Blog

Thinking About Moving Your Corporation Across Borders? Here’s What You Need to Know to Manage Risk

If you’re thinking about moving your business internationally, you’re not alone. In 2015, Business Insider reported via Goldman Sachs that foreign sales drove 33 percent of aggregate revenue for the S&P 500 in 2014.

But it’s not without its risks, and that’s where your risk management comes in. Long before you open the door to the new office in a new country, there are some things to consider.

1. Knowing What Coverage You Need

From a risk management and compliance perspective, the first step is determining where you need insurance coverage.

Does the country you are entering dictate securing in-country D&O coverage for directors and officers? What about property, general liability, auto, employer liability or workers’ compensation? From an employee benefits perspective, how are your globally mobile employees covered?

The first step is to find out what is required of you in that country. That typically starts with identifying if you’ll have physical offices and/or if you will have local directors or officers.

You may be able to have a US-based foreign package policy, also called a “difference in conditions” policy that can cover employees globally, but understand that if it’s “non-admitted” coverage (written by an insurer that is not licensed nor registered in the country), it may not be compliant with the local laws.

Each country dictates where non-admitted is allowed with respect to each line of coverage. If the country requires locally admitted coverage, you will have to separately place a local policy within that country. In many instances, your US-based insurer can do this for you.

2. Managing Complex Insurance Programs Globally

A good broker with global expertise will know all the nuances of the country where you are legally required to place local insurance coverage.

For example, in some countries like India, they have a cash-before-cover approach where policies don’t go into effect until coverage is paid. Or in Canada, US policies cover a business operating there, but regulations require a local broker and insurer, or you could face a tax penalty.

Some brokers offer and are expert at global policy management for all countries in which you operate your business.

The logic is that it is always better to have centralized control and coordination of your program globally rather than different local brokers handling their piece with no coordination. Without the centralized control and coordination, there’s often duplication of coverage or coverage gaps.

3. Understanding Local Laws and Risks

To better manage risk, it’s important to be aware of the risks in the country to which you are expanding – some of which may not be obvious.

For example, the US enforces regulations under the Foreign Corrupt Practices Act (FCPA) for both private and public companies. Trends show some countries more than others are the recipient of government enforcement actions under FCPA, like Nigeria, China and Iraq.

And regulations aren’t always crystal clear. For example, my colleague Priya Huskins wrote about the United States v. Joel Esquenazi and Carlos Rodriguez case (an FCPA matter), where two U.S. businessmen had been convicted of bribing employees of a telecommunications company in Haiti (Telecommunications d’Haiti S.A.M. aka “Teleco”):

The defendants argued that bribing employees of Teleco was not an FCPA violation. However, the U.S. Court of Appeals for the 11th Circuit determined the employees in question were government officials because the government owned nearly 100 percent of Teleco, making it an “instrumentality” of the government.

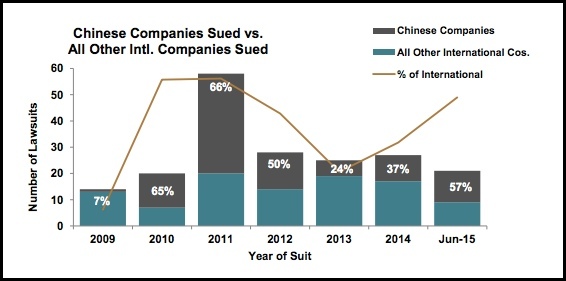

With more and more US companies heading to China as well, the increased scrutiny of these companies are leading to class action lawsuits, so it’s important to ensure teams operating in risky environments are fully trained in compliance and covered with insurance – especially international D&O coverage.

Source: 2015 DataBox Mid-Year Securities Class Action report

In the end, expanding into new territory is no doubt an exciting time for businesses, and with the right risk management program in place, companies can move forward with confidence.

Table of Contents