Blog

Are SPAC D&O Tails Still Worth Buying?

Until recently, it was an established practice for a SPAC team to buy a six-year tail insurance policy when it merged with its target. The tail costs were usually pre-negotiated years before—at the time of the SPAC’s IPO—when the SPAC’s original D&O policy was bound.

A month or two ago, however, the SPAC D&O market began to shift. For various reasons described in this article, the up-until-now standard practice of electing a tail to cover the SPAC’s directors and officers post-merger will likely fade into history.

The Old SPAC D&O Insurance Structure

SPAC teams were advised to buy the tail because up until now, the combined entity’s post-merger D&O policy would not cover the SPAC’s directors and officers for their wrongful acts prior to the merger.

| In the United States, D&O insurance policies are “claims made in nature,” which means a policy needs to be in place when a claim comes in. If the policy is inactive at the time of the claim, there will be no coverage for that claim even if the claim relates to actions that occurred while the policy was active. |

A SPAC’s original IPO D&O policy expires at the time of the merger, but most SPAC-related lawsuits spring up after the merger. If a claim against the SPAC’s directors and officers comes in because of such a suit and relates to their wrongful acts prior to the merger, that claim would not be covered unless a tail policy was in place.

So, in a typical SPAC scenario, you’d likely have three D&O policies:

- The SPAC’s IPO policy, which would cover its Ds and Os and be converted into a tail at the time of the merger;

- The go-forward policy, which would cover the combined entity’s Ds and Os after the merger; and

- The target company’s tail to cover the actions of the target’s Ds and Os prior to the merger.

Problems With the Old Structure

This structure worked well for a time. A few problems crept up over the years when multiple parties (e.g., the SPAC, its directors and officers, the combined company and its directors and officers) were pulled into the same lawsuit. This is where we saw some finger-pointing if multiple carriers were insuring various entities and individuals.

Other problems arose around the costs of all these policies. D&O insurance costs exploded in 2020 and 2021 to keep up with unprecedented market demand. The premium of a SPAC’s tail, for example, typically ran between 2x and 4x of the SPAC’s original IPO D&O policy, which would routinely be in the $3 million to $4 million range, even for SPACs with limits of coverage not exceeding $5 million.

A Softening D&O Insurance Market In 2023

Since the beginning of 2023, the wider D&O insurance market has softened quite considerably. Its subset, the SPAC D&O market, softened as well.

In the first quarter of 2023, we saw the pre-negotiated tail pricing for SPACs be aggressively re-negotiated. Carriers were forced to be more receptive to demands for lower premiums because of:

- Increased competition from new entrants that were willing to “steal” those tails from the original carriers;

- Many SPAC teams that were running low on funding after lengthy search periods deciding to “shop” those tails in the market;

- The continuing lack of activity in the general IPO and de-SPAC markets; and

- High redemptions in the SPAC market, which greatly reduced the number of non-insider investors, thereby reducing the risk of lawsuits.

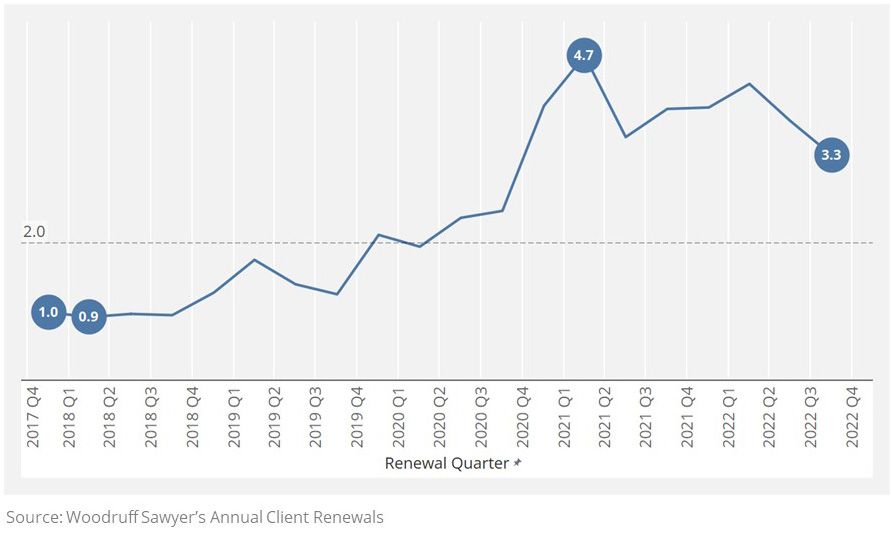

Woodruff Sawyer's Public D&O Insurance Market Rate Index (2018: Q1 = 1.0)

[caption id="attachment_57043" align="alignnone" width="891"] In this figure, we show an engineered market rate pricing index for the wider (not SPACs only) D&O insurance market. The index shows that relative to Q1 2018, the market rates for Woodruff Sawyer’s median client rose to 4.7x, then dropped to 3.3x by the end of Q4 2022.[/caption]

In this figure, we show an engineered market rate pricing index for the wider (not SPACs only) D&O insurance market. The index shows that relative to Q1 2018, the market rates for Woodruff Sawyer’s median client rose to 4.7x, then dropped to 3.3x by the end of Q4 2022.[/caption]

The Big Bang

All seemed to be going fairly smoothly for SPACs earlier this year, at least on the insurance end; more carriers were willing to negotiate coverage and pricing, and many SPAC teams were getting reductions on their tail premiums and extensions at reasonable rates if they needed a few more months to close their deal.

The premiums for the go-forward coverage were down, so companies could get higher limits. Even self-insured retentions (like deductibles) were getting lower.

| Then a seismic eruption—the Clover Health decision—sent the underwriting market reeling. In Clover Health, Delaware’s Superior Court Judge Johnston decided that the SPAC’s tail coverage should pay for the claims arising from pre-merger wrongful acts of the target’s directors and officers. |

Let’s think about that for a minute. The SPAC’s tail was designed to cover wrongful acts of the SPAC’s Ds and Os. The insurers priced the policy based on the potential risks arising from wrongful acts of those Ds and Os, not a random group of other Ds and Os. But in Clover Health, the judge decided to settle the SPAC’s insurer with the costs of risks not only of the SPAC’s Ds and Os but also of a whole new set of Ds and Os—the target’s Ds and Os.

The target’s D&O risks, as everyone in the insurance world understood and intended, should have been covered by either the target’s tail policy or, in some cases, if so negotiated, by the go-forward’s policy. No one anticipated the SPAC’s policy or the SPAC’s tail policy to cover the risks of what would pre-merger be a completely unrelated entity, the target.

Unfair? Out of the blue? Crazy? Many would agree. The case is an interesting read in convoluted logic, and the decision may be appealed, but in the meantime, it has caused a gradual shift in how insurers are thinking about and pricing SPAC-related policies.

The Aftermath: A Combo Policy

Because underwriters had not priced the risk from the target’s Ds and Os into their models when they agreed to bind those policies, they have become a lot less open to reducing pre-negotiated SPAC tail premiums since the Clover Health decision. Some have even tried to push SPACs that needed policy extensions (because they exceeded their initial policy period and needed more time to close their deal) into firm commitments to elect their pre-negotiated tails.

SPACs, many of which were at the end of their investment period and quickly running out of cash, were not happy.

The idea that surfaced to solve this problem was simple—merge the three policies into one. At Woodruff Sawyer, we were already successful in getting some carriers to cover the Ds and Os of the target within the go-forward policy, eliminating the need to buy the target’s tail. Convincing carriers, which would potentially be exposing their SPAC tail policies to unanticipated risk from the target’s Ds and Os, to instead consider offering a combined policy that would cover all three groups was the logical next step. The price of the combined policy might be a little higher, but it would eliminate the need to buy the SPAC’s tail, thereby saving millions for SPAC teams and their targets.

Off With Their Tails

Indeed, in the past month or two, some carriers have realized that insisting on SPAC tail coverage was quickly becoming a losing battle. A few have decided to start offering the 3-in-1 coverage option instead.

Although the Clover Health decision was rubbish and showed a lack of understanding of how these insurance policies were designed to work, it ultimately moved the market in a better direction. The efficiency of the 3-in-1 coverage comes from the elimination of finger-pointing in a claim situation and the cost reduction for SPAC teams via the elimination of the need for the SPAC’s tail.

What Steps Should You Take?

If you are a SPAC team or a target that is close to a merger and are still operating on the assumption that the SPAC will need to purchase tail coverage, you need to think about it very carefully and talk to a knowledgeable SPAC insurance broker.

While we at Woodruff Sawyer have been successful in securing the 3-in-1 coverage option for our clients, it is not a widely available alternative. Our long-established relationships in the insurance market and our leadership in the D&O SPAC market have allowed us to offer the combination option to our clients. However, this option is not something most carriers are currently willing to stomach. It's important to have an experienced insurance broker who specializes in SPAC D&O insurance coverage on your side to successfully negotiate for this combo option.

Visit our SPACs industries page for more insights and resources related to Special Purpose Acquisition Companies.

Author

Table of Contents