Blog

Brokers: How to Build the Ultimate Deductible Workers' Compensation Program

How do you build a great deductible workers' compensation program? There are a number of components to consider, and each must be reviewed and negotiated to secure the best terms at the lowest price possible for clients.

This can be especially important when premiums are on the rise. Constructed well, a deductible workers' compensation program can provide a meaningful reduction in your clients' total cost of risk.

What Is a Deductible Workers' Compensation Program?

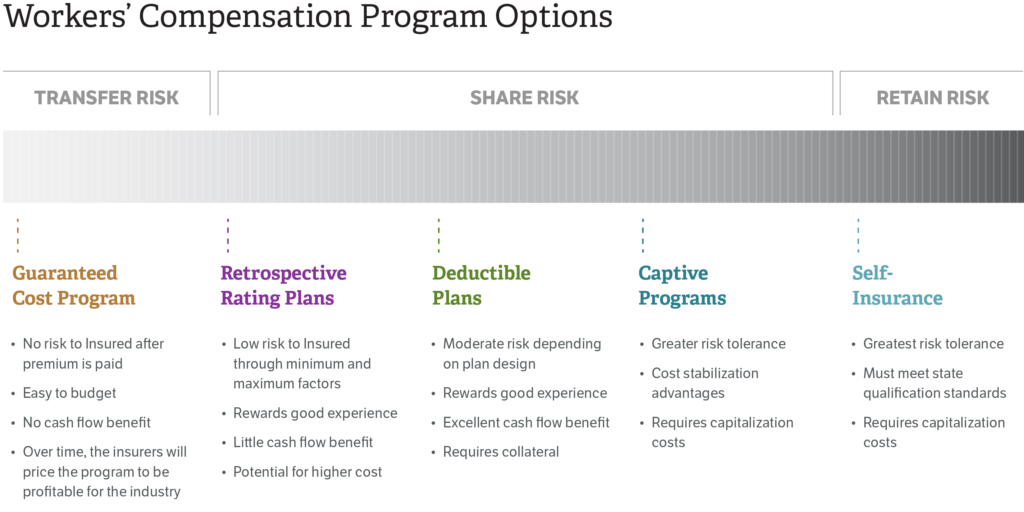

There are a wide range of workers' compensation programs out there designed to absorb or transfer risk to the business. On the spectrum, deductible workers' compensation programs are right in the middle, and share the risk between insurer and business. Simply put, an organization assumes a per-accident deductible and transfers the remainder of the risk to the carrier.

Just some of the benefits of this type of program are:

- Reduced premiums: The net rates (through applicable deductible credits) are significantly less than guaranteed cost plans and translate to a lower premium.

- Excellent cash flow benefits: the deductible plan allows insureds to hold cash until actual loss payments.

- Experience modification is a non-factor: The experience modification factor is no longer used in determining the premium.

- Additional flexibility for loss prevention: Customization of loss prevention services is available through carrier or outside vendor partner.

- More control in the claim settlement process: increased leverage in claim settlement decisions are realized as well as the ability to outsource and customize claims handling services.

This program is not for every business. There is moderate to high risk, depending on the deductible chosen. However, this shared risk program, when done well, can pay dividends for many types of businesses.

Five Key Areas to Negotiate

To get the most from this program, there are several components to consider and negotiate:

- Paid loss versus incurred loss programs

- Deductible levels

- Amount and type of security

- Options for claims handling

- Premiums

Let’s look at each of these in closer detail.

1. Paid Loss versus Incurred Loss Programs

In the paid loss option, companies are allowed to hold that money until the carrier actually pays the claim.

In an incurred loss program, the reimbursement bill will go to the client immediately after a claim reserve is posted.

Paid loss, for the most part, is preferred over the incurred loss option because clients are not paying too much into the program too early, allowing the business to enjoy present value cash benefits as well as increased cash flow.

2. Deductible Level

Choosing the right deductible depends on the individual business and its risk profile. Some companies may need a low deductible in the beginning until they get comfortable with how to prevent and manage claims.

We've seen several carriers offering deductibles as low as $10,000 to $100,000. In this case, you may not need to put up any collateral with the insurer.

On average, though, most carriers that deal with deductible workers' compensation programs offer the $250,000 to $500,000 deductible. That is what many of the mid-sized to larger companies are looking at. These companies can afford to take on more risk and can financially, as well as operationally, absorb more claims and losses.

3. Amounts and Type of Collateral

Another piece of the puzzle with choosing deductible levels is collateral. Carriers want to be sure claims get paid, so to mitigate their credit risk, they will estimate based on company financials, projected loss reimbursements and so on to determine that collateral figure.

There are generally three types of collateral companies can put up:

- Pre-funded, which means companies pay for the estimated liabilities on a monthly basis because it's built into the premium. In other words, this collateral method acts as a "working fund" to cover monthly reimbursements.

- Cash and/or securities deposit, which means the insurance carrier holds these funds/securities as collateral for the insured's claim obligations.

- A letter of credit, issued by a bank, typically a bank with which the insured has a relationship.

Of these options, most companies tend to go with a letter of credit; it's the least costly option.

It is important to keep in mind, however, that of all the members of the clients' management team, CFOs will likely have the most concerns. They understand the opportunity costs associated with letters of credit as they tie up available credit each year until fully funded.

Therefore, it is up to us as brokers to manage the interests of our clients by helping them weigh the above collateral options as well as negotiate the lowest collateral possible.

In order to secure the lowest collateral—run your own loss projection to determine what carriers should be requiring. Then, discuss in detail the creditworthiness of your client. Finally, if interested carriers require more explanation on the credit risk position of the company, bring the CFO in on a conversation with the insurer. This will maximize your chances for a successful outcome.

Employing any/all of these methods will assist greatly in making sure the collateral is at the lowest possible amount.

4. Claims Handling Costs

Another important consideration is the method by which carriers—or if unbundled, third-party administrator's (TPAs)—get paid for handling claims. The first is a percentage of the claim amount (also known as a loss conversion factor) whereby the insurer will add another 9%, for example, for handling that claim.

That percentage would not be for the life of the claim; it would be 9% every time they have to do something to the account. Keep in mind that if the claim went from $10,000 to $20,000, the bill for handling that claim also goes up.

These percentages can be negotiated and, as a broker, are part of getting the best deal for your client. Depending on the carrier/TPA, these charges range from a low of 9%t to a high of 11%. However, you might find the percentage model is not the way to go.

That brings us to the second way insureds get charged for claims handling. With the lifetime cost per claim, your client pays a one-time fee for the life of the claim.

We have found this to almost always be the most cost-effective for clients. Be sure to carefully review the quotes/agreements, however. Sometimes TPAs will attempt to limit the length of involvement to only a "life of this agreement" definition. Or, in other words, the life of the partnership.

Brokers should look to negotiate the cost per claim charge as well. These can range from $25 to $50 for first aid or incident reports; $125 to $165 for medical; and $1,250 to $1,900 for indemnity.

5. Premiums

Because there are big discounts on premiums for deductible workers' compensation programs, you cannot base commission percentages on premiums.

Instead, look at the number and complexity of claims these companies have, how much loss control assistance they need, as well as how much transactional servicing is required, and come up with a model that takes into account how many hours and people need to be dedicated to the client.

The next thing you will want to consider is if the premium will include an aggregate stop loss. An aggregate stop loss puts a cap on the deductible if there are multiple catastrophic claims. There is a price for this, and it will increase the premium the lower the aggregate chosen, so have both options ready.

Finally, you will want to put best practices in place to help control losses and premiums in the long run. This is where you need to know what the client is doing to prevent and manage claims.

For example, what are they doing once a claim comes in to get the employee back to work as quickly as possible? Do they have modified duty? Do they have a nurse on staff? If there are any opportunities to get claims closed as quickly as possible, you, as a broker, need to identify them.

From a pre-loss and a post-loss perspective, we want to make sure we put our best foot forward for our clients. Then we take that information to the carrier for credits to lower that premium.

Additional Considerations

In addition to the five key areas that brokers need to consider and negotiate, there are other factors to look at, like the:

- Revolving loss fund: Companies entering a deductible program need to set up a small loss fund for reimbursing carriers (typically $10,000 to $50,000) and it will always need to have that amount available.

- Medical cost containment charge: This is often a hidden piece of the allocated loss adjustment expense that can be negotiated. It represents the work the insurer's team does to negotiate medical bills down before they are settled. Usually insureds are charged a percentage of the savings (sometimes up to 25% of the savings), though you can sometimes negotiate a per bill fixed-dollar amount. If companies go through the carrier's PPO network, there will also be savings that companies will have to pay a percentage on, which can be negotiated down (15 percent is a fair deal).

- Number of loss control hours: You want to negotiate as many hours as possible with the insurer's loss control experts. These folks go on-site to pinpoint risky activities and ways to improve them. Some carriers will offer unlimited hours, while others may start with 25 or 50.

- Claims handling: Will the insurer handle claims in-house or will it be a third-party administrator? Preferably, third parties are the way to go, but not all carriers will offer that option. The advantage of a third party is that companies have more control over how the claim is handled.

- Claims reviews and Risk Management Information System (RMIS) access: These are important for insight into losses, where claims are at today, what is trending and how to get them closed quickly. Some insurers may only offer one review per year and some may charge for it. It's up to brokers to make sure claims reviews happen, clients have access to RMIS and the cost gets built into the premium.

Assembling an excellent deductible workers' compensation program takes time, effort and knowledge of all the intricate pieces of the puzzle. With the right approach, brokers can create an ideal program that is built for their clients' financial and risk profile while saving them money in the long run. For more information, reach out to your Woodruff Sawyer account team.

Table of Contents