day of the incident. You can use this to make the decision about whether to report the claim in light of your deductible/retention, and if you do, you can send this estimate to the insurer.

How to Expedite the Property Claims Process

Insurers are currently experiencing a high volume of claims due to extreme weather events and staffing shortages. As a result, response times have been slower, and the property claims process is taking even longer than usual.

Therefore, following the steps in our loss guide, being organized in your submissions, and being strategic in your communications is more important than ever.

We encourage Woodruff Sawyer clients to report claims directly to our intake team through WS360, or you can email the following loss specifics to our claim intake team:

- Contact information for the risk manager/decision-maker

- Contact information for onsite property manager/employee who can escort the adjuster during the inspection

- Complete address of the loss site

- Date and brief description of loss

- Lease or contract copy (if applicable)

- Estimates or inventory list of damages

An experienced claim consultant will review your loss details and contact you to discuss how best to present the information to the adjuster. We can help you navigate through a simple or complex claim process, or coverage issues, providing coaching and advocacy from the initial reporting of the claim to final negotiations.

You’re not alone. The Woodruff Sawyer team will assist you with any claim so you can focus your time on what you do best—running your business.

Author

Table of Contents