Blog

A Discussion of the Current SPAC Litigation Environment

What’s the latest in SPAC litigation and enforcement? To find out, I recently spoke with two experts from the Dallas office of Holland & Knight, a prestigious multinational law firm.

Chauncey Lane is a corporate mergers and acquisitions (M&A) partner, and Scott Mascianica is a litigation partner who previously worked in the Securities and Exchange Commission’s (SEC) enforcement division.

Below are some highlights from our conversation. You can also watch the full discussion below.

In our discussion, we focused not only on the latest SPAC lawsuits and enforcement actions but also offered a few takeaways on best practices to avoid litigation and enforcement.

A Look at Recent SPAC Court Cases

Yelena Dunaevsky: What are some recent court cases that are reverberating throughout the SPAC market? Following in the steps of Multiplan, we have a recent decision from the same judge in the Delman v. GigAcquisitions3 (Gig3) case in Delaware. It is another denial of a motion to dismiss and involves fiduciary duties and the entire fairness standard. Scott, how do you view the impact of this decision?

Scott Mascianica: Multiplan laid the foundation for Gig3. While the facts are not the same, there are a lot of similarities. We have allegations of a lack of independence for the directors and a single controller exercising significant authority over the SPAC. There is a purported failure to disclose certain material facts, and there are valuation questions about the SPAC and the target company, Lightning eMotors.

Essentially, the allegation is that the proxy statements about the value of Gig3 shares were materially misleading based on certain dilutive aspects that, frankly, we see in quite a few SPACs that go through the de-SPAC.

Once again, we had the entire fairness standard applied in terms of the breach of fiduciary duty allegations. We're again dealing with a significant uphill battle for the defendants to get the complaint dismissed. Vice Chancellor Will declined to dismiss the case, and—based in large part on adopting Stanford professor Michael Klausner's model—found that the claims were sufficient to go forward.

| Yelena Dunaevsky: It seems to me that the most important piece of the puzzle is the conflicts and making sure the conflicts will not land you in a situation where you face the entire fairness standard. Because disclosure is a slippery slope—you can always find issues with disclosure. |

Yelena Dunaevsky: The opinions I am hearing in the market are, first of all, skepticism about Professor Klausner’s formula being the correct formula to follow. Secondly, everyone seems to agree that dilution is discussed in multiple places throughout the SPAC’s public filings. There is no prescribed legislative requirement for a dilution formula. And finally, many are of the opinion that ultimately, if the case progresses, the plaintiff’s argument around dilution will lose.

Scott Mascianica: I think you're right. Vice Chancellor Will's opinions have focused on conflicts when looking at what standard to apply. The other piece of the opinion that jumped out to me is that Vice Chancellor Will found a “decoupling”—her word—of economic and voting interests for SPAC shareholders. It's going to be interesting to see how that develops.

What About Dilution?

| Chauncey Lane: Dilution is a tricky animal when it comes to SPACs because many of the cases we see are at the pleading stage. It's a question of whether the case should be dismissed or not. And it would be interesting to see if this case wins on the merits because most SPAC disclosures already include robust disclosure on dilution. |

Chauncey Lane: When it comes to disclosure on dilution, you want to cover all forms of dilution, be it sponsor compensation, convertible securities, warrants, or additional capital coming into the deal like a PIPE investment.

In some deals, there might be a focus primarily on sponsor compensation but not a focus on some of these other elements that might result in dilution. I think SPAC disclosure has caught up, and in most of the SPACs you see, there is robust disclosure across all the different elements of potential dilution.

We’re also seeing pro forma ownership tables where you're stress-testing various dilution scenarios—be it a situation where there are no redemptions, 50% redemptions, or maximum redemptions. Right now, we're seeing close to maximum redemptions.

My goal is to make sure clients fully understand that it's better to put it all out on the table in a clear and concise manner so that shareholders understand what the future holds.

Is Delaware Now Toxic for SPACs?

| Yelena Dunaevsky: In light of the Multiplan and the Gig3 decisions in Delaware, it seems to me, and many of my SPAC contacts agree, that we will no longer see SPACs choosing Delaware as their jurisdiction of incorporation. |

Yelena Dunaevsky: They will likely go elsewhere in the US or most likely to Cayman. Chauncey, what advice are you giving to your clients in that area?

Chauncey Lane: Cayman has been in the mix for SPACs for a long time. It’s obviously a favorable jurisdiction, but the bottom line with Delaware is you know what you're going to get. There is some benefit to that because part of what I do with clients is help them understand the analytical framework that would be applied to a transaction.

There might be a bit of a shift to Cayman or other jurisdictions, but I do think that Delaware is doing what Delaware's always done. And that is being very clear, being very upfront, and setting a very clear path for corporate directors who are involved in any type of transaction.

Termination Fee Cases: Who Keeps the Fee?

Yelena Dunaevsky: There has been a series of recent cases relating to termination fees. One of the better-known ones is the Fast Acquisition case.

Scott Mascianica: It’s a fascinating case because it presents a different factual backdrop than what we've seen in a lot of SPAC litigation. It involves a business combination that did not go forward in a SPAC that ultimately was seeking to wind down. But there was a termination fee of about $26 million that was to be paid by the target company to the SPAC if the transaction did not go forward. It did not, in this case.

The question then was, who gets that $26 million? A dispute arose between the class A public shareholders, class B shareholders (which tend to be the sponsor), and the insiders.

This case is going to be interesting to follow because the opinion will serve as a stress test of the standard of review for the directors and officers in connection with the wind-down of a SPAC. Will we see entire fairness applied here? Will we see business judgment? This case is definitely worth monitoring.

A Few Bright Spots

Yelena Dunaevsky: Everyone loves to talk about the negativity around SPACs, but there are some recent bright spots, such as the Lucid Motors and DraftKings cases.

Scott Mascianica: In the Lucid case, we have a class action lawsuit filed by SPAC shareholders. The shareholders' allegations are based on the premise that they were induced to purchase SPAC shares.

Defendants filed a motion to dismiss. It was based on two primary aspects that the court considered. The first was whether the SPAC shareholders had standing to sue based on misstatements made by parties other than the SPAC itself. Then the second was the general motion to dismiss arguments.

The court did dismiss the complaint without prejudice. However, the plaintiffs have filed a motion for leave to amend their complaints. So, this case is still evolving. The court found from the materiality perspective—they didn't even get to scienter—that the statements made by the target company CEO were made before the SPAC had ever made any indication that they were in discussions with the target company.

What the court spent most of its time addressing was standing. And now there is a New York and California circuit split situation on standing so I'm going to be interested to see how the standing argument plays out.

Yelena Dunaevsky: There’s nothing better than a circuit split, but what about DraftKings? That's an interesting scenario as well.

Scott Mascianica: DraftKings, filed in the southern district of New York, was another class action shareholder complaint. The allegations were pulled from a notable short-seller report around the DraftKings business combination.

Even with multiple amendments to the complaint, the court found that there was essentially a “global deficiency”—to use the court's term—in the allegations based on a short seller source and a report made by anonymous parties.

Because of what the court called “threadbare sourcing,” the court dismissed the complaint.

What's interesting here is that short sellers were incredibly active during the SPAC boom. So, this opinion will give companies some ammunition when faced with class action allegations that are essentially a copy and paste job from a short seller report.

Yelena Dunaevsky: On the short seller reports, we crunched some numbers a few months ago and at least one-third of all SPAC securities class actions follow a short seller report. Those are a significant driver of litigation, which is another reason why I am happy to see the DraftKings decision here.

SPAC Structuring and Disclosure Advice

Yelena Dunaevsky: Chauncey, from a transactional perspective, but keeping in mind all these cases, what advice are you giving your clients right now to help them avoid any pitfalls?

Chauncey Lane: There is a definite trend toward treating a de-SPAC like an IPO. I think a de-SPAC participant is better off engaging in that same level of diligence and providing that same level of disclosure. And, in April, when the proposed SEC rules become final, you won't have a choice but to treat a de-SPAC like an IPO.

Here are a few other recommendations I offer my clients:

- Don't overly rely on precedent language. There is typically a delay in terms of how litigation becomes reflected in disclosure. So, if you grab precedent language and you're not testing whether it has caught up to where we are in litigation, you might be using a bad precedent. Make sure your disclosure is tailored for your specific transaction and your specific circumstances.

- Always include detailed disclosure on potential dilution. A failure to focus on dilution, how dilution may come into play, and what that will look like for public stockholders is a big misstep for a SPAC sponsor or anyone involved in a de-SPAC transaction. That disclosure, in one form or another, has been present in multiple places in SPAC filings, but nonetheless, it continues to be low-hanging fruit.

- Avoid using projections. In some instances, you don't have a choice, but if you can get a deal done without projections or with minimal projections, you're better off. Projections can lead to the potential for litigation.

- Understand the framework of the transaction. I always explain to my clients the analytical framework that will apply to their transactions. For example, entire fairness is something that you are likely going to run into in a SPAC transaction that is being reviewed by courts, certainly Delaware courts. So, it’s in your best interest to understand what that litigation concept looks like and how it applies to the transaction.

Yelena Dunaevsky: My banker friends are worried about the Section 11 liability that is part of the proposed SEC rules. Some of the larger banks took a step back from the SPAC market when the proposed rules came out, but clearly there are quite a few smaller banks still happily operating in this space. What is your perspective on how this rule has already impacted SPACs and what we will see in the future?

Chauncey Lane: It's interesting to watch some of the largest players in the SPAC market scaling back their involvement. But it's understandable.

Treating your de-SPAC like an IPO is what we're seeing the SEC strive for—they’ve been explicit about that. The de-SPAC transaction is entirely separate from the IPO transaction.

There are some instances, however, where a banker is still involved with a SPAC through its de-SPAC, serving as a financial advisor, assisting in arranging PIPE financing, and, more importantly, receiving deferred compensation that is tied to the successful completion of a de-SPAC transaction.

In those instances, there might be an expectation that an underwriter will continue to serve in that same gatekeeper role as with an IPO. At least, that's the SEC's view.

It's a slightly different situation when you have an underwriter who is not involved with that SPAC at the de-SPAC stage. It is a different type of liability with respect to a de-SPAC transaction that a banker is going to incur with respect to an IPO.

Opening underwriters up to Section 11 liability with respect to a de-SPAC transaction means that to the extent projections are used in that M&A transaction, the bankers are on the hook for those projections. That potential liability occurs even if that banker had no involvement in preparing or disseminating the projections. It is a slightly broader type of liability than what you typically have for a banker in an IPO.

Smaller banks tend to sometimes be scrappier and more willing to take on a little more risk to get a deal. That does leave space for smaller banks to come in and try to make money in a SPAC space that is getting increasingly regulated.

With the right guidance and mindset in terms of how you manage those risks, I think it's a space that is still worth being in. You just have to be prepared for it.

Yelena Dunaevsky: I am hearing from the market that even though most folks agree on the proposed rules relating to disclosure, many think the SEC is overstepping its bounds on underwriter Section 11 liability. If the rules are passed as-is, there's likely to be pushback from the market and potentially even litigation. So, we'll see how that works out.

SPAC Enforcement Activity

Yelena Dunaevsky: Scott, what are you seeing in terms of recent enforcement activity?

Scott Mascianica: My first point it that we haven’t yet experienced a fully blossomed SEC enforcement program in relation to the SPAC boom.

The average length of an SEC division of enforcement investigation can be anywhere from 24 to 30 months. They have limited resources, some of these cases are complex, and getting an action approved by the commission can take time. We are still in that window.

Point two is that the public doesn't see most investigations the division is conducting unless there's a filed action or a self-disclosure by a party involved in an investigation. Many of these investigations are taking place behind the scenes.

However, that privacy doesn't mean there aren't significant costs and collateral consequences being felt throughout the SPAC market by those entities that are subject to investigation.

My third point is that there are similarities between how the SEC has approached the SPAC space and how it has handled other blossoming industries. Take cybersecurity as a corollary.

The SEC first focuses on middle-of-the-road message cases, such as those that involve alleged fraudulent activity. Then, the SEC will work outward to non-fraud actions to control cases and cases within a regulated entity space.

I don’t think the SEC’s enforcement division is done with SPACs, by any means. We’ll see the SEC’s division of enforcement push out to the non-fraud cases as we go forward. We will continue to see enforcement activity. It may not be 20 cases, but we'll still see cases.

| Yelena Dunaevsky: I have a gut feeling that we are in the eye of the storm right now as far as SEC enforcement is concerned, and it sounds like you agree, Scott. |

Predictions for the Rest of 2023

Yelena Dunaevsky: What are your final thoughts on what 2023 has in store for the SPAC market?

Scott Mascianica: I would love to have a crystal ball because we've got so many uncertainties here. We have the SEC's proposed rules ahead, and we are still dealing with the market turbulence of 2022 and the effects of the crypto winter.

I do predict the SEC division of enforcement will continue to be active in filing cases. On the litigation front, I'm interested to see if there will be more pre-business combination injunctive actions.

It’s a space where having experienced advisors and experienced practitioners—certainly from a D&O side—is critical. So much uncertainty results in a lot of risk.

Chauncey Lane: I think we will see a market that may not be as robust as it was in prior years but that functions more like the IPO market. Those two markets will function a little more in tandem than over prior years.

We also are likely to see more mature targets—companies that are truly ready to be publicly traded—as we see more scrutiny put on these transactions. At the height of the SPAC market, it didn't take much for a company to go public. I think that is changing.

Much of the sentiment we've seen from the SEC staff over the last couple of years is heightened skepticism about the SPAC market. If I had to speculate, I would say we’ll see an immediate reaction from the SEC to aggressively enforce those rules.

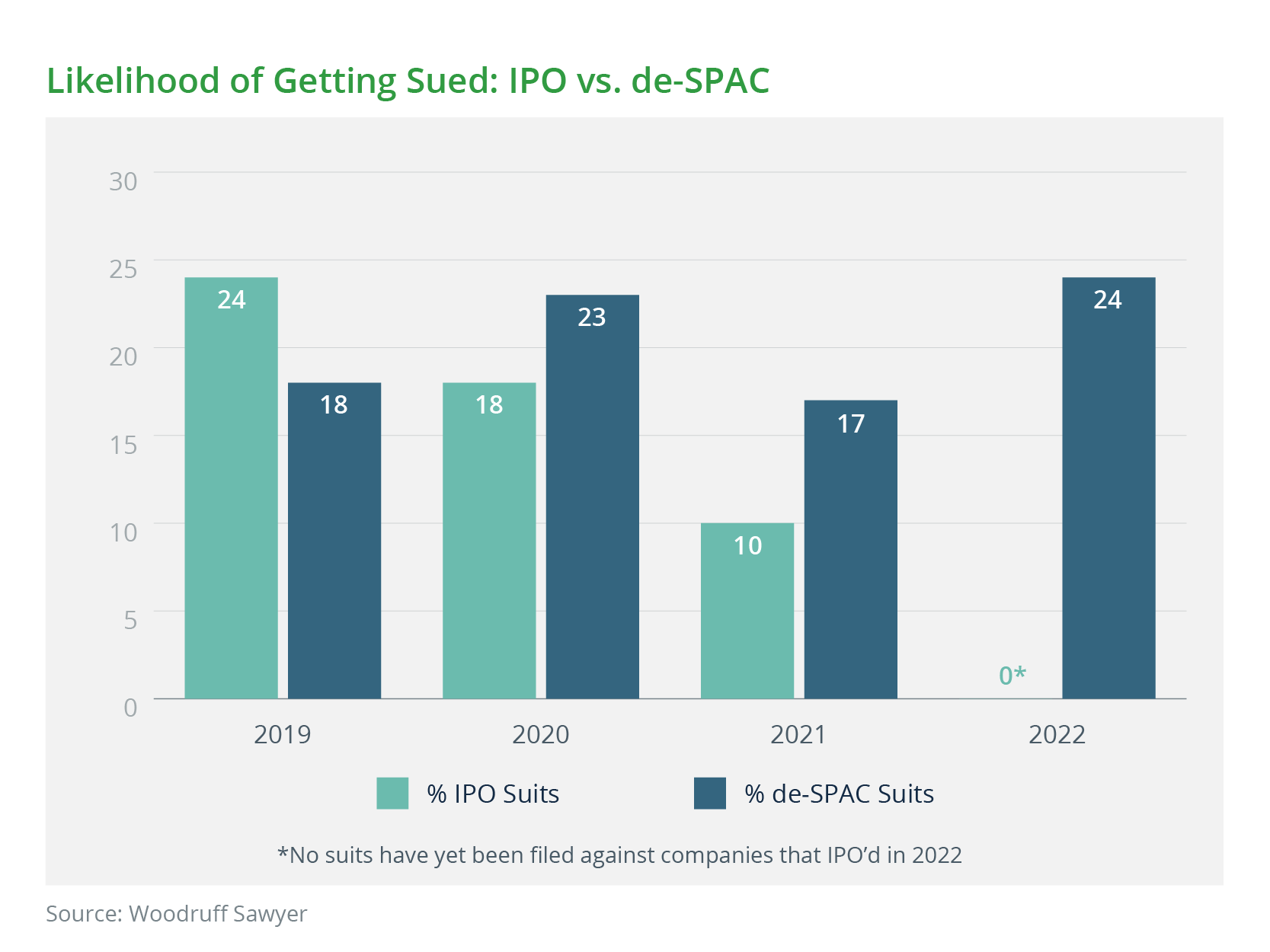

Yelena Dunaevsky: On the insurance side, we've been seeing a serious softening in the D&O insurance market space as a result of almost no IPOs last year and decreased activity levels on de-SPACs.

| Yelena Dunaevsky: The carriers are reaching a point of higher competition, which is great for our clients because we can negotiate better pricing and terms. I believe this environment is going to continue until we hit a point where more IPOs are happening towards the end of the year and into early 2024. |

Yelena Dunaevsky: So, for now, things are looking positive from the coverage perspective for the SPAC teams, both on the IPO and the de-SPAC side. There's also a lot of creativity going into structuring those policies.

I encourage everyone to reach out to their broker or to me about how to restructure their policy and drive some cost savings because there is room for that in the current market.

Author

Table of Contents