Blog

Insurance Rates for the Technology Industry: 2022 Trend Report

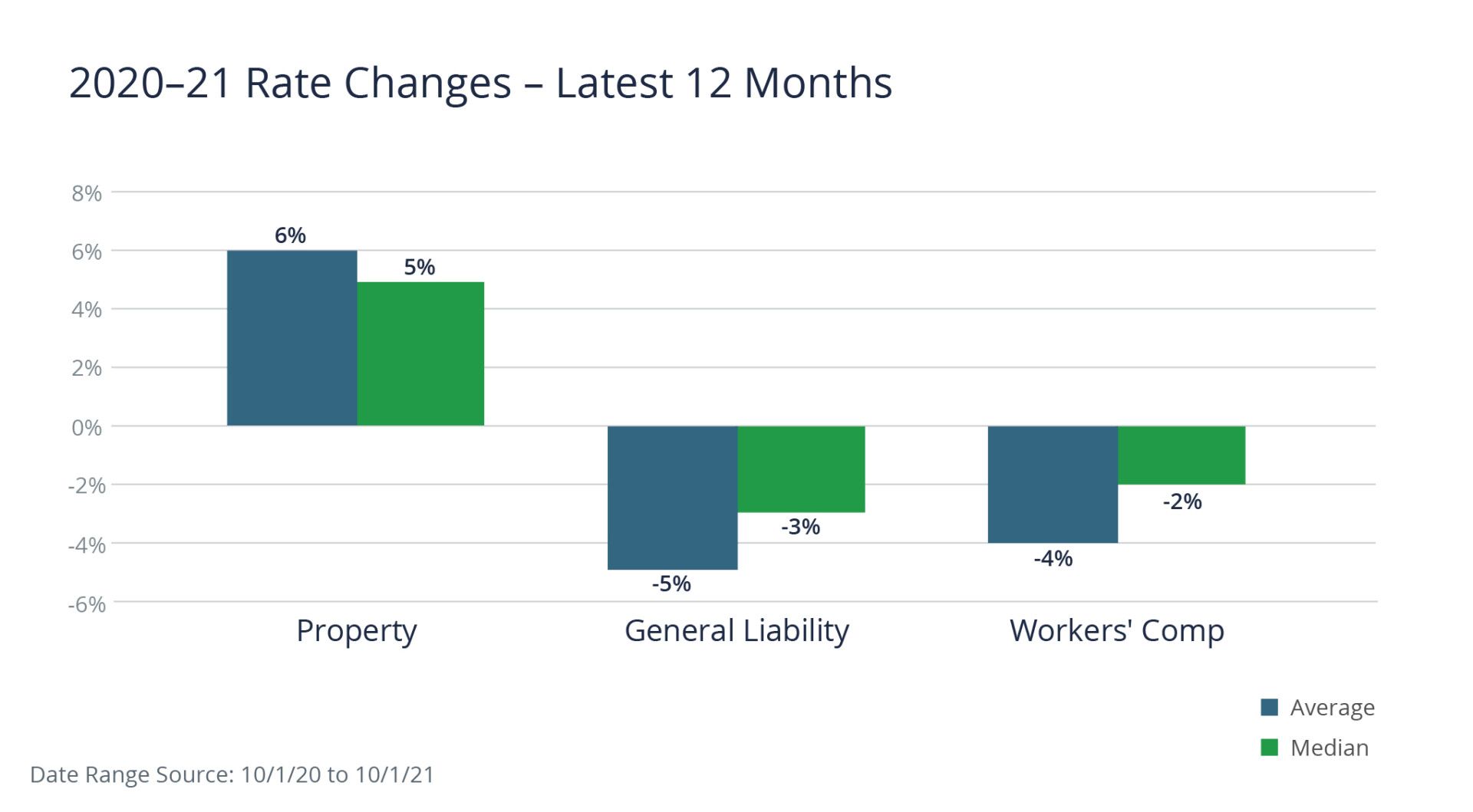

In this report, we identify the emerging trends that are impacting insurance for the tech sector, with a specific review of the property, general liability, and workers' compensation (WC) coverage areas. The big takeaway? Property rates and WC rate trends remained stable, while general liability rates have dropped slightly in the last 12 months.

The Rate Environment in 2021

During the first nine months of 2021, insureds enjoyed rate reductions on general liability and workers’ compensation renewals. For property, however, rate increases are still the norm.

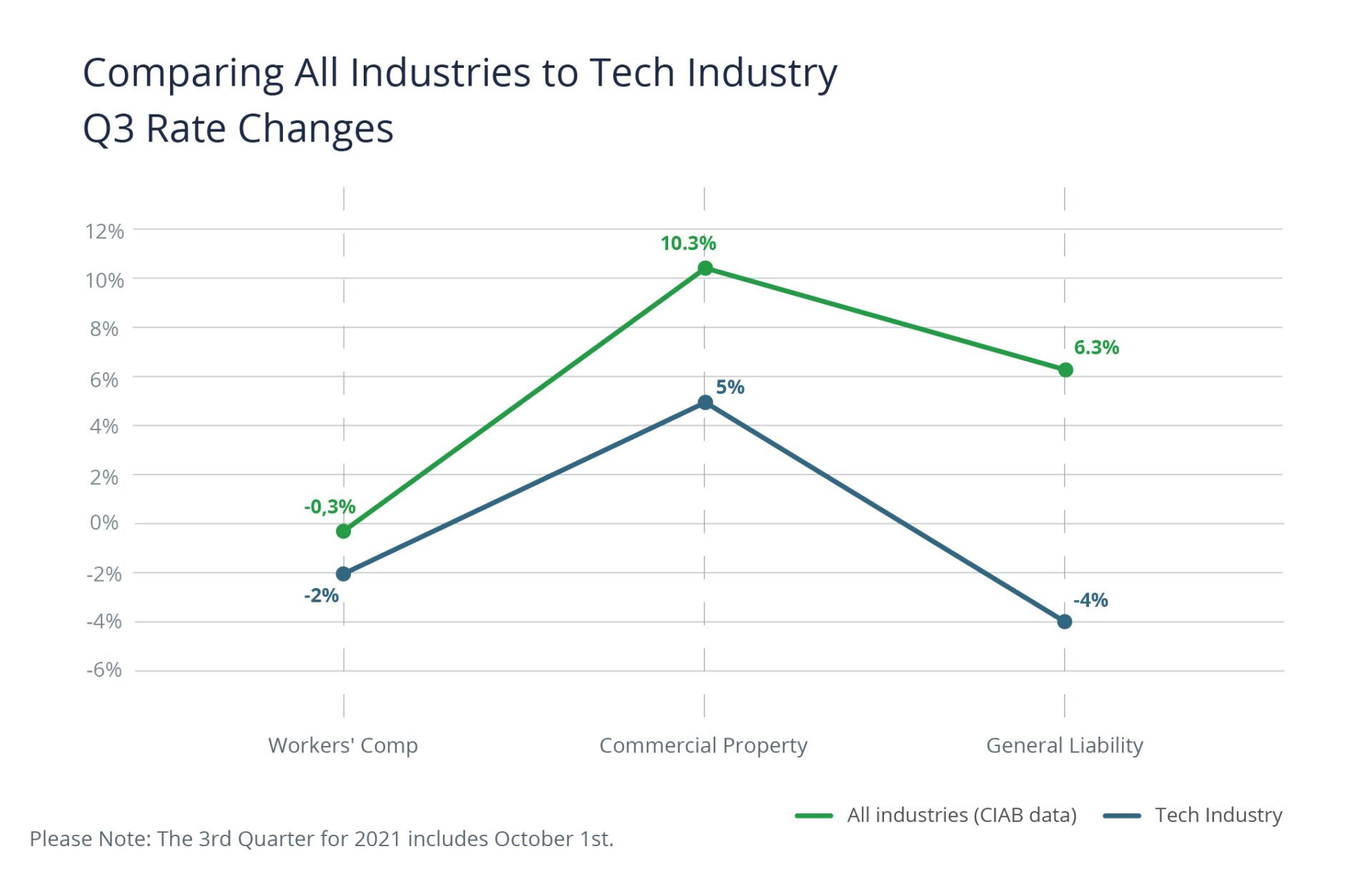

As we have noted in previous reports, the overall market conditions for technology insureds remain much better than in other industries. The main reason is that the tech industry is still very profitable for insurers. Most tech companies have very few losses, so insurers can continue to offer them reduced rates.

Now, let's continue the discussion of market conditions broken down by major coverage lines.

Property Insurance: The Tale of Two Markets Continues

Renewal data shows that rates continue to increase, but we're seeing a different story play out when the property insurance is bundled with other coverage versus a monoline policy.

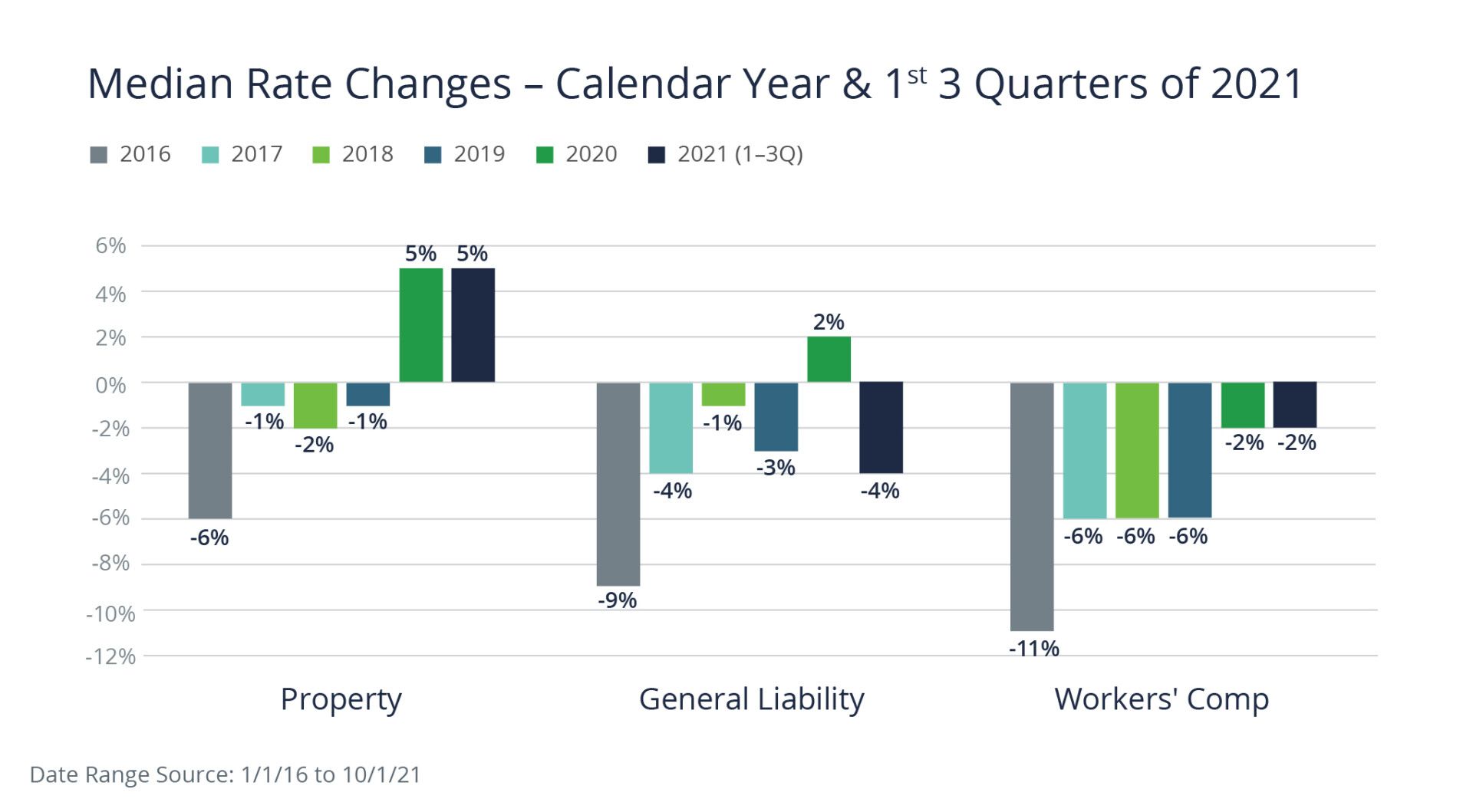

First, let's look at property rate trends overall. In Q3 2021, the median property rate remained the same at 5% in Q4 2020. This is a continuation of the direction we have seen since 2019. This trend started with a few years of bad loss experience due to natural disasters and continued into 2021 with COVID-19 losses as well as damages due to civil unrest.

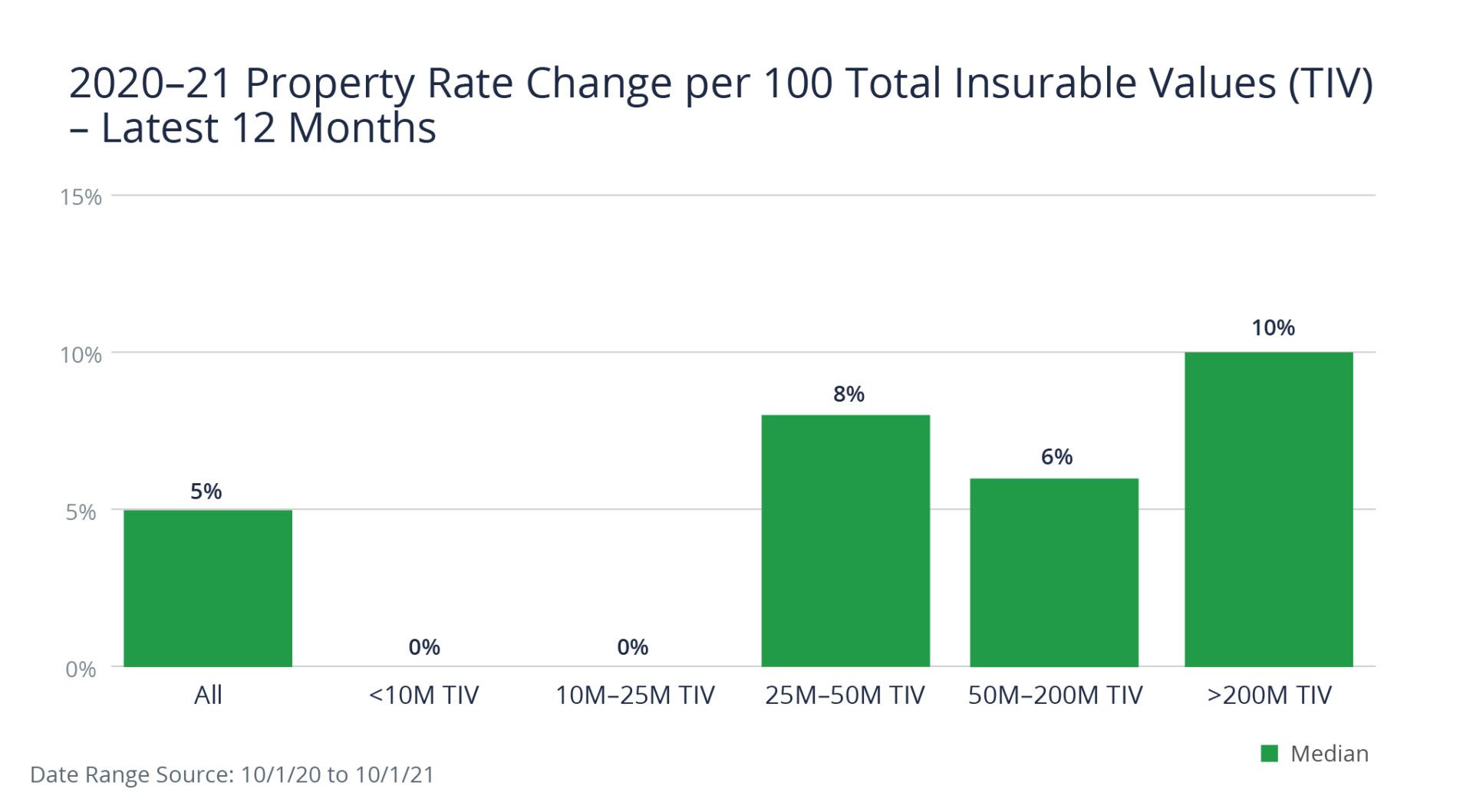

As in 2020, there is still a dichotomy in market conditions between mid-market companies that package property and liability programs together and larger companies that purchase property coverage as a standalone placement.

For example, we're seeing the median increase for all tech insureds is 5%, but for those with over $200 million in values, the median increase was far larger at 10%. Companies that have more than $200 million in total insured values are more likely to have a standalone property program.

When packaged, insurers can price a company's risks across a portfolio (essentially spreading the risk) and rates are typically lower. The chart below illustrates the difference in rates amongst insureds with different sized property schedules (i.e. values).

Monoline programs have the advantage of offering broader coverage, but this result is generally accompanied by higher rates. In part, this is also because insurance carriers have increased scrutiny on property risks associated with monoline coverage.

General Liability: Soft Market Is Returning

About a year ago we started to see insurers get rate increases on general liability programs. This new trend followed years of a very soft market. Unlike property rate increases that were primarily driven by losses, here, insurers were simply pushing for market-based rate increases and were able to obtain them.

We are happy to report that this tendency seems to have been short-lived. Starting with the first quarter of 2021, the rate trend for general liability swung from modest increase to modest decreases and remained there through the first nine months of 2021. Rates also dropped for all other revenue categories and appear to be holding steady in the low single-digit level.

It is our belief that this new rate trend was driven by a few insurers who had not previously been very aggressive or interested in tech business. Their push to write new tech business helped drive rates down as incumbent insurers had to lower their rates to stay competitive. We expect to see this trend continuing in 2022.

Workers' Compensation: Very Steady Marketplace

For the past few years the WC market has been among the most stable for insureds in all industries. This stability is true for tech insureds as well. As you can see from the chart below, since the start of 2020 there has only been one quarter where the median rate change was NOT a reduction, and even that was only a slight increase.

Given the insurer competition for this business and the very favorable loss ratio for most tech insureds on Workers’ Compensation we expect the trend of low to mid single digit rate reductions to continue.

The Outlook for Insurance Rates in Tech

In 2022, it's likely we will continue to see property and general liability rates remain the same as those that occurred throughout 2021—at least in the first half of the year. Beyond that, it is too early to tell if the market will continue to stabilize or continue to increase. For WC rates, once we get further into 2022, we'll have a clearer picture of how the payroll cap for computer programming and software development has affected rates. Our expectation is that there will continue to be low single-digit rate reductions.

In 2022, tech companies are in the preferable position of negotiating lower rates. Insurers are pressured to extend better rates to compete with new entrants. Thanks to low historical rates, you’re in the driver’s seat during renewal time. Consider negotiating multiple year deals at a rate that appeals to you.

About the Data

Our data reflects information on more than 100 tech company renewals for which Woodruff Sawyer is the broker. The vast majority in the survey are "mid-market" or commercial, and their P&C programs are written on a package basis.

Author

Table of Contents