Blog

Work-From-Anywhere Culture: Do Your Employees in Other States (or Countries) Have Workers' Compensation Coverage?

Ask any business owner, Human Resources manager, or hiring placement specialist and they will tell you about the challenges of hiring and retaining employees since the COVID-19 pandemic began in March 2020. We have all heard the new buzzwords "The Great Resignation" and "quiet quitting," and there are plenty of stories about employees retiring early (especially during the pandemic) or leaving their jobs to pursue other careers. The need for employees is so great I've even seen a sign advertising a $1,500 signing bonus for a cook.

Most employers are upping their game in the types of employee benefit programs offered, including financial education, childcare, commuting expenses, gym memberships and fitness programs including online activities (such as Pilates, yoga, spin or Peloton classes, and tai chi), employee assistance programs, stress management, and self-care.

Many employers are also offering a work-from-anywhere culture, and employees have started relocating to different states. Some are even moving to or working temporarily outside of the US for extended periods of time. Employees working from home have similar risks (such as ergonomics issues and slip and fall injuries), but they're likely covered by your workers' compensation policy if they've stayed in-state. If you have employees moving to other states and working from different countries, however, you may need to review your WC policy to ensure they're covered.

Workers' Compensation Laws Vary by State

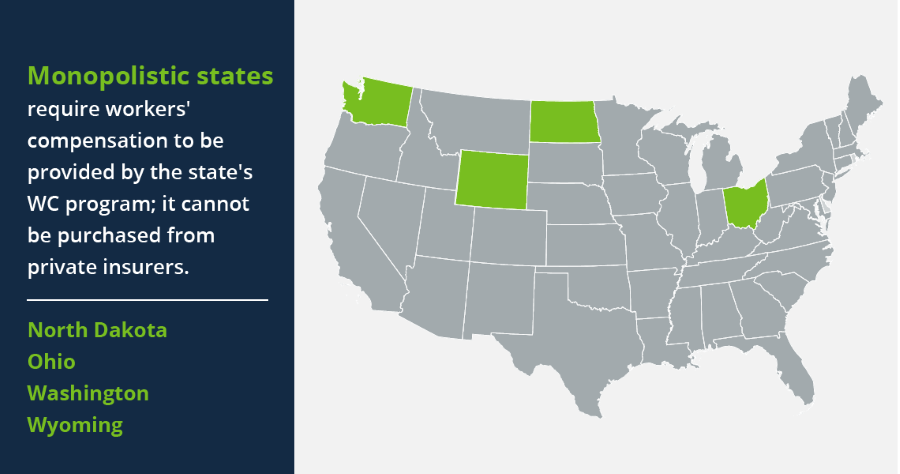

Each of the 50 states has its own set of unique workers’ compensation statutes and laws. To remain compliant, if an employee is permanently residing and working in that state, it must be endorsed onto your workers’ compensation program. In some instances, you may need to obtain a separate policy for that state if your current insurance carrier is not licensed to write in that state or it is in one of the four monopolistic states.

Adding an endorsement for another state shouldn't cost more unless the other state has a higher rate. However, having to obtain a separate policy could lead to paying double—it depends on the circumstances and the states you're dealing with.

For example, if an Oregon-based employee travels to another state to work temporarily, you need to ensure there are extraterritorial provisions or a reciprocity agreement that will cover the employee when they're working in that state. If the Oregon employee travels to a state that doesn’t have reciprocity, like Arizona, you may need to buy another policy in Arizona.

Keep an open line of communication with your employees. Check on them to determine if they've moved to another state—we have anecdotally heard of some employees who moved during the pandemic without telling their employers.

If you have employees working in a certain state and you don't endorse your workers' comp policy to that state, expect a notice in the mail. The state will ask for proof of insurance to avoid a fine. Some states have more severe penalties than others—for example, in California, it's a criminal offense, and in New York, employers could be charged with a misdemeanor or a felony. Ask your broker for the endorsement once you're aware of a move to avoid potential fines and complications.

What Is the Foreign Voluntary Workers' Compensation Endorsement?

If your employees are traveling outside the US on company business or if they are allowed to work in another country on a temporary basis for up to six months, request that your insurance broker add the Foreign Voluntary Workers’ Compensation (FVWC) endorsement to your policy.

The FVWC endorsement will provide the same workers’ compensation benefits to the employee while traveling abroad as their domestic state of hire for medical expenses and lost time wages. It also includes several other coverages, such as repatriation expenses if they need to be transported back to the US and coverage for endemic diseases. Endemic diseases are those diseases peculiar to a foreign locality or region, such as malaria in many parts of the world, hepatitis B in parts of Asia and Africa, and yellow fever in parts of South America and Africa.

Advise your broker of every country your employees are traveling to, as some carriers will exclude coverage for specific countries in dangerous/war regions. These include Ukraine, Colombia, Burma, Syria, Iraq, Afghanistan, Pakistan, Somalia, Venezuela, Saudi Arabia, and many others. Russia is not included at this time, but this may change in the future.

It's easy to overlook workers' compensation insurance—until you have a claim and you find your company isn't covered. Staying updated on your employees' work locations and having a clear understanding of WC laws and needs will allow you to avoid any complications. If you have questions, consult with your Woodruff Sawyer Account Executive.

Table of Contents