Blog

Business Interruption Insurance: Planning for Disaster

Fire claims, water damage claims, and more frequent extreme weather-related disasters have made business interruption (BI) losses more common in the US and around the globe.

No one wants to think about a business interruption loss, let alone plan for it. However, fire claims, water damage claims, and more frequent extreme weather-related disasters have made business interruption (BI) losses more common in the US and around the globe.

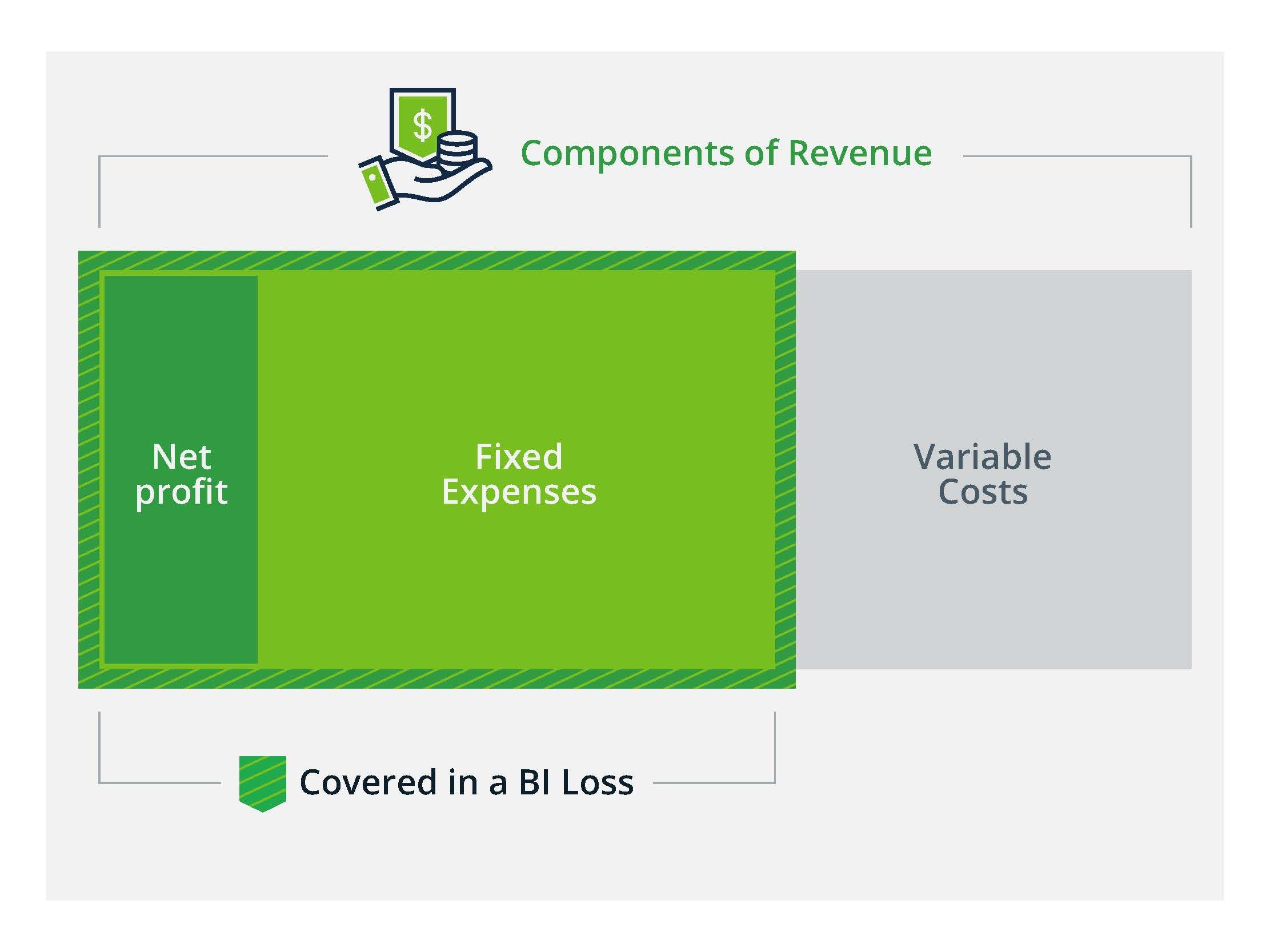

The good news is there is a way for businesses to recover their losses and move ahead. BI Insurance covers fixed expenses and lost profit while your business is recovering from a covered property loss, allowing you to continue paying, rent, utilities, payroll, taxes, and overhead expenses.

| A BI value is an estimate of the annual fixed expenses and profit that would be exposed following a covered property loss. Accurate BI values allow the insured to estimate the amount of coverage needed, allow underwriters to determine pricing, and give insurers confidence in your underwriting submission. |

If you overreport your BI, you'll have a premium overcharge. If you underreport, you could be underinsured. Maintaining accurate BI worksheets is the best approach to obtaining the appropriate amount of coverage.

This article provides an overview of what BI covers and offers a look at how the income statement (or profit and loss statement) relates to BI insurance coverage.

What Does Business Interruption Insurance Cover?

BI insurance helps pay for the actual financial losses sustained from direct physical loss or damage. A good rule of thumb is that BI values should approximate the gross profit/gross earnings on an income statement.

Gross earnings coverage is production-based coverage, most often used by manufacturing operations. It is based on sales that are lost due to downtime at business operations during the entire period up to the point at which full operation capabilities are restored.

Usually, there is no pre-set limit to the period of liability other than the time it takes to repair or rebuild a location. Therefore, an "extended period of liability" or "extended period of indemnity" only applies to gross earnings. The extended period of liability or extended period of indemnity covers loss when sales don’t immediately return to pre-loss levels after the location is returned to pre-loss operational status.

Gross profits coverage is a sales based coverage. This coverage is based on lost sales and pays for the period up to when pre-loss sales levels are restored. However, there typically is a 12-month time limit for the liability period, with no option for an extended period.

Some carriers provide business interruption coverage that allows insureds to choose between either gross earnings or gross profits coverage.

In addition to a business interruption loss, insureds may experience additional expenses during the course of a loss that are above and beyond their normal operating expenses. Coverage for these expenses can be captured under the "extra expense" sublimit in a property policy. Recoveries under the extra expense sublimit should be in addition to coverage provided under the business interruption limit.

Income Statement: A Basis for Your BI Worksheet

| The income statement (also known as the "statement of operations" or "profit and loss statement") is the source of information for a BI worksheet. The general format of an income statement closely matches the "subtraction method" of a BI worksheet (explained below). |

The income statement starts with revenues, then subtracts costs and expenses to end up with an overall profit or loss.

Expenses fall into two main categories, variable and fixed. (Some are mixed, but we'll keep it simple here.)

- Variable costs tend to fluctuate with revenue and would likely stop if operations were interrupted. The cost of goods sold (COGS) often represents most of the variable costs.

- Fixed expenses are not directly tied to revenue but are critical to maintaining operations. Research and development, general, and administrative expenses are mostly fixed.

Keep in mind that BI covers net profits and fixed expenses. It does not cover variable costs.

Two Methods for BI Worksheets

There are two main types of BI worksheet methods used to determine your BI value—the subtraction method and the build-up method.

As mentioned earlier, the subtraction method follows the format of an income statement. This method works well for manufacturers, retail organizations, and hospitals. It shows the following:

| Revenues – Cost of Sales = Gross Profit* *Fixed Expenses + Profit |

The build-up (addition) method works best for research and development and some technology firms. It shows the following:

| Continuing (Fixed) Expenses + Profit (if applicable) |

What About Payroll Coverage?

Paying your employees is a significant financial concern during a business interruption. Salaried employees are usually covered under the fixed expenses portion.

In contrast, ordinary payroll (OP) involves direct labor or hourly payroll directly involved with production or sales. Technology and life science companies typically have relatively low OP values, while hospitals and manufacturers usually have high OP values.

For BI insurance, companies have the option to purchase a year’s worth of OP coverage, partial OP coverage (such as 30 or 90 days), or no OP coverage. Labor contracts may dictate how much OP coverage the insured must purchase. OP coverage should include the cost of benefits as well as pay.

BI Values Are Complicated—We're Here to Help

There’s no getting around the fact that BI insurance is complicated. The recent increased focus on valuations has resulted in heightened scrutiny of BI values, particularly as the global interconnectivity of organizations increases.

You can rely on the specialists at Woodruff Sawyer for up-to-date information and advice on this essential coverage and how it relates to your business.

Table of Contents