Blog

Large Deductibles on Property Loss Claims: Understand Your Policy

The property insurance market continues to harden in response to more frequent and severe catastrophes. Not surprisingly, insurance carriers have responded to the new normal of more intense storm seasons and increased building costs by increasing premiums and moving toward larger deductibles.

While most property policies have a reasonable deductible for more frequent and less severe losses, we have observed in the last couple of years insurance carriers moving toward larger deductibles for catastrophic events such as floods, named windstorms, and earth movement. Insurers are moving to a percentage or large deductible for property losses and using the average daily value (ADV) as a measurement tool for business income/extra expense losses.

Clients with limited claims histories are sometimes surprised by a large and unexpected deductible. Understanding policy deductibles can help you prepare for catastrophic larger losses, and having the funds to pay for large deductibles is critical to your business's sustainability.

Interpreting these deductibles can be complicated. Here, we'll explain the types of property insurance deductibles and provide some examples and explanations of actual policy deductibles.

3 Types of Property Insurance Deductibles

Three types of deductibles commonly appear in commercial property policies.

Flat Deductible

Most commercial property policies include a flat (or straight) deductible. A flat deductible is a specified dollar amount that applies to each loss. It is subtracted from the amount of a covered loss, and the amount remaining is paid by the insurer.

Percentage Deductible

A percentage deductible often applies to perils that can cause catastrophic losses, such as an earthquake. When an earthquake is a covered peril and a loss occurs, the loss is typically reduced by a deductible that applies on a percentage basis. The deductible may be a percentage of the limit or the reported value of the damaged property.

Time Element Deductible

Most business income policy forms don't use a separate deductible for the property damage and business interruption/time element loss. However, we are starting to see a trend toward having a BI/time element "deductible” in addition to the property deductible on the same loss. The time element deductible can be a flat dollar amount, a percentage, a “waiting period” deductible, or be based on the ADV value (more on that below).

The insurer may also require that a “waiting period” must first be met for some causes of loss. This waiting period is the amount of time that must elapse before business interruption coverage begins. Depending on the policy, the first 24, 48, or 72 hours are not covered, while anything beyond that period may be a covered loss. Alternatively, coverage may extend retroactively to the initial time of loss, including the waiting period for some perils. For some policies, the “waiting period” does not apply for extra expense, so it’s important to review the definitions of policy terms.

Reading the policy clauses and interpreting them is tricky, and clients should collaborate with their claim consultant to understand their coverage.

| Learn more about property exposures, limits, and deductibles. Watch P&C 101: Property, Cargo & Stock Throughput. |

Water Loss and Flood Deductibles

Global warming and climate change have brought severe rainstorms and atmospheric rivers into the rain season in the past few years. These storms can result in both water damage claims and flood events. The cause of damage or loss may determine the deductible that is applied.

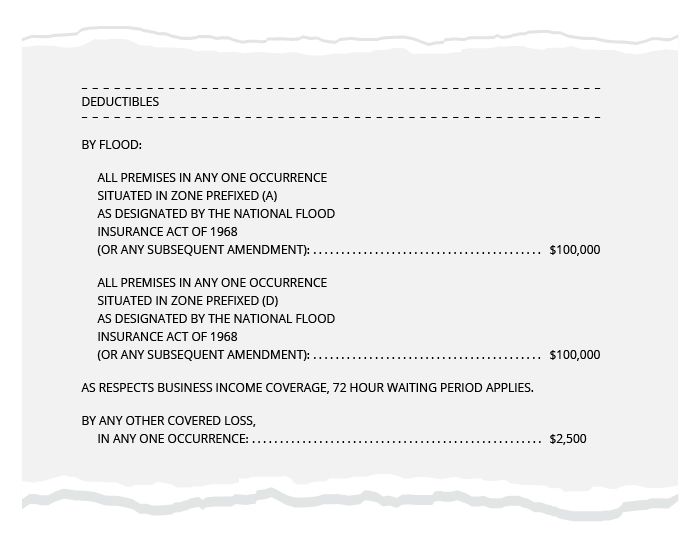

If a storm causes rainwater to enter through a hole in a roof or through a leaking or open window, the policy may provide coverage if it's not excluded. The deductible for this water damage claim, as an example, might be $2,500, as shown in the example policy below.

However, if the water damage is a result of heavy downpours that flood roads and streets, overwhelming storm drains and causing the water to enter through doorways, walls, and from the ground, this would be considered a flood and subject to a much higher deductible. In the example below, the policyholder would have a $100,000 flood deductible applied to the claim settlement.

Windstorm Deductibles

The last few years have continued to produce tornadoes, hurricanes, and strong windstorms. Major hurricanes are by far the world’s costliest natural weather disasters, in some cases causing well over $100 billion in damage. There’s now evidence that human-caused global warming is already making hurricanes stronger and more destructive. The latest research shows the trend is likely to continue if the climate continues to warm.

A windstorm that causes significant damage to a building and business property may result in percentage deductibles or a large deductible. The main factor driving deductible values for windstorms is location. Although wind and hail damage is a standard part of commercial property insurance coverage for much of the country, it's often excluded in coastal areas that are prone to hurricanes. In these areas, insurers may add a separate, higher deductible for wind and hail damage to compensate for the increased risk.

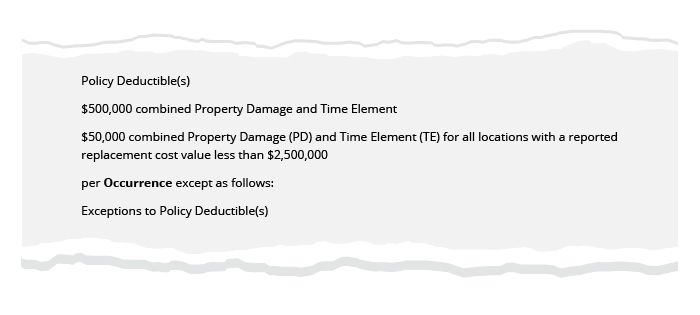

Below is an example of a large flat deductible. Note there is a much lower deductible for buildings with a lower replacement cost—deductibles may be structured this way to differentiate between offices and manufacturing sites.

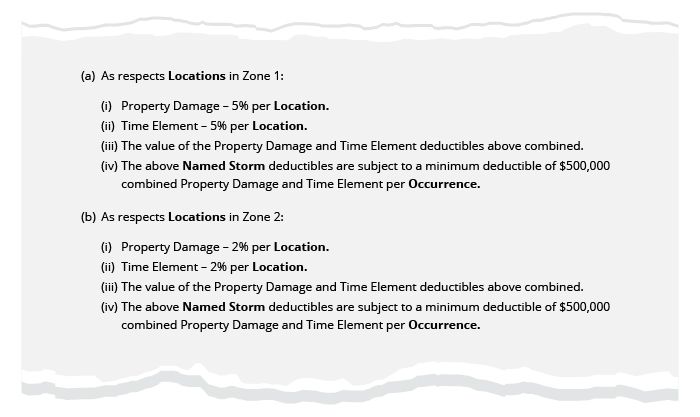

Percentage deductibles usually end up causing the insured to retain more of the loss. Whether your policy has a percentage or large flat deductible depends on how your policy is written as well as your carrier and loss history. Below is an example of a percentage deductible, showing the deductible is 2% or 5% of property loss cost per location (based on zoning), plus 2% or 5% for business interruption cost (time element) per location.

Earthquake/Earth Movement Deductibles

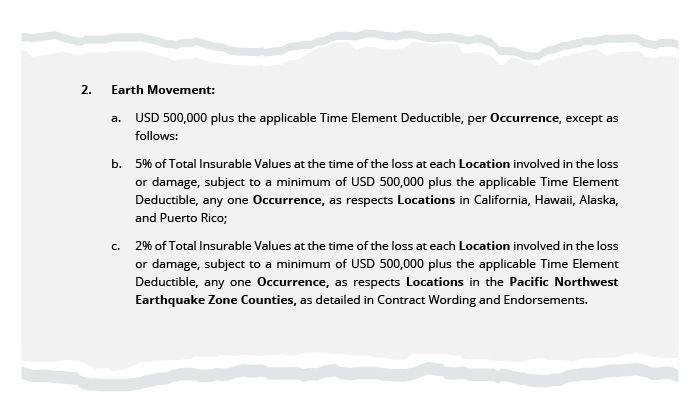

There has been more seismic activity in recent years causing property damage. Earthquake deductibles are normally higher than other policy deductibles due to the severity and catastrophic damages—insurers must account for higher damage costs. The deductible clause can include a few elements: a dollar amount, a percentage of total insurable value at the locations involved in loss or damage, and ADV for time element claims, with or without a waiting period.

ADV is the business income that would have been earned during the period of interruption if no loss had occurred. To get the ADV, divide the total loss amount by the number of working days in that period of restoration.

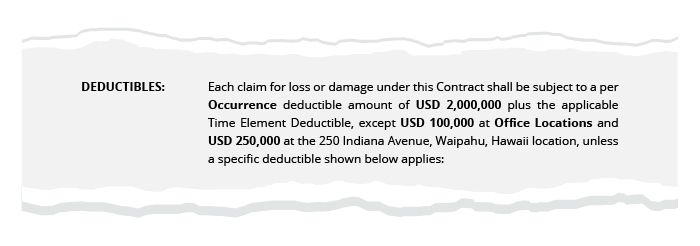

Below is an example of a flat deductible for an earthquake policy, showing a much higher deductible for production sites than office locations and other non-production sites.

The percentage deductible can vary based on location. In the example below, states and territories that have higher rates of earthquakes (California, Hawaii, Alaska, and Puerto Rico) have a higher deductible percentage.

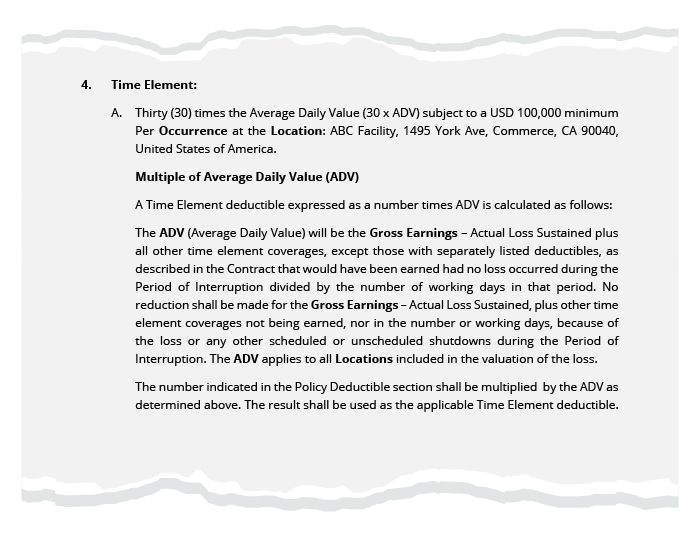

The time element deductible example below shows that the insured is responsible for 30 times the ADV (business income earned had no loss taken place). Larger companies with adequate funds may choose the higher 30X ADV to control premium costs.

Deductible Calculation Example: An Earthquake in California

Let's consider the following scenario and calculate the deductible using the policy example above.

A magnitude 6.2 earthquake occurs on the Mendocino Coast in California, affecting an insured business. Building damages amounts to $1.2 million, and operations shut down for two months due to loss of electricity, resulting in $650,000 in lost revenue.

Here's how we would determine the deductible using the earthquake policy examples above:

- Building/property damages: The deductible for a loss/occurrence is 5% of the insurable value (because it's in California) at each location, with a minimum of $500,000 . With a policy value of $30 million, the deductible is $1.5 million.

- Business interruption: The time element deductible is 30 times the ADV. Take the gross profits for the period of interruption and divide it by the number of days of interruption to arrive at ADV. In this case, the ADV is $10,833. Multiply this by 30 to get the total time element deductible of $325,000.

The occurrence deductible for the loss to the building/property damage is $1.5 million, and the time element deductible for the loss is $325,000, for a total sum deductible/retention by the insured of $1,825,000.

Note that these are general calculations, and the final calculations would need to be done by an accountant.

Review Your Property Insurance Deductibles

Work with your Woodruff Sawyer claim consultant to fully understand your policy. The examples above are specific ones, and ADVs and deductibles vary depending on the policy wording.

Contact your account team at least three months prior to a renewal to review deductibles and if necessary, make any changes needed. When you receive your new or renewal property policies, review the information with your account team and claims consultant. Talk through different scenarios so you understand how the policy may apply deductibles and how the out-of-pocket costs will impact your business.

We also suggest you prepare a business continuity plan. Review the plan yearly with your organization and with your Woodruff Sawyer account team. Being prepared for any of these larger or catastrophic losses will position your business to respond and continue operations while the claim is being investigated and evaluated for settlement.

In the event of a claim, your claim consultant will help you determine the best possible outcome based on your policy.

Author

Table of Contents