Blog

Beware Opting Out Of Workers’ Compensation: Critical Information For Executives and Boards

In California, executive officers/owners and members of the board of directors of a wholly owned corporation have the option to waive their rights to workers’ compensation benefits if they have both an employee health benefits and disability policy “comparable” in scope to the California workers’ compensation policy effective July 1, 2018.

The Department of Insurance released a legal opinion on May 30, 2018 detailing the specific benefits that must be included in a disability policy for it to satisfy the State requirements in a disability policy. The full article can be viewed here.

The Option

Labor Code section 3352(a)(19) (effective 7/1/18) allows executive officers/owners and members of the board of directors of a cooperative corporation to waive workers’ compensation insurance coverage, if he or she executes a waiver “in writing and under penalty of perjury… stating that he or she is covered by both a health care service plan or health insurance policy, and a disability insurance policy that is comparable in scope and coverage… to a workers’ compensation policy.”

The Downside

If the employer does not have a valid disability policy, then waivers executed pursuant to Labor Code section 3352(a)(19) would be deficient. If the employer does maintain a valid workers’ compensation policy, however, the insurer may assess additional premium from the employer based on employees who were supposed to have been covered in light of the defective waivers.

The Penalties

If an individual executes a waiver under penalty of perjury that he or she is covered by a disability insurance coverage policy that is comparable in scope and coverage to a workers’ compensation policy, but is in fact not, then he or she could be subject to criminal penalties as they attach to perjury. (Cal. Pen. Code section 118, section 1170).

Labor Code section 3700.5 makes it a misdemeanor, punishable by imprisonment in the county jail for up to one year, or by a fine of up to double the amount of premium, but not less than ten thousand dollars ($10,000), or both, if a person fails to secure the payment of compensation as required by Labor Code section 3700, et seq. If an employee’s waiver of workers’ compensation is defective, and his or her employer has not otherwise secured the payment of workers’ compensation benefits, then the employer could be subject to penalties as provided by Labor Code section 3700.5.

The insurance carrier may also collect premium for any officers/ board members by multiplying the classification code rate per $100 of payroll against the actual annual payroll, subject to the minimum $50,700 and maximum $128,700 thresholds.

The Recommendation

Based on our review, disability policies offered by most employers do not provide adequate coverage. As noted in the CA DOI opinion, California workers’ compensation insurance provides liberal benefits and reimbursement for certain expenses that arise in connection with a claim; including indemnity payments, lifetime medical benefits, mileage, penalties for late payments, job displacement benefits for injured workers who cannot return to work, death benefits, and other ancillary benefits. Among other things, disability policies do not typically provide comparable death benefits or lifetime benefits.

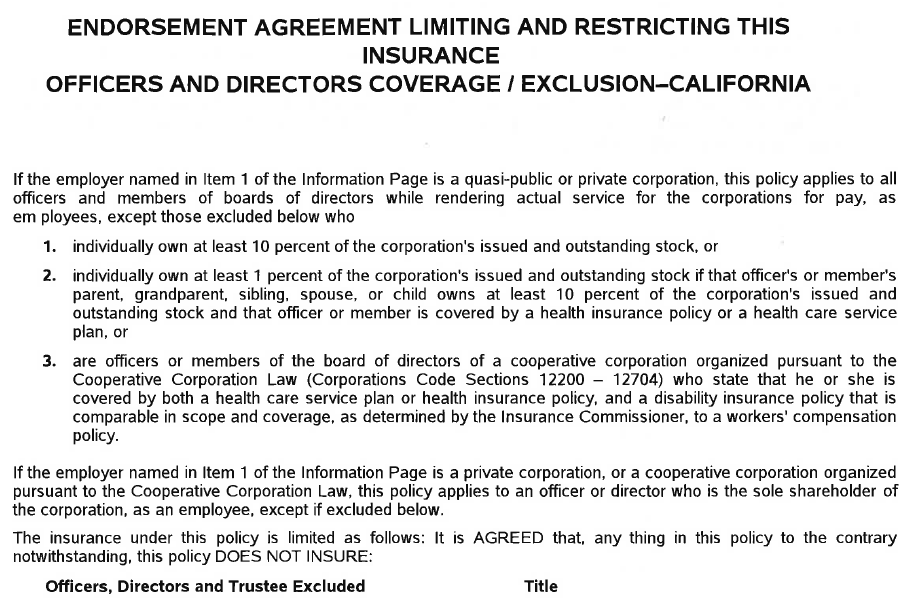

We have included a copy of the exclusion endorsement below. Please consult with your Woodruff Sawyer account executive to determine eligibility and to explain the consequences for not having valid insurance coverage.

Table of Contents